🚨💸 “Inflation’s Cunning Sting: Markets in Disarray” 🚨💸

Like a masterful chess player, inflation has outmaneuvered the U.S. Federal Reserve once more, as the core personal consumption expenditures price index executed a daring leap of 0.4% in February, the most substantial monthly bound since January 2024. 📈

The Fed’s Inflation Conundrum: A Setback of Epic Proportions

That most fastidious of inflation gauges, the core PCE price index, now taunts the Fed with an annual inflation rate of 2.8%, stubbornly above the coveted 2% target. Overall, PCE prices rose 0.3% for the month and 2.5% year-over-year, driven by the relentless drumbeat of services and goods costs, including the ever-escalating realms of healthcare, financial services, and recreational goods. 🤕

Meanwhile, consumer spending, that stalwart driver of economic activity, managed a lackluster 0.4% growth in February, mustering a mere $87.8 billion, below the lofty expectations of analysts. Gains were led by spending on goods ($56.3 billion), particularly those most indulgent of pursuits: motor vehicles and recreational items. Services outlays rose $31.5 billion, though declines in food services, accommodations, and gasoline spending served as a dampening counterpoint. Real PCE, adjusted for inflation, inched up a paltry 0.1%, whispering tales of weaker demand amid the inflated landscape. 📉

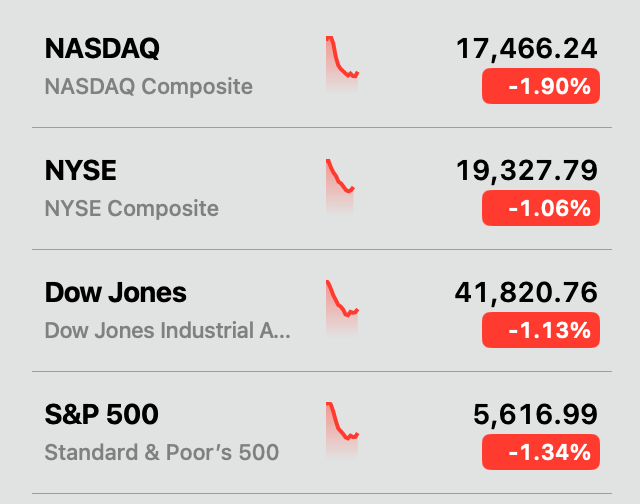

Financial markets, those mercurial beasts, reacted with characteristic flair to the report, sending all major U.S. stock indices into a tailspin on Friday. Because, why not? 🤷♂️

