Ah, the winds of change are blowing through the hallowed halls of finance! If this projection comes to fruition, we might just witness a metamorphosis in global finance, with Ripple’s XRP taking center stage in the grand theater of cross-border liquidity networks. 🎭

Ripple Aims to Revolutionize Global Settlements

In a gathering that could rival a Shakespearean play, Garlinghouse took the stage, illuminating the audience with Ripple’s grand vision. “SWIFT is like a two-headed beast: messaging and liquidity. But liquidity? That’s the banks’ playground! I’m more interested in liquidity than the chatter. If you control the liquidity, XRP shines… so let’s say five years, 14%,” he quipped, with a wink. 😏

His words have sparked a wildfire of enthusiasm in the XRP community, with many interpreting this as a clear signal that Ripple is ready to elevate XRP’s role in the global settlement arena. 🔥

Why Liquidity, Not Messaging, Is Ripple’s Focus

Unlike the grand SWIFT, which serves as a global messaging system for interbank transfers, Ripple is tackling the core issue of liquidity. With its On-Demand Liquidity (ODL) product, XRP becomes the bridge asset, enabling near-instant cross-border payments while waving goodbye to pre-funded nostro accounts. Adieu! 👋

Garlinghouse’s musings reflect a belief that the future of finance hinges on which networks can best facilitate the movement of value—not just the chatter surrounding it. With XRP ledger transactions confirming faster than you can say “blockchain,” the efficiency advantage is as clear as a sunny day. ☀️

Ripple’s Chief Legal Officer chimed in, predicting a tsunami of tokenized assets on the horizon, stating, “Hundreds of billions of tokenized global assets [will emerge] fairly quickly,” emphasizing XRP’s potential as the bedrock of this new financial landscape. 🌊

XRP Price Prediction: What Happens If Ripple Hits Its Target?

If Ripple manages to snag 14% of SWIFT’s $5 trillion daily volume, the implications for XRP’s price could be mind-boggling. Analysts and AI platforms have weighed in with forecasts that are as speculative as they are intriguing.

According to DeepSeek AI, XRP could reach:

- $63.88 in a base-case scenario,

- $170 in a bullish scenario, and

- Around $25.55 in a bear case, depending on adoption rates and token velocity.

Meanwhile, Grok AI estimates the price could soar between $100 to $500, assuming XRP handles $700 billion in daily volume. Even with just 1% of SWIFT’s market share, XRP could potentially hit $35.80, the model suggests. Talk about a rollercoaster ride! 🎢

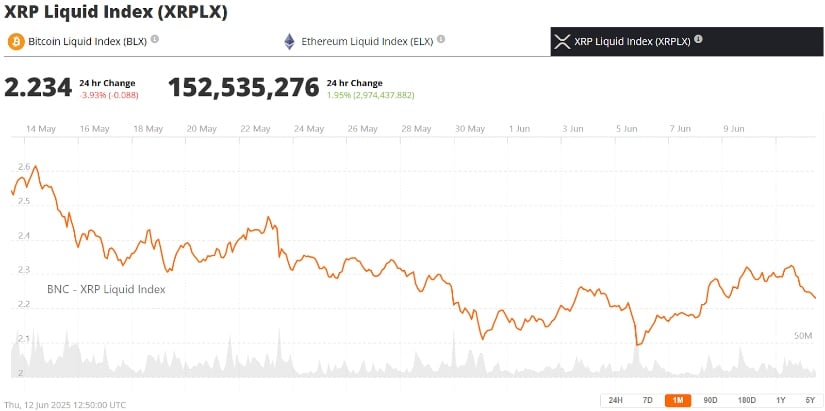

However, these predictions are as speculative as a cat in a room full of rocking chairs. “The math shows ambition, but execution risk is extreme,” DeepSeek cautioned, adding that institutional accumulation around the $2.50 level may be a key technical indicator to keep an eye on. 👀

Ripple’s Expanding Network and U.S. Momentum

Ripple’s growing presence in the U.S. banking sector has become a beacon of optimism. Following a favorable outcome in the long-running XRP lawsuit against the U.S. Securities and Exchange Commission (SEC), the firm saw a “surge” in domestic partnerships, Garlinghouse confirmed. Who knew legal battles could lead to such fruitful alliances? ⚖️

The resolution of the 2024 Ripple SEC lawsuit not only lifted the regulatory cloud but also opened the door for potential innovations like an XRP ETF and broader regulatory clarity—especially under the crypto-friendly Trump administration. Who says politics can’t be fun? 🎉

