In a world where the digital and the tangible often collide in the most unexpected ways, the prominent decentralized exchange Hyperliquid has once again proven itself a master of timing and strategy. With a flourish worthy of a grand stage, Hyperliquid has unveiled its plans to launch USDH, a stablecoin so novel and so aligned with its ethos that one can almost hear the collective gasp of the crypto community. And what a reaction it was! The mere whisper of this development sent HYPE soaring 3% intraday, a testament to the power of anticipation and the allure of the unknown. 🚀

The announcement came through the official Discord channel of Hyperliquid, a platform that has become the digital town square for crypto enthusiasts and validators alike. It was stated with the solemnity of a decree that USDH’s proposal would now be subjected to a validator vote, a process as democratic as it is crucial, much like the asset delisting process that has been a cornerstone of the platform’s governance. 📜

HYPERLIQUID IS RELEASING $USDH

A Hyperliquid-first, Hyperliquid-aligned, and compliant USD stablecoin.

– 800.HL (@degennQuant) September 5, 2025

The voting process, a true test of the community’s will, will take place directly on-chain at the first level. Here, validators will hold the keys to the kingdom, with the authority to approve the design and select the development team. It’s a moment of high drama, where the future of a stablecoin and the fate of a community hang in the balance. 🗳️

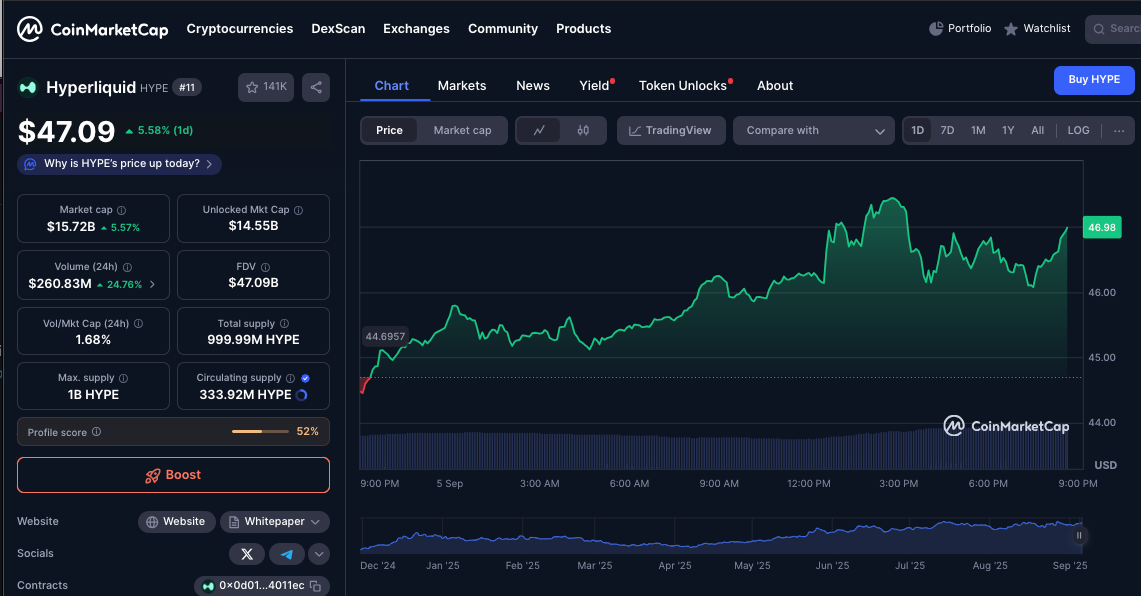

Hyperliquid Price Action on September 5, 2025 | Source: CoinMarketCap

Despite the whirlwind of excitement, the official website of Hyperliquid remains curiously silent on the matter of USDH, leaving traders and enthusiasts in a state of delightful suspense. Yet, the markets, ever quick to react, have shown their approval. HYPE has risen 3.4% on the daily chart, reaching a high of $47 at press time, a figure that speaks volumes about the confidence and optimism of the crypto community. 📈

Tether Co-founder’s Project Shows Decentralized Stablecoin Model

Since the signing of the Genius Act by the illustrious President Trump in July 2025, the landscape of stablecoins has undergone a seismic shift. USDC and USDT, the titans of the industry, have seen their on-chain supplies reach unprecedented heights, drawing in high-profile newcomers such as the Trump-backed WLFI’s USD1 and the US banking giant JP Morgan’s JPMD. It’s a veritable parade of innovation and ambition, a testament to the dynamic nature of the financial world. 🎉

However, it is Hyperliquid’s proposal that truly captures the imagination. Investors, it seems, are not content with merely pegging to the dollar; they seek something more, something that embodies the spirit of decentralization and innovation. The USTT, YLD, and STBL stablecoins, brainchildren of the decentralized stablecoin protocol chaired by none other than Tether co-founder Reeve Collins, offer a glimpse into the future-a future where stablecoins are not just a means of exchange but a foundation for a new financial order. 🌐

The future of finance isn’t just about tokenization. It’s about building the infrastructure that makes it usable, trusted & accessible for all. That’s the mission behind .Very soon, we take another big step towards that vision.

– Reeve Collins (@Reeve_Collins) September 5, 2025

The dual-token architecture at the heart of these projects is a marvel of transparency and user control. One token maintains the peg, ensuring stability and reliability, while the other captures yield from the reserves, offering a tantalizing blend of security and profit. It’s a system that empowers users, giving them more control over their risk and participation, a true democratization of finance. 💼

This model, backed by overcollateralized assets and enabled by smart contract minting, eliminates the need for intermediaries and the delays that often accompany traditional financial systems. It’s a bold step forward, one that promises to reshape the way we think about stablecoins and the broader financial ecosystem. 🤝

Adding to the excitement, Hyperliquid has announced a major protocol update. Maker, taker, and user fees for dual-currency spot market pairs will see an 80% reduction, a move that is sure to delight traders and increase transparency across the platform. To activate these pairs, projects must lock a minimum amount of HYPE tokens, a requirement that adds a layer of security and commitment to the system. The exact collateral threshold and slashing rules will be revealed in due course, keeping the community on the edge of their seats. 🎭

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-09-06 05:07