Welcome, dear reader, to the US Crypto News Morning Briefing-your indispensable guide to the most riveting developments in the world of crypto, where fortunes are made and lost faster than you can say “blockchain.”

Pour yourself a cup of that artisanal coffee, for we are about to embark on a tale of a decentralized derivatives exchange (DEX) that has the audacity to disrupt Wall Street’s efficiency metrics, leaving titans like Tether, Nvidia, and even the venerable Apple in its wake. Yes, you heard it right-revenue per employee metrics that would make even the most seasoned corporate executive weep with envy. ☕️

Crypto News of the Day: Hyperliquid Surpasses Apple and Tether With $102.4 Million Revenue Per Employee

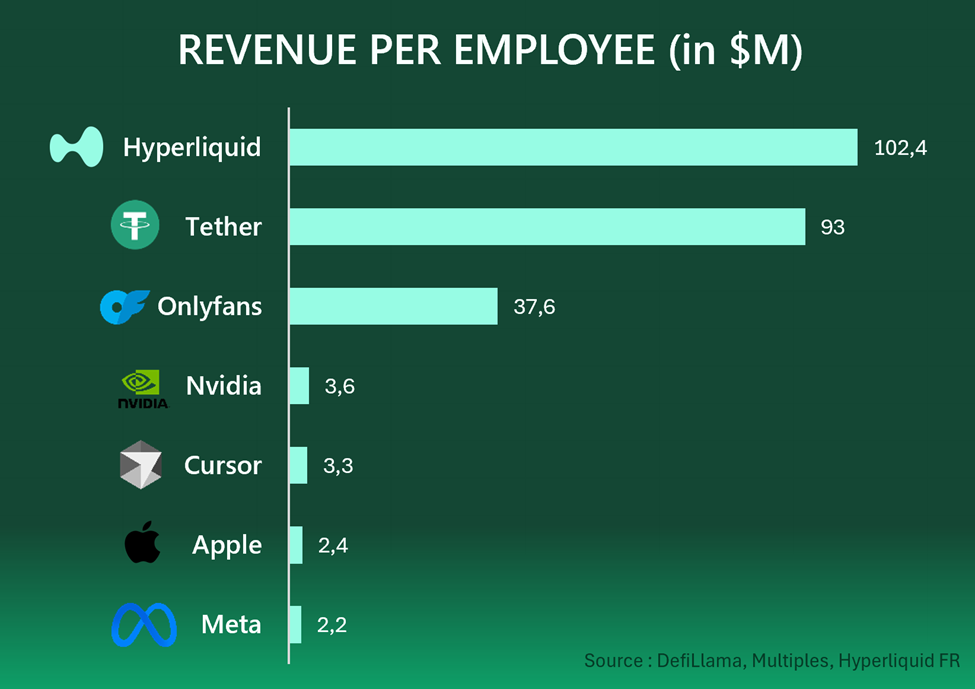

According to the ever-reliable DeFiLlama, Hyperliquid is raking in an estimated $1.127 billion in annual revenue with a mere 11 core contributors. That’s a staggering $102.4 million in revenue per employee, a figure that would make even the most ambitious hedge fund manager blush. 💰

In a rather amusing twist, Tether’s per-employee revenue is a paltry $93 million, while Apple, with its $400 billion annual sales machine, manages a meager $2.4 million per employee. One can only imagine the boardroom discussions at Apple-“How do we compete with a bunch of crypto enthusiasts?”

This remarkable success underscores the power of crypto’s lean operational models. Unlike traditional firms, which seem to employ half the population, Hyperliquid’s streamlined structure allows a handful of developers to generate revenue that rivals the largest corporations. Who knew less could be more? 🤷♂️

Jeff Yan, the CEO and co-founder of Hyperliquid, recently confirmed that the protocol’s team consists of just 11 individuals. In a moment of candidness, he admitted that while the team has its strengths, there’s always room for improvement-an understatement if ever there was one.

Reportedly, Jeff remains deeply entrenched in the technical work, ensuring that the overall architecture and performance are up to snuff. One can only hope he has a good supply of energy drinks to keep up with the demands of such a monumental task.

Moreover, the DEX has taken a rather bold stance by turning down venture capitalists, opting instead for self-funding. Jeff argues that traditional VC financing creates an illusion of progress by inflating valuations. Ah, the sweet irony of a crypto company rejecting the very thing that fuels most startups! 🎭

Hyperliquid Founder: Why We Turned Down All Venture Capital?

Jeff stated that Hyperliquid has been entirely self-funded and was not created for profit. He criticized traditional VC financing for creating an “illusion of progress” by inflating valuations, stressing that true progress…

– Wu Blockchain (@WuBlockchain) August 18, 2025

With DeFiLlama estimating Hyperliquid’s annualized revenue at $1.127 billion, this lean 11-person team is setting a new benchmark for efficiency. It’s like watching a well-oiled machine, if that machine were powered by a few caffeine-fueled developers in a basement somewhere.

This aligns with a 2022 study that found DeFi platforms routinely achieve 50-70% higher revenue efficiency than their traditional counterparts. Hyperliquid is the poster child for this phenomenon, pushing beyond niche success to challenge mainstream enterprises. Who knew crypto could be so… efficient?

Hyperliquid Dominates Blockchain Revenue

The decentralized exchange’s dominance is also evident at the ecosystem level. According to DeFiLlama, a mere nine protocols generated 87% of all distributed protocol revenue last week. Hyperliquid, along with the Solana meme coin launchpad Pump.fun and Aerodrome, accounted for a staggering 75% of the total. Hyperliquid alone captured 37% of blockchain revenue in July, proving its outsized role in the DeFi economy. Talk about a power trio! 💪

87% of protocol revenue distributed to token holders over the past week came from only 9 protocols.

75% of all revenue distributed to token holders came from only 3 protocols: Hyperliquid, Pump, and Aerodrome.

– DefiLlama.com (@DefiLlama) August 18, 2025

BeInCrypto reported that July’s record-breaking run was fueled by soaring demand for simple, high-volume derivatives trading. Open interest, USDC inflows, and active trading volumes surged, even as the exchange faced temporary outages that tested its scalability. A true test of character, if you will.

Looking ahead, Hyperliquid is preparing for its HIP-3 upgrade, a shift that would evolve the platform from a derivatives exchange into a full Web3 infrastructure layer. Because why stop at being a mere exchange when you can be the backbone of decentralized applications and “smart derivatives”? Ambition, thy name is Hyperliquid!

This grand ambition puts Hyperliquid on a collision course with centralized exchanges and established DeFi hubs. If successful, it could cement the exchange as both a trading venue and a foundational layer for decentralized finance (DeFi). The stakes have never been higher!

Meanwhile, by surpassing Apple, Tether, and Nvidia in per-capita efficiency, Hyperliquid compels us to rethink traditional corporate metrics. Critics may argue that comparisons with firms like OnlyFans or tech giants overlook structural differences, but the numbers are hard to dismiss. After all, who doesn’t love a good underdog story? 🐶

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of August 19 | Pre-Market Overview |

| Strategy (MSTR) | $336.57 | $339.75 (+0.94%) |

| Coinbase Global (COIN) | $302.07 | $304.34 (+0.75%) |

| Galaxy Digital Holdings (GLXY) | $24.10 | $23.99 (-0.44%) |

| MARA Holdings (MARA) | $15.17 | $15.15 (-0.13%) |

| Riot Platforms (RIOT) | $11.96 | $11.98 (+0.17%) |

| Core Scientific (CORZ) | $14.35 | $14.32 (-0.21%) |

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-20 17:00