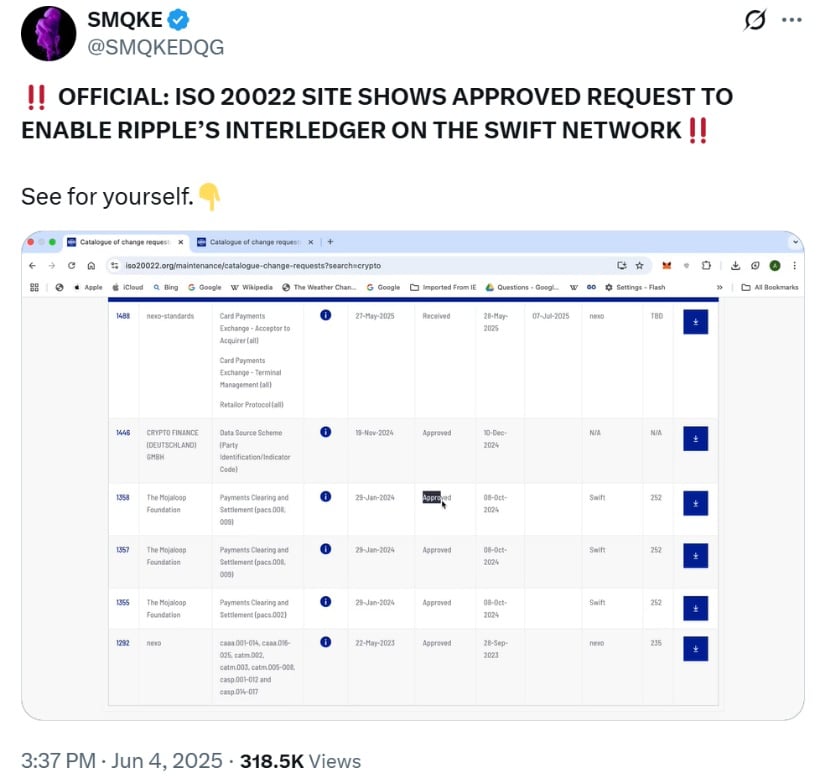

Ripple now boasts over 100 financial institutions in its ecosystem, many of which are SWIFT-connected banks, offering a potential bridge between legacy systems and blockchain rails. Speculation about a Ripple-SWIFT collaboration is rife, though nothing has been officially confirmed. 🤔

Community Reaction: “He Means It”

XRP community leaders and influencers have reacted positively to Garlinghouse’s comments. Prominent figure @Nietzbux remarked, “When he speaks, he means it; it eventually comes true,” suggesting that the CEO’s forecast is more than just optimistic rhetoric. Sounds like a prophecy! 🔮

Others have pointed out that the XRP Ledger (XRPL) is already capable of handling significant liquidity volumes and that the infrastructure is in place for scaled adoption—pending further institutional buy-in. If Ripple succeeds, the Ripple currency price could reflect demand not only from speculative investors but also from global liquidity providers using XRP as a settlement bridge. 🌉

Can XRP Truly Compete with SWIFT?

Despite the excitement, industry experts caution that Ripple’s 14% market share goal is ambitious. SWIFT is entrenched in the global financial system, serving over 11,000 institutions across 200+ countries. Ripple, while growing, still operates a comparatively smaller network. It’s like David versus Goliath, but with more zeros! 🥊

Moreover, Ripple crypto adoption has faced hurdles in the past due to regulatory challenges, such as the now-resolved SEC Ripple lawsuit. The volatility inherent in XRP and competing technologies, including Ripple’s own RLUSD stablecoin, also present potential roadblocks. But hey, what’s life without a few bumps in the road? 🚧

Nonetheless, Garlinghouse’s focus on liquidity infrastructure, not just transaction speed, sets Ripple apart from other players in the blockchain-based financial space. It’s like choosing a sturdy ship over a flashy yacht! ⛵

Final Thoughts

Ripple’s ambitious plan to capture 14% of SWIFT’s global transaction volume by 2030 could represent a seismic shift in the way cross-border payments are conducted. With XRP already gaining ground in institutional adoption and the Ripple market expanding, the conditions for a breakout may be aligning. 🌍

Whether or not XRP reaches the lofty price targets of $100 or more, its strategic role as a liquidity enabler in the evolving financial ecosystem continues to solidify. As traders watch key resistance zones and potential ETF catalysts, XRP’s path forward may define the next chapter in global payments innovation. Buckle up, folks! 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

2025-06-12 20:21