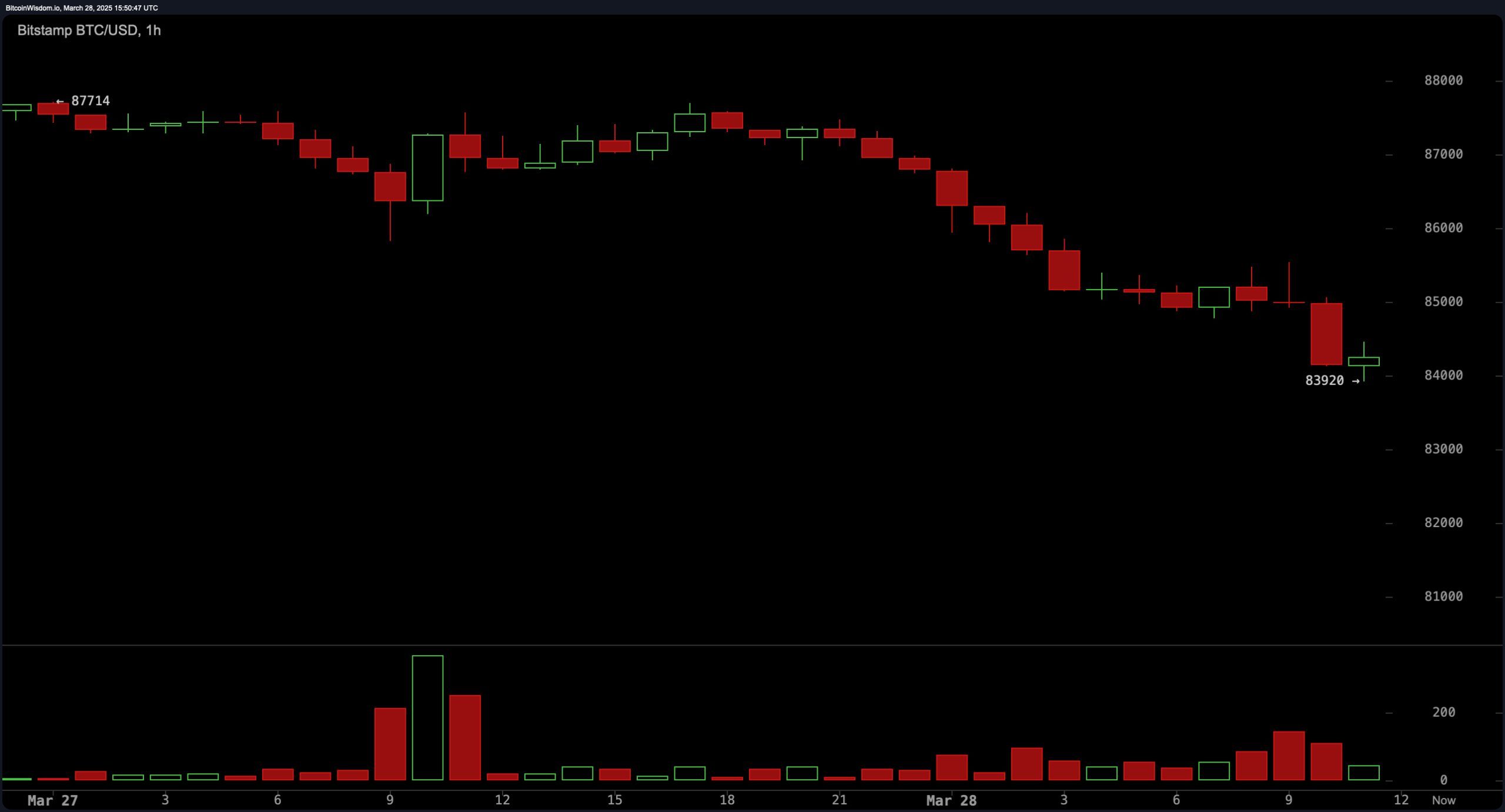

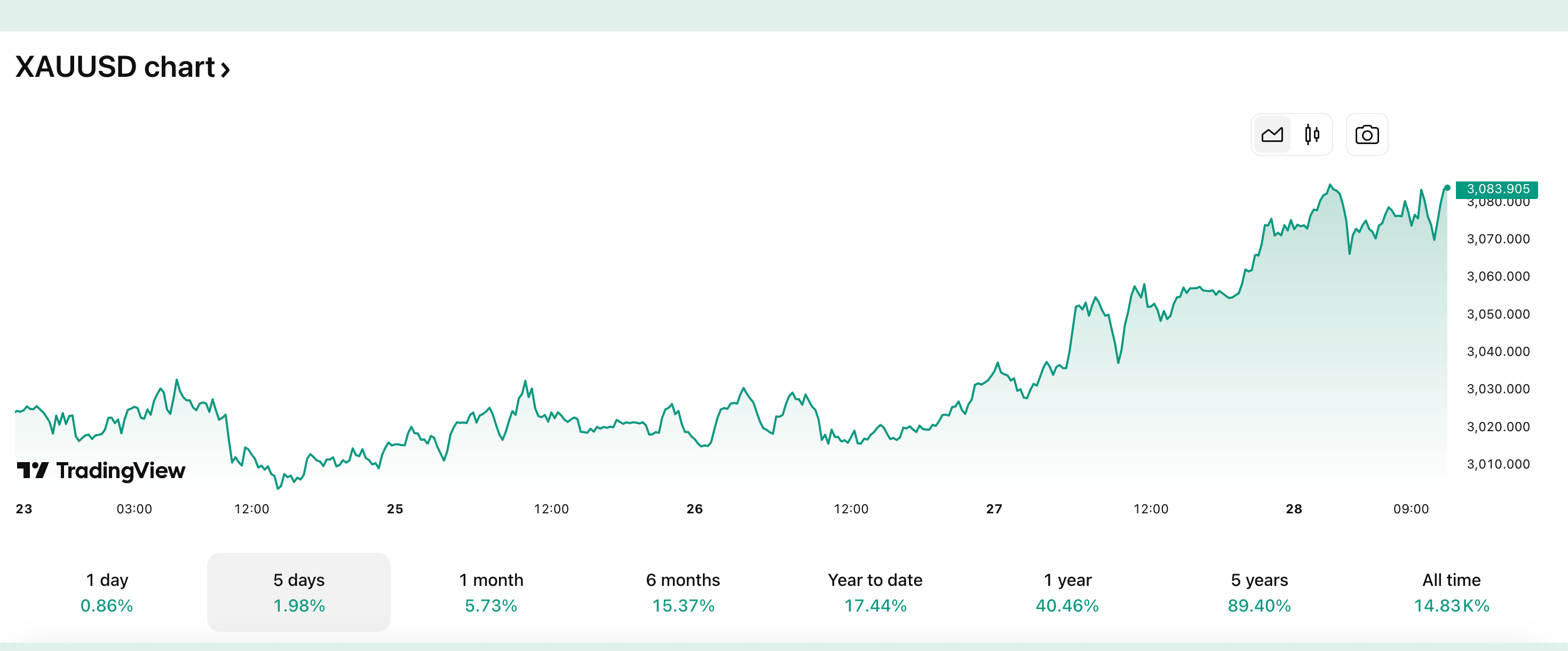

Bitcoin ( BTC), that most capricious of crypto assets, plunged to an intraday low of $83,920 per unit, as investors scrambled for the exits. Gold, the traditional inflation hedge, stood firm at $3,071 per ounce at 11:30 a.m. ET on Friday, a beacon of stability in uncertain times. 💃

