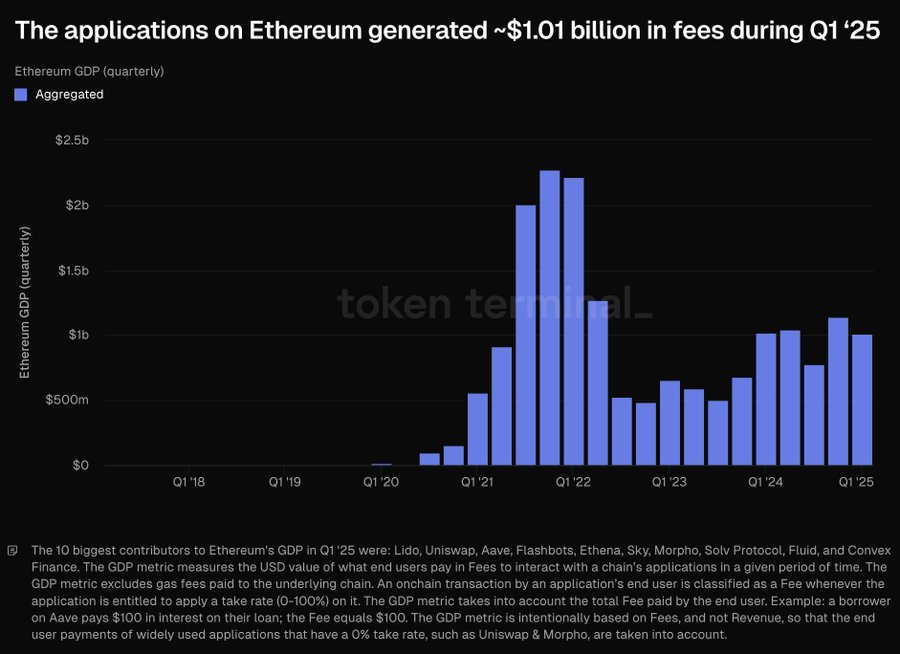

- In the remarkable first quarter of 2025, Ethereum DApps garnered a staggering $1.01 billion in fees

- A most curious phenomenon: a 10% decrease in Ethereum whales, whilst the retail camaraderie appears to diminish

In a most unexpected turn of events, Ethereum’s esteemed DApps have amassed a whopping $1.01 billion in fees during the first quarter of 2025. One might assume this bounty would lift the spirits of ETH holders, but alas, the currency itself has chosen to display a rather lackluster performance.

Nevertheless, one cannot ignore the subtle shifts beneath this gleaming façade – the esteemed Ethereum whales have retreated by a rather alarming 10% since February, hinting rather melodramatically at a potential change in the sentiment of the investor throng.

Indeed, one must wonder: could the flourishing DApps be veiling deeper anxieties regarding ETH’s long-term prospects? It is a question befitting the most earnest of discussions.

A billion-dollar quarter, yet ETH resembles a sulking wallflower

Despite the undeniable prowess of Ethereum’s ecosystem in amassing over $1 billion in application fees, ETH itself lingers in the shadows as one of the most woeful performers among prominent assets this quarter. One might think it enjoys playing the role of the overlooked cousin at a lavish family gathering.

Statistics reveal that ETH has plummeted by an astonishing 41.63% between January and April—rather overshadowed by its more illustrious counterpart, Bitcoin, along with the stalwart S&P 500. How dreadfully pedestrian!

This disconnection between the utility of the network and the token’s rather dreary price suggests all may not be well in this digital Eden. While DApps flourish, those unfortunate souls holding ETH appear to be experiencing no small amount of distress.

The usage remains robust, yet the market seems decidedly unconvinced of ETH’s value as a discerning capital asset. Bitcoin, on the other hand, stands proudly, thus raising the specter that Ethereum is waning as the second most esteemed option.

Ethereum – A retreating caste of whales and waning retail fervor

Indeed, the price travails of Ethereum are mirrored by a conspicuous retreat among both whale and retail activities. Addresses boasting holdings exceeding 10,000 ETH have diminished by nearly 10% since mid-February, declining curiously from 999 to a mere 896 as of the fourth of April. Surely, this hints at little more than deep-pocketed disinterest or perhaps a mere rotation.

Yet, the exodus does not solely reside with the affluent. Daily active addresses have steadily declined throughout March and taken a nosedive in early April, currently languishing near 205,000. One might liken this to a once-bustling soirée now filled only with the echoes of distant laughter.

