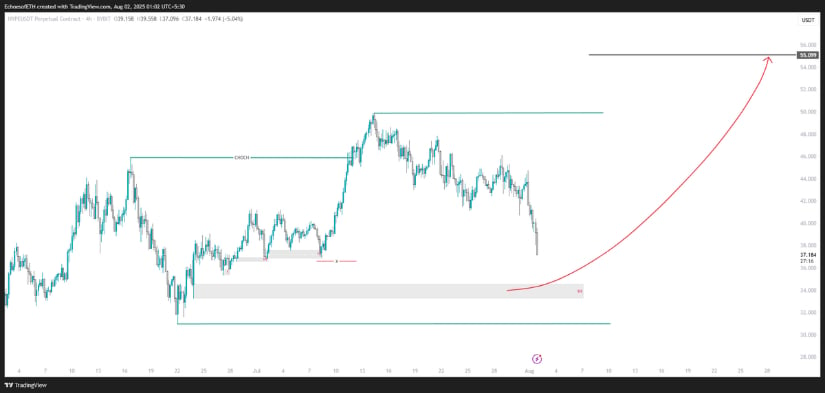

In a quiet corner of the financial world, Hyperliquid, that curious creature, seems to be teetering between an ingénue and a trickster. The signs are whispering, no, shouting, that it might soon take a dramatic leap—though, honestly, who knows if it’ll be graceful or a full-blown tumble. Watchers with too much time and too little caffeine are mistrustfully eyeing the $34 to $32 zone, as if it’s the door to Narnia or maybe just the next disappointment. If, by some miracle, the buyers muster the courage, a quick rebound could follow—like an underdog finally getting its star turn. And don’t forget the internal signals, wagging their tails like excited dogs, hinting that HYPE might just surprise us all—unless it doesn’t.

Hyperliquid’s Almost-Unaffected Demand Zone Near $34–$32

Since hitting a high of about $49.90, our beloved Hyperliquid has been sliding down like an awkward teenager, now resting near $37 and inching toward a demand zone that hasn’t really been tested yet. The stretch between $34 and $32 remains unchallenged—an untouched, pristine field awaiting the brave. It’s not collapsing with dramatic flair, but gently lowering its highs, like a shy debutante trying not to cause a scene. This cautious descent might either be a calm before a storm or just a slow parade of minor tremors.

EchoesofETH, the prophet with charts, predicts a V-shaped comeback if this demand zone holds. The target? A stunning, all-time high of around $54. That’s not just a fancy number, it’s a whole new chapter, a full recovery of the recent trend—unless it’s just wishful thinking. But beware the mid-range resistance near $49.90; it’s the gatekeeper, the old guard, the mighty wall that stands between hope and disillusionment.

The SWPE Ratio: Like a Nostradamus With a Special Mood Swing

As Hyperliquid approaches its support, think of the SWPE ratio—an internal valuation whispering sweet nothings—dropping to 3.05. Historically, this has been the sign for a party, a rally, a rebirth. Looking at the colorful chart from 0xPicasso, every time this ratio dipped to similar levels—March 7, March 16, April 8—the price was in the low teens, and then, suddenly—a miracle, or perhaps not—a rally ensued. Each of those moments was like a quiet sigh that hinted, “Maybe, just maybe, this is the bottom.”

Today’s setup isn’t much different. It’s like déjà vu, but with a chance for the underdog to finally shine. The internal data is whispering, “Hold on, the best is yet to come,” or so we hope.

//bravenewcoin.com/wp-content/uploads/2025/08/Bnc-Aug-4-657.jpg”/>

More interesting are the oscillators—stochastic and RSI—making a dance of bullish divergence, while the price makes a lower low. It’s almost poetic, like watching a tragedy turn into a comedy, hinting that sellers might finally tire out. Combine that with the SWPE ratio’s descent into earnest territory and an untested demand zone—set the scene for a possible reversal, or at least some suspense.

On-Chain Moves and the Quiet Confidence of Big Players

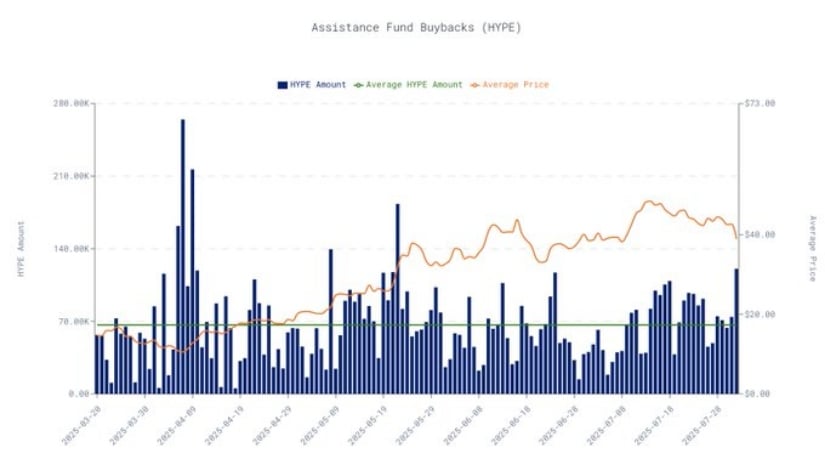

Despite the dips, Hyperliquid shows an impressive resilience, as if it’s got a secret stash of strength. The buybacks from the fund are climbing, like a stubborn kid trying to prove it’s still growing. The average buyback price remains high, which suggests the big shots still believe in this ship. These protocol buybacks act as an invisible pillow, softening the fall and hinting that this isn’t a crash—more like a calculated pause, or a dramatic pause for effect.

Then there’s the absorption ratio—like a sponge soaking up sell volume. When it dips, it’s a sign that the market is tired, and sellers are losing steam. Right now, it’s hinting at a gentle turnaround, or maybe just a lull before the inevitable chaos. Either way, it adds another layer to the puzzle, one that says, “Hold tight. Something might happen soon.”

Wrapping It Up, Or Just Wasting Words?

All in all, Hyperliquid dances at a crossroads—technicals, internal signals, and gut feelings telling different stories. The demand zone near $34–$32 is like the last slice of cake—tempting and untested, ready for someone brave enough to try. The bullish divergences and EMA support are the cheerleaders lining up for a comeback, while the SWPE ratio and buybacks whisper promises of better days. But whether it’s a genuine rebound or just another flash in the pan, only time will tell—because, frankly, nobody really knows, and that’s what makes it fun—or tragic.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-04 00:11