Ah, the Internet Capital Markets (ICM) sector, once a beacon of hope, now finds itself in a dismal state, akin to a Dostoevskian character grappling with existential dread. The trading volume on the Believe App has plummeted by a staggering 80%, as if the very essence of its vitality has been siphoned away, leaving behind a hollow shell of what once was.

In a parallel universe, the creation of new tokens has also dropped by 77%, a clear sign that the market’s interest is waning faster than a fleeting thought in a troubled mind.

Is the End Near for Internet Capital Markets?

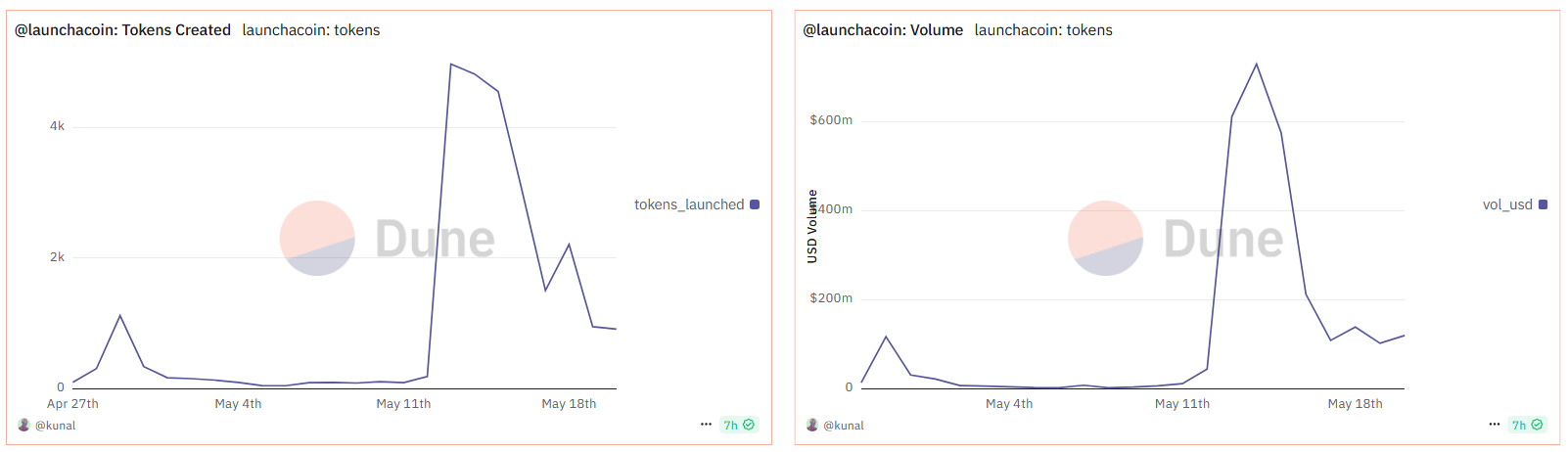

Data from Dune Analytics, that ever-watchful observer, reveals that the daily trading volume of ICM tokens has been on a relentless decline since it peaked at a dizzying $729.3 million on May 14. By May 20, it had dwindled to a mere $143.6 million, a tragic fall from grace.

Similarly, the number of newly created tokens per day has plummeted from 4,977 on March 13 to a mere 1,134 by May 20. One might wonder, is this the beginning of a tragic narrative?

Moreover, the Believe App has facilitated the creation of over 23,000 tokens to date. Yet, only 5.3% of these tokens have been activated. A disheartening statistic, indeed! It suggests that many tokens are languishing in obscurity, much like the dreams of a disillusioned soul.

This low activation rate hints at an oversupply or a lack of utility, a cruel irony in a world that promised so much. The critics have emerged, sharp-tongued and unforgiving. Analyst Mars DeFi recently lamented the erosion of user trust in ICMs, attributing the decline to an influx of “empty tokens” driven by the meme coin craze. Ah, the irony! 🎭

“Users were meant to believe in new capital formation. Instead, they got noise. And now, we’ve undoubtedly hit a fatigue point. Not with tokens, but with empty tokens. This is the tipping point — and also a wake-up call,” the post read.

The analyst argues that the original vision of ICMs, to foster valuable, product-driven projects, has been undermined by low-effort launches devoid of substance. The era of the meme-driven market, it seems, is fading into the annals of history.

According to him, the problem isn’t the memes themselves, but rather that they no longer offer the substance or credibility needed to sustain long-term interest. A tragic comedy, indeed!

“The endgame isn’t launchpads. It’s liquid, decentralized capital markets. Not ‘launch a coin and disappear,’ but ‘launch a product and build it in public.’ That’s the power of ICMs. And that’s where this is heading if we continue to support actual products and not senseless memes,” he wrote.

DYOR co-founder, Hitesh Malviya, had previously cautioned that the ICM narrative might only sustain momentum for four to six weeks. With the sector showing signs of exhaustion just one week after its peak, Malviya’s prediction may be materializing, like a dark cloud looming over a once-bright horizon.

Nevertheless, not all developments point to a permanent downturn. Ben Pasternak, founder of Believe, recently announced the upcoming launch of the Believe API, a glimmer of hope in this bleak landscape.

“The goal of the Believe API is to make it easy for builders to create harmony between their product and coin, no matter what their product does,” Pasternak stated.

This development could attract more builders to the platform, perhaps even reviving token creation and trading volume by enabling developers to integrate better functionalities into their projects. A noble endeavor, indeed!

In addition, Base Network is also keeping a close eye on the Internet Capital Markets trend. Jesse Pollak, Head of Base and Coinbase Wallet, told BeInCrypto that he views the increasing token creation and the growth of decentralized applications as part of this emerging ICM trend.

“We’re pleased to see a steady increase in TGEs and new apps on Base. We see all this as internet capital markets, and we see the $14 billion+ assets on Base as the center of that emerging global economy,” Pollak said.

He also emphasized Base’s role in supporting the crypto economy by providing infrastructure and tools for users and developers. A Herculean task, indeed!

“If we want to bring a billion people onchain, then one day soon, many more things will be tokenized, and Base provides both the infrastructure and tools to help make that easier for both consumers and builders to deploy tokens,” he added.

Still, challenges remain. If the ICM sector hopes to regain user confidence and sustain growth, it must shift its focus from speculative, meme-driven launches to projects with tangible utility. A daunting task, but perhaps not impossible!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Wuthering Waves Mornye Build Guide

2025-05-21 15:14