The conjunction of fading whale enthusiasm and diminishing grassroots patronage casts a rather disheartening panorama for Ethereum’s user base, and thus, we approach Q2 with a decidedly bleak on-chain outlook.

Ethereum’s price outlook: A comedy of errors?

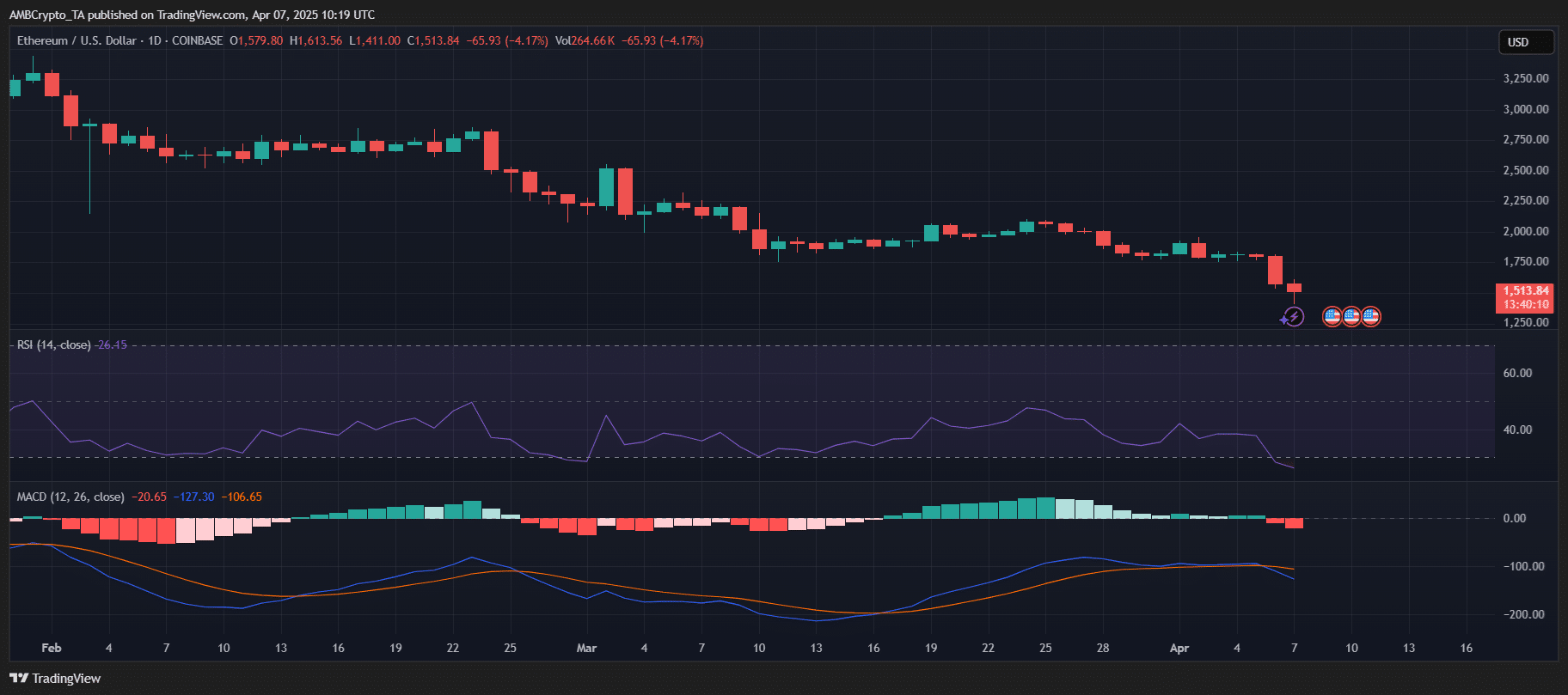

At present, Ethereum is languishing at $1,513, denoting a rather sad 4.17% drop and extending its lengthy downtrend. The RSI hath plunged to 26.45, deeply entrenched in oversold territory – a signal of rather intense selling pressure most unbecoming of its stature. Meanwhile, the MACD histogram flashes a rather dismal negative, confirming the presence of bearish momentum in emphatic fashion.

Notably, there appears to be no bullish divergence in sight, suggesting there exist scant signs of reversal. Unless ETH can find support above the $1,480 mark, one can only speculate that the next psychological threshold might well be $1,300, a prospect that elicits a most sorrowful sigh.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-04-07 18:21