My dear readers, it seems that the Bitcoin trader sentiment has been teetering on the edge of extreme greed for the last few days, a sign that a break may be coming. Or, as I like to think of it, the market is about to have a bit of a nervous breakdown. 🤦♂️

Bitcoin Fear & Greed Index Is Sitting On The Boundary Of Extreme Greed

As is visible above, the indicator currently has a value of 74, which implies the investors as a whole share a sentiment of greed and a strong one at that, considering the high value. In fact, this value is so high that it’s right on the gateway to a special zone called the extreme greed. This region, which is situated beyond the 75 level, corresponds to euphoria among the Bitcoin traders. There is a similar territory on the other end of the scale as well, known as extreme fear (under 25). When the index is in this zone, it naturally suggests the investors are in the deepest state of despair. It’s like the crypto version of a bad hair day. 😢

Historically, both of these zones have held much significance for Bitcoin and other digital assets, as major reversals have occurred when the investors have held these mentalities. Thus, extreme greed can lead to a top and extreme fear to a bottom. It’s the crypto equivalent of a rollercoaster, but with more charts and less screaming. 🎢

Recently, Bitcoin has climbed to price levels near the all-time high, so it’s not surprising that the sentiment is heating up. Still, for now, the index hasn’t broken into the extreme greed zone yet, so it’s possible that the run could have more room to run before overhype becomes an issue. It’s like a sprinter who’s just about to cross the finish line but hasn’t quite broken the tape yet. 🏃♂️

It only remains to be seen how long this would hold, however, considering that the Fear & Greed Index has been sitting on this boundary level for three straight days now. It’s like a cat sitting on a fence, unsure whether to jump or stay put. 🐱

Any continuations to the rally could take the market sentiment beyond the extreme greed threshold, at which point a reversal could become more likely, the higher the index ventures into the zone. It’s like a balloon that’s been inflated to the point where it’s just begging to pop. 🎈

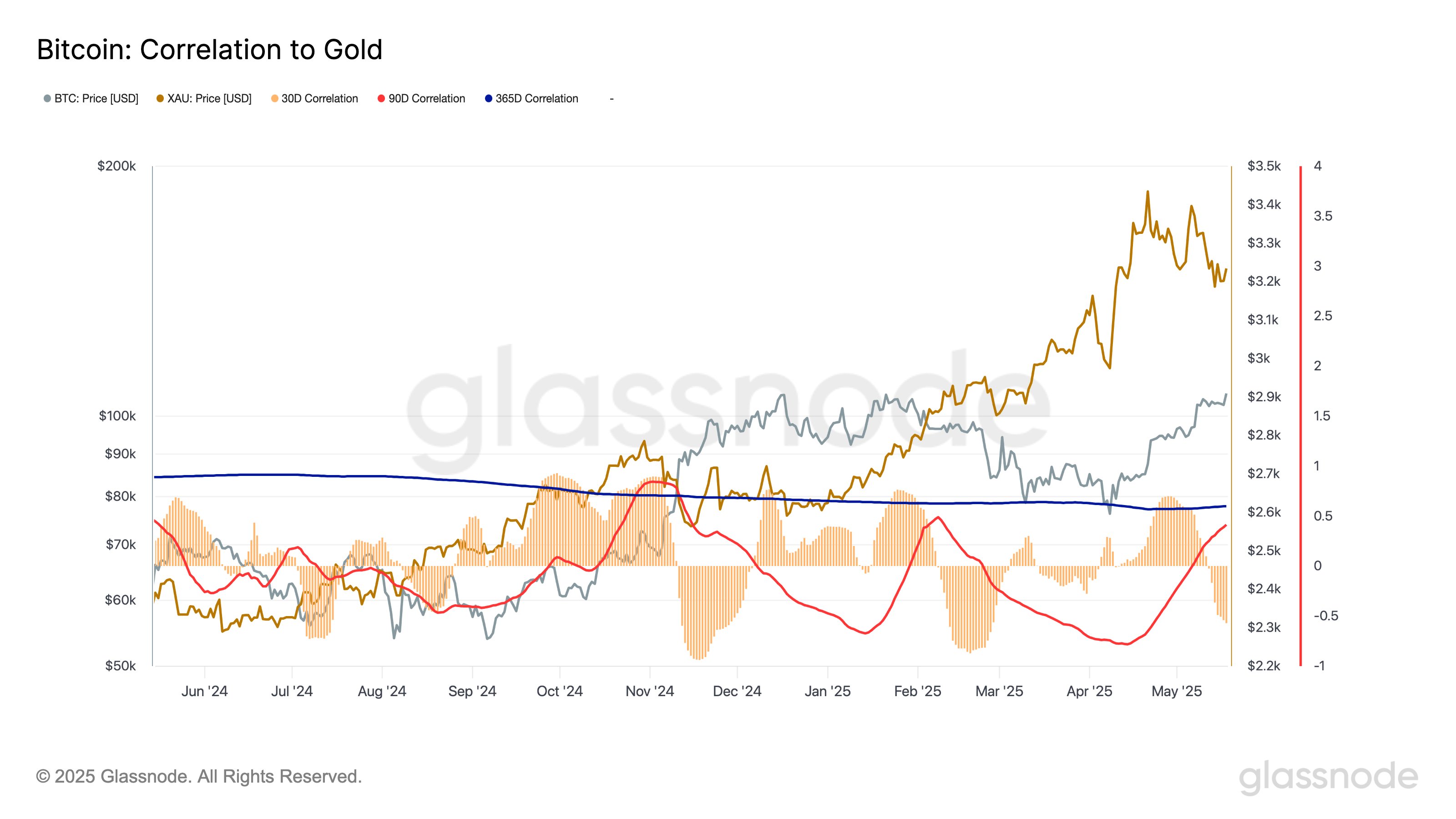

In some other news, Bitcoin’s 30-day correlation with Gold has recently declined to its lowest level since February, as the analytics firm Glassnode has pointed out in an X post. It’s like Bitcoin and Gold have decided to take a break from each other, much like an old married couple. 🤵♂️👵

At present, the 30-day correlation between Bitcoin and Gold is sitting at a value of -0.54, which means that over the past month, the two have traveled oppositely to each other to some degree. It’s like they’re playing a game of tug-of-war, but one of them is a bit stronger. 🤺

BTC Price

Bitcoin saw a sharp burst to the $107,000 level yesterday, but the coin has since fallen off just as rapidly, as its price is now floating around $102,300. It’s like a yo-yo, but with more zeros. 🕹️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-05-20 06:44