Solana Company (NASDAQ: HSDT), which used to be called Helius Medical Technologies-presumably before realizing that brains are overrated and crypto is where the real money is-announced it’s been hoarding SOL like a squirrel preparing for winter. The company now owns a staggering 2.2 million SOL, plus $15 million in cash, presumably to buy more SOL when no one’s looking. According to their October 6 press release, this stash is worth over $525 million, which is more than they raised in their recent private placement. Because nothing says “long-term commitment” like dumping your medical device business to bet big on internet money. 🚀

At $232.50 per SOL (as of, oh, let’s say midnight on October 6, because why not?), their digital treasure chest is overflowing. The company insists this is all part of their “strategy,” which, let’s be honest, sounds suspiciously like watching Michael Saylor and Tom Lee do something and yelling, “Me too!”

Staking SOL: Because Sitting on It Wasn’t Enough

Why Solana? Well, according to the company, Solana can handle 3,500 transactions per second (allegedly), has 3.7 million daily active wallets (probably bots), and has processed 23 billion transactions this year (give or take a few million failed ones). Plus, SOL offers a sweet 7% staking yield-unlike Bitcoin, which just sits there, judging you silently. 🧐

“We’re totally not copying MSTR and BMNR, okay?” said Cosmo Jiang of Pantera Capital, who may or may not have been holding a “How to Be Michael Saylor” handbook at the time. “In just three weeks, we’ve already surpassed our initial capital raise. Efficiency!”

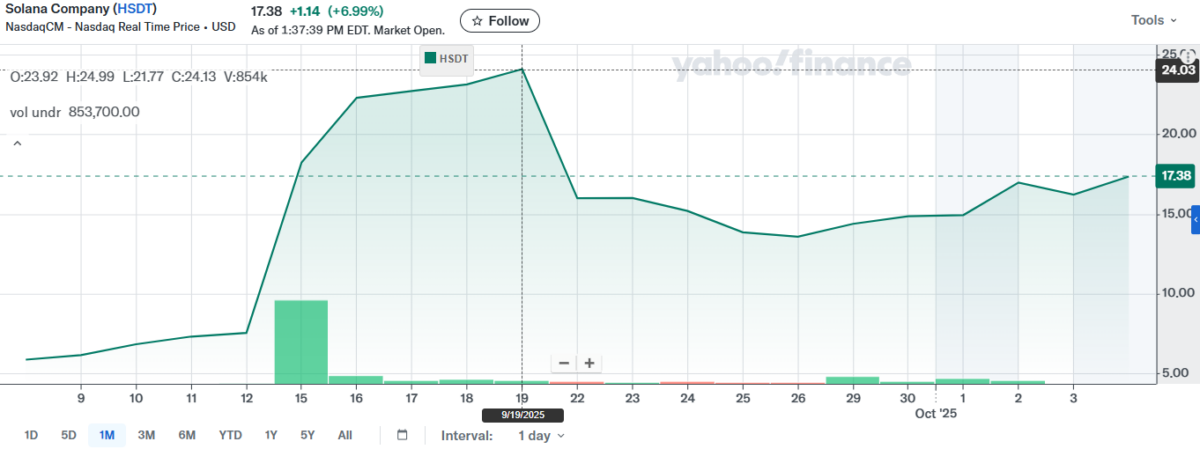

Meanwhile, HSDT’s stock has been bouncing around Nasdaq like a caffeinated kangaroo, recently rebranding as “Solana Company” because, let’s face it, “Helius Medical Technologies” doesn’t scream “crypto bro.” Shares are now hovering near $17.38, up a casual 190% since they decided SOL was their new best friend. 📈

Solana Company stock performance | Source: Yahoo! Finance (or, as we like to call it, “The Casino Ledger”)

Everyone Else Is Doing It Too

Turns out, Solana treasuries are the new corporate fad-like standing desks, but with more volatility. Pantera Capital has $1.1 billion in SOL, Fitell launched an Australian SOL treasury (because why not?), and US-listed firms are piling in faster than you can say “bubble.”

According to Coingecko, nine public companies across three countries now hold over 13 million SOL. That’s still only 2.46% of digital asset treasuries, which means there’s plenty of room for more reckless financial decisions. 🎢

The Future: More SOL, More Problems?

Galaxy Digital, Multicoin Capital, and Jump Crypto are reportedly raising $1 billion to-you guessed it-buy more SOL. Because if there’s one thing the world needs, it’s another publicly traded company pretending to be a crypto hedge fund.

Meanwhile, Forward Industries and others are jumping on the bandwagon, proving that corporate treasuries are rotating away from Bitcoin faster than a politician changes promises. Solana’s staking rewards and “network activity metrics” (read: hype) are apparently irresistible. Who needs boring old cash when you can have volatile digital assets? 🤷♂️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-10-07 03:13