What to know:

- Bitcoin options worth over $10 billion are about to expire this Friday at 08:00 UTC on Deribit. Expect some wild market action.

- The $95,000 to $105,000 range is the hot zone—traders are holding their breath, hoping it doesn’t turn into a roller coaster.

- Despite Bitcoin reaching the moon, Deribit’s DVOL index is showing no signs of panic over the upcoming expiry.

Ah, the sweet sound of billions of dollars ticking away. Bitcoin options worth over $10 billion are set to expire this Friday at 08:00 UTC on Deribit, and guess what? The $95,000 to $105,000 range has become the battlefield for traders. The stakes? Nothing less than potential volatility and the fate of the crypto market. Get ready for the show, folks.

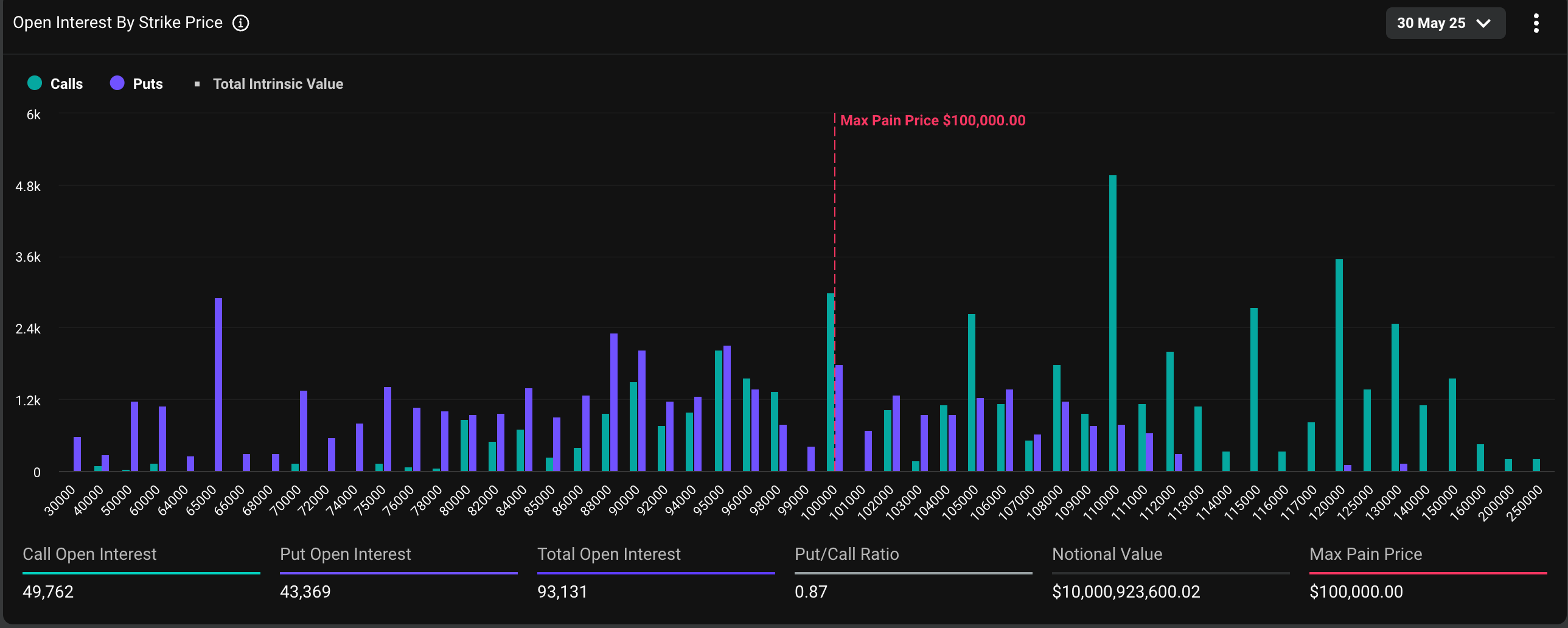

At the time of writing, there were 93,131 bitcoin monthly options contracts hanging in the balance, each representing one BTC on Deribit. Of these contracts, 53% are calls (because who doesn’t like a bullish bet?) while the rest are puts (for those who’d rather play it safe, or perhaps just hedge their bets). That’s a lot of skin in the game.

The open interest distribution is particularly juicy, with a lot of “” exposure clustered around the $95,000, $100,000, and $105,000 strikes. Translation: if Bitcoin’s price wavers, traders at these levels could face some serious directional risks. So, what happens when prices start dancing? It’s chaos, naturally.

And let’s talk about Gamma. No, not the gamma rays you’d expect from a sci-fi movie. This one measures how sensitive options are to price changes. As the expiration gets closer, gamma’s going to peak, and that means volatility could go through the roof. Investors and market makers will be scrambling to hedge their positions, making the price movements even more dramatic. Hold on to your hats.

“The largest concentration is in Deribit BTC’s May 30 expiry, with $2.8B exposure led by strikes at $100K, $105K, and $95K,” said Volmex, a decentralized crypto trading platform. “Expect strong gamma-driven flows into the end of the month.” Translation: buckle up, we’re in for some turbulence.

“Any move can trigger aggressive dealer hedging, fragile gamma environment! Expect volatility!” Volmex added, sounding like the crypto equivalent of the boy who cried wolf. Only, in this case, there might actually be a wolf.

As of now, Bitcoin is trading at $107,700, having reached a record high above $111,000 last week, according to CoinDesk data. Pretty impressive, right? But don’t get too comfortable. The market is like that one friend who always promises to be calm but never fails to cause a scene at parties.

Deribit’s DVOL index, which measures the 30-day implied volatility based on options, continues to decline, signaling that there’s not much concern about the expiry. But, with the way crypto works, who knows? It could all change in a heartbeat.

Meanwhile, Volmex’s one-day implied volatility index has ticked up slightly to 45.4%, which means we might see a 2.37% price move within the next 24 hours. If that’s not a fun ride, I don’t know what is.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-29 09:36