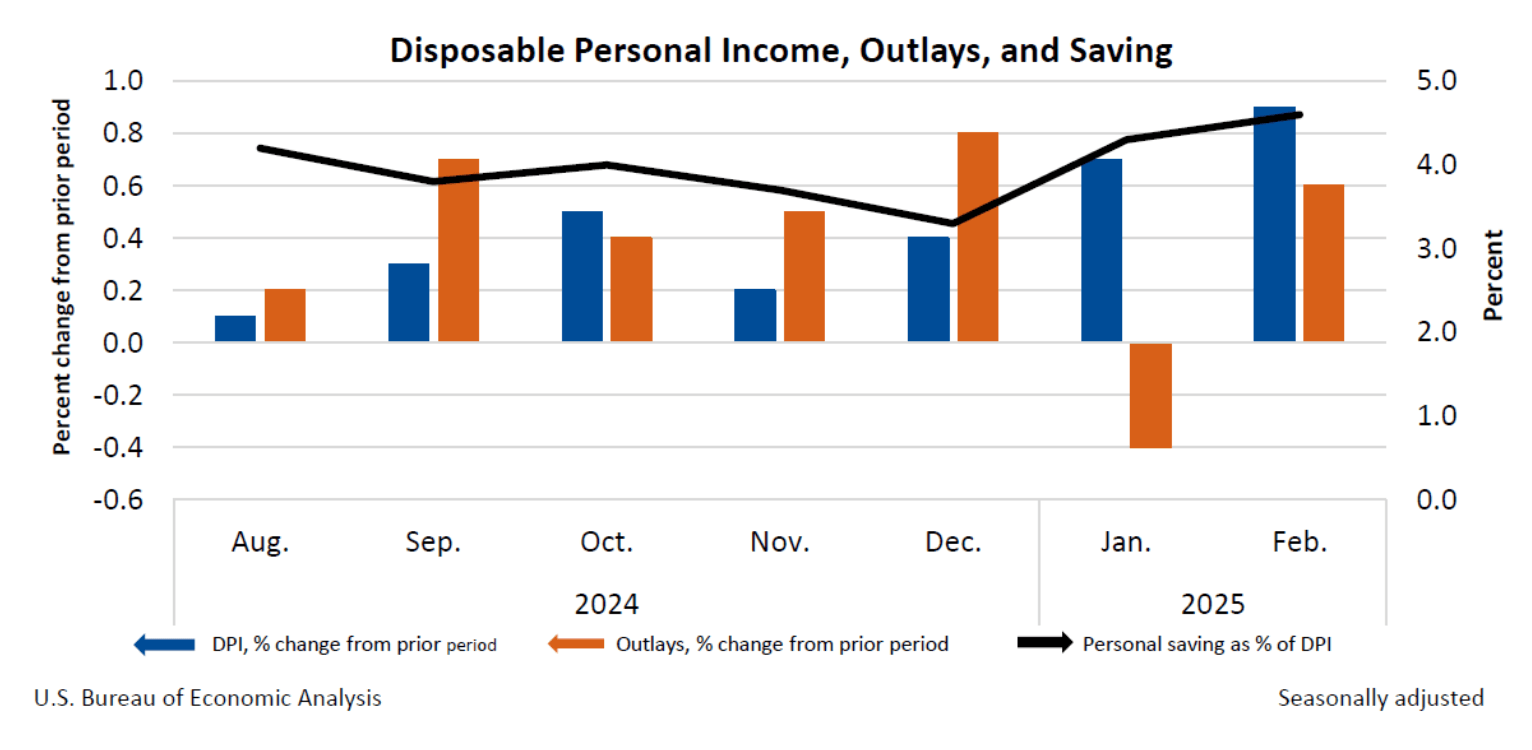

The Commerce Department noted personal income climbed 0.8% in February, buoyed by wage growth and those delightful transfer receipts, including healthcare subsidies. Disposable income rose 0.9%, though real disposable income—adjusted for inflation—grew a more modest 0.5%. Meanwhile, the personal saving rate held steady at 4.6%, suggesting households remain cautiously perched on the fence. 🤔

Revisions to prior data revealed weaker income growth in January, with wages revised down to 0.2% and farm proprietors’ income slashed by $33.9 billion due to delayed relief payouts. Federal workforce adjustments, including those intriguing deferred resignation programs, did not impact February’s employment metrics, per the Bureau of Economic Analysis. Because, bureaucracy. 🙄

The report sets the stage for a deliciously tense Fed policy meeting in April, as the central bank’s policymakers attempt to balance the competing interests of resilient inflation and moderating consumer momentum. The Commerce Department, in a masterclass of understatement, explained that updated income and spending data for March will be released on April 30. Stay tuned, folks! 🍿

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- M7 Pass Event Guide: All you need to know

2025-03-28 19:36