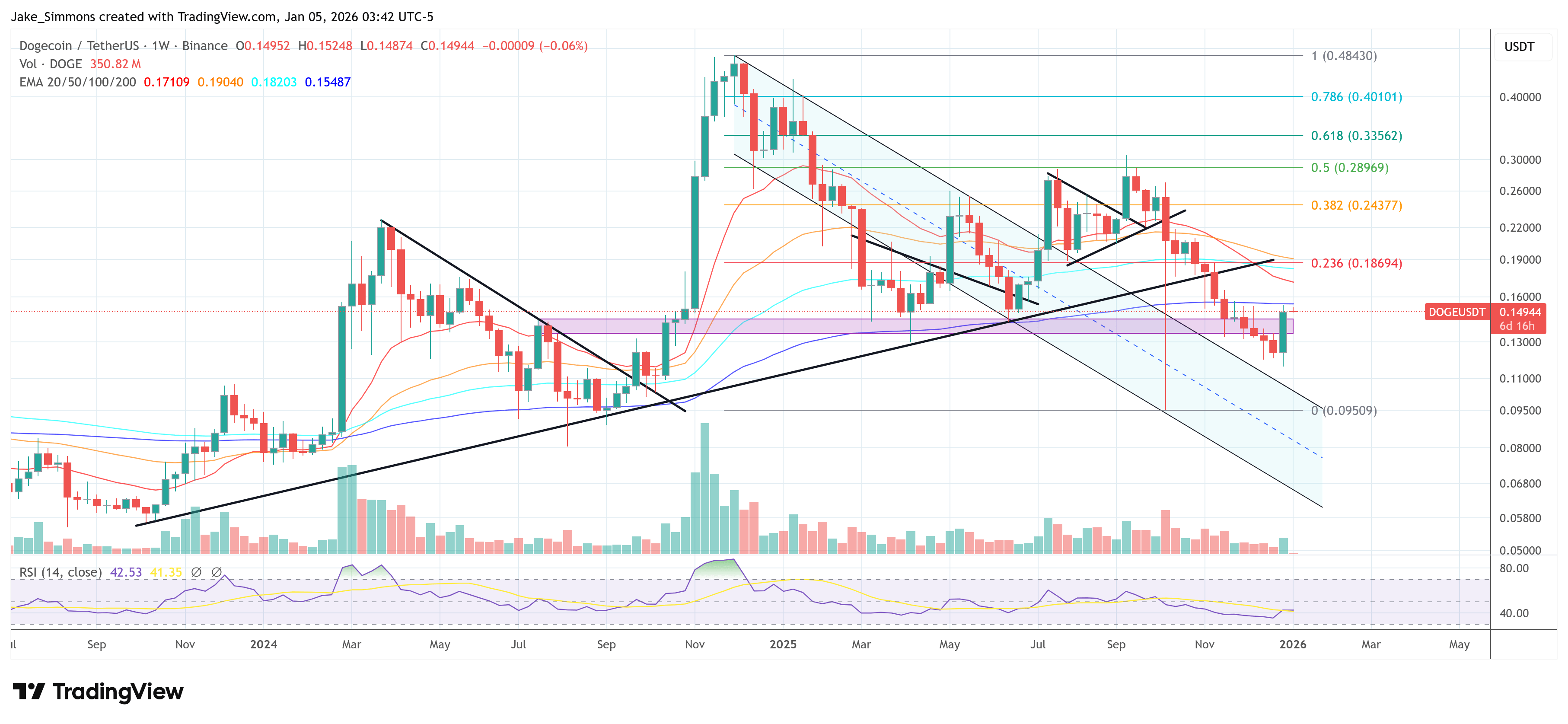

After jumping 28% in the last four days, Dogecoin is at a crucial point. Three analysts believe the price will likely dip slightly before continuing to rise, as long as it stays above a specific technical level (a Fibonacci retracement). They don’t expect the rally to simply end, but rather a temporary pause followed by further gains.

Looking at the charts – the 4-hour, weekly, and monthly – from sources like Matt Hughes, Byzantine General, and Cantonese Cat, I’m seeing a generally strong market that’s now running into some resistance after a recent, significant price increase. It seems we’ve had a good run, but things might slow down as we approach these resistance levels.

Is Dogecoin’s Rally A Dead Cat Bounce?

Matt Hughes identifies a key price level for DOGE – around $0.13847 – as a turning point. If the price rises above this level, it suggests further gains are likely. He’d previously noted this as an important support area, and many were skeptical when it was tested. He also highlighted a strong buying opportunity in the $0.11-$0.12 range, offering a favorable risk-reward ratio.

Looking at the 4-hour chart of DOGEUSDT on Binance futures, it’s easy to see why some traders are suggesting a temporary price increase before another drop – a ‘dead cat bounce.’ The price quickly rose, touched previous high levels, and then fell back down. This pattern could either lead to a successful test of those highs, or a sharp reversal downwards.

According to the analyst known as Byzantine General, Dogecoin is likely to briefly fall back to around $0.14 before continuing its upward trend. He notes the recent price increase has been significant and a small dip would be a normal part of the process, but he remains optimistic about its overall strength.

Looking at the four-hour chart, this price movement is happening alongside increased activity in the derivatives market. Velo’s total open interest has risen to $4.714 billion. Funding rates across major exchanges – Binance, Bybit, and OKX – are positive, suggesting traders are generally bullish, but the market doesn’t appear overly enthusiastic based on these indicators.

Cantonese Cat believes the recent price rally for DOGE could still be successful, but it needs to behave predictably when it encounters resistance. He notes the price has dropped significantly, but this pullback still fits within a long-term, bullish pattern called a ‘cup and handle’ formation, suggesting it remains a potentially valid setup.

Once the price hit that level, he commented that it perfectly matched the resistance point. He then said, with a month still to go, it would be interesting to see how DOGE performs from this point forward.

According to Hughes’ 4-hour chart analysis, key support levels are clearly defined. The 0.382 retracement is at 0.13847, followed by higher retracements at 0.19070 (0.5 level) and 0.26261 (0.618 level).

Looking at the monthly chart, prices are currently squeezed between 0.11778 and 0.15428. To confirm an upward trend, we need to see prices consistently move higher, gradually breaking through these levels, rather than a single, sudden jump. The 0.20210 level is an important target to watch as a sign of continued upward momentum.

Whether DOGE will experience a temporary recovery (a “dead cat bounce”) depends on its performance. If it can stay above $0.13847 for the week and rise to around $0.15428 – a level it previously reached – analysts believe it might be stabilizing before another price increase.

If the price drops below 0.13847 again, it will likely signal that the recent attempt to recover is failing. This could mean the price will fall back down to previous support levels around 0.11778 and 0.09320.

At press time, DOGE traded at $0.14944.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Witch Evolution best decks guide

2026-01-05 12:25