It is a truth universally acknowledged that a cryptocurrency in possession of good fortune must be in want of stability. This week’s HYPE price update reveals a most distressing shift in sentiment, as the broader crypto market’s melancholy casts a shadow upon Hyperliquid’s native token. Despite its admirable revenue fundamentals and rather audacious long-term projections, the short-term frailty and dwindling open interest provoke the gravest of inquiries into the HYPE price prediction outlook. 📉

Revenue Strength: A Beacon of Hope Amidst the Chaos

One cannot deny the singular fascination surrounding HYPE crypto, chiefly due to the company’s most extraordinary financial disposition. Hyperliquid, with a mere eleven souls toiling away, generates an estimated $1.15 billion in annual recurring revenue-rendering it one of the most profitable and, dare we say, frugal enterprises in the sector. Such efficiency has not escaped the notice of Mr. David Schamis, CEO of Hyperliquid Strategies, who, with the confidence of a man accustomed to success, has declared the enterprise most intriguing indeed. 💼

David said $HYPE will go 20× from current MarketCap

“Anything with 11 employees and a billion one of cash flow with no outside capital (VC’s) is very very interesting”

(Hyperliquid has generating around $1.15 billion in ARR and there are 11 employees)

– BabaKarl (@BabaKarl) December 5, 2025

Such declarations have emboldened Mr. Schamis to prognosticate a most ambitious trajectory for HYPE’s valuation-twentyfold, no less!-provided the ecosystem continues its revenue conquest without the crutch of external capital. Yet, alas, the present market’s malaise threatens to render such optimism premature, for what are fundamentals in the face of macroeconomic despair? 😒

Short-Term Prospects: A Dance Upon the Edge of a Knife

While the long-term prospects of HYPE may inspire dreams of grandeur, the immediate circumstances paint a rather less flattering portrait. The $30-$31 range, dear reader, is the battleground upon which HYPE’s fate shall be decided. Should this bulwark crumble, the token may find itself in a most ignominious descent toward the $20 region-a fate shared by many a high-beta altcoin in these troubled times. Conversely, should it hold firm, a resurgence may yet grace the beleaguered token in the year 2026, provided the broader market deigns to stabilize. 🎭

Open Interest: A Most Melancholy Decline

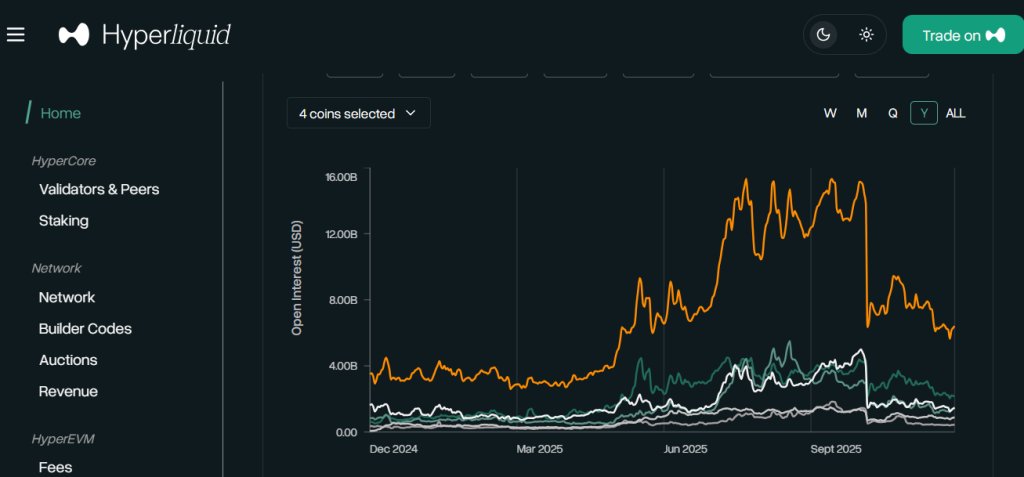

Further compounding the intrigue is the lamentable contraction in trading activity. During Bitcoin’s glorious zenith in October, Hyperliquid boasted open interest nearing $16 billion-a sum most impressive! Yet, by December’s frosty embrace, this figure had withered to a mere $6 billion, a decline most severe. Such reticence among traders suggests a marked reduction in risk appetite, though one may hope that, with Bitcoin and Ethereum’s revival, Hyperliquid’s fortunes-and HYPE’s price-may yet be restored. 🤔

Thus, we find ourselves at a most curious juncture: a confluence of diminished risk-taking, faltering technical fortitude, and exceptional revenue fundamentals. A narrative most perplexing, indeed, and one that shall require the keenest of minds-or perhaps the stoutest of hearts-to unravel. 🧐

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- M7 Pass Event Guide: All you need to know

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

2025-12-06 17:08