Hedera is like that friend who promises to get their life together but keeps hitting the snooze button. After a series of unfortunate events, it seems HBAR is finally ready to shake off its recent losses. The market sentiment is improving, and buyers are starting to feel like they might actually have a say in this chaotic dance of crypto. 💃

Key technical indicators are now pointing to a steady uptick in demand for the token, hinting at a possible price rebound. Or, you know, just another false alarm. Who can tell these days?

HBAR Gears Up for Rebound as Bulls Take Charge 🐂

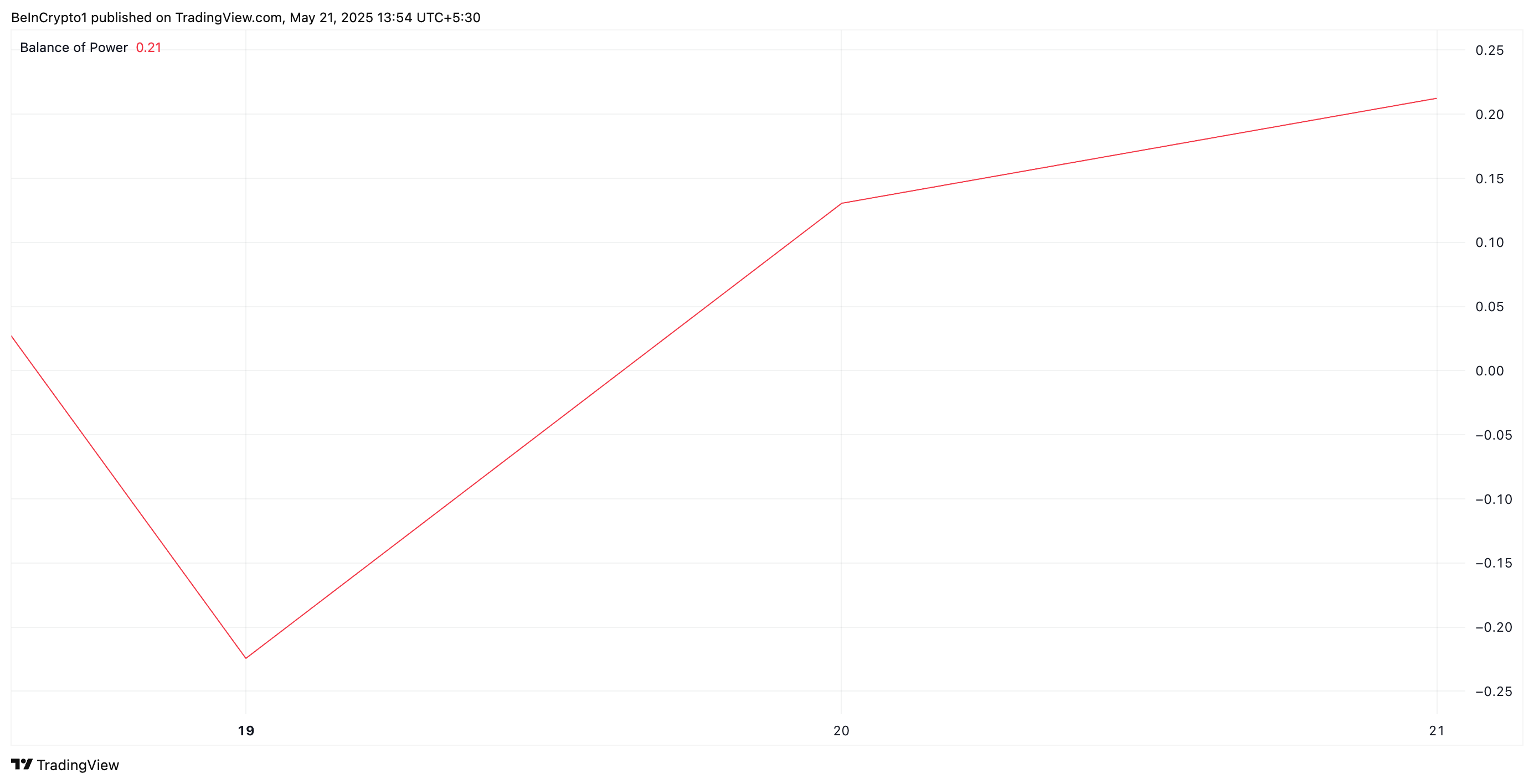

HBAR is showing early signs of recovery, much like a toddler learning to walk—wobbly but determined. Technical indicators suggest that investors are increasing their buying activity. For instance, in recent sessions, the altcoin’s Balance of Power (BoP)—which sounds like a superhero’s power level—has shifted in favor of the bulls. At press time, HBAR’s BoP is a positive 0.21. Not exactly a world record, but hey, it’s something!

This indicates that HBAR buyers are flexing their muscles and showing stronger control over price action than sellers. It hints at the potential for a sustained upward move in the asset’s price, or at least a brief moment of joy before reality sets in.

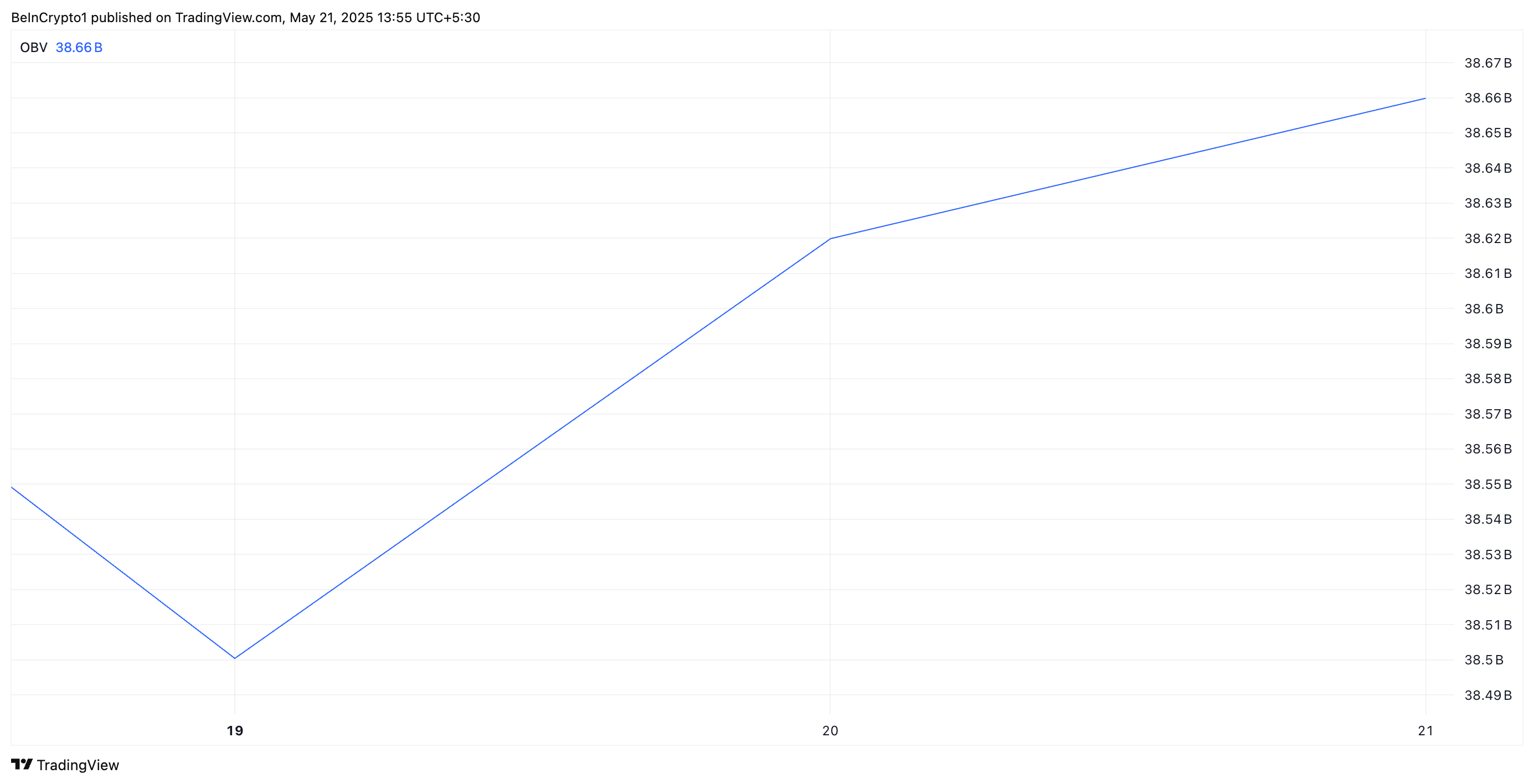

Furthermore, HBAR’s rising On-Balance Volume (OBV) confirms the growing buying pressure and positive momentum in the spot markets. As of this writing, the indicator is at a whopping 38.66 billion. That’s a lot of zeros, folks!

The OBV measures buying and selling pressure by tracking cumulative trading volume based on whether prices close higher or lower. When OBV climbs this way, it indicates that volume is flowing into the asset on up days, suggesting increasing demand and potential for a price rise. Or, you know, just a temporary spike before the inevitable crash.

Technical Indicator Signals Buyers Are Regaining Control 🔧

The steady rise in HBAR’s Relative Strength Index (RSI) reinforces the growing bullish momentum. Currently sitting at 52.53 and climbing, the indicator signals increasing buying pressure and a potential continuation of the upward trend. Or it could just be a mirage in the desert of despair.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a price decline. Conversely, values under 30 indicate that the asset is oversold and may witness a rebound. It’s like a game of musical chairs, but with money!

HBAR’s RSI reading indicates that the bulls are gradually regaining market dominance, which would drive up its value in the near term. If this continues, HBAR could break above the $0.20 price mark to trade at $0.23. But let’s not get too excited; we’ve seen this movie before.

However, if selling activity intensifies, HBAR could resume its decline and break below $0.19. If bearish pressure strengthens, the altcoin could fall toward $0.12. So, buckle up, folks! It’s going to be a bumpy ride!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-05-21 15:07