KEY POINTS:

Ed Yardeni, a prophet of markets, calls gold “physical Bitcoin,” praising its resurgence as a safe-haven asset for those who fear the future. Meanwhile, the Federal Reserve’s “beige book” reveals an economy as lively as a deflated balloon. Bitcoin Hyper, that digital alchemist, promises upgrades to turn $BTC into a “cash equivalent”-a phrase so charming it could sell ice to polar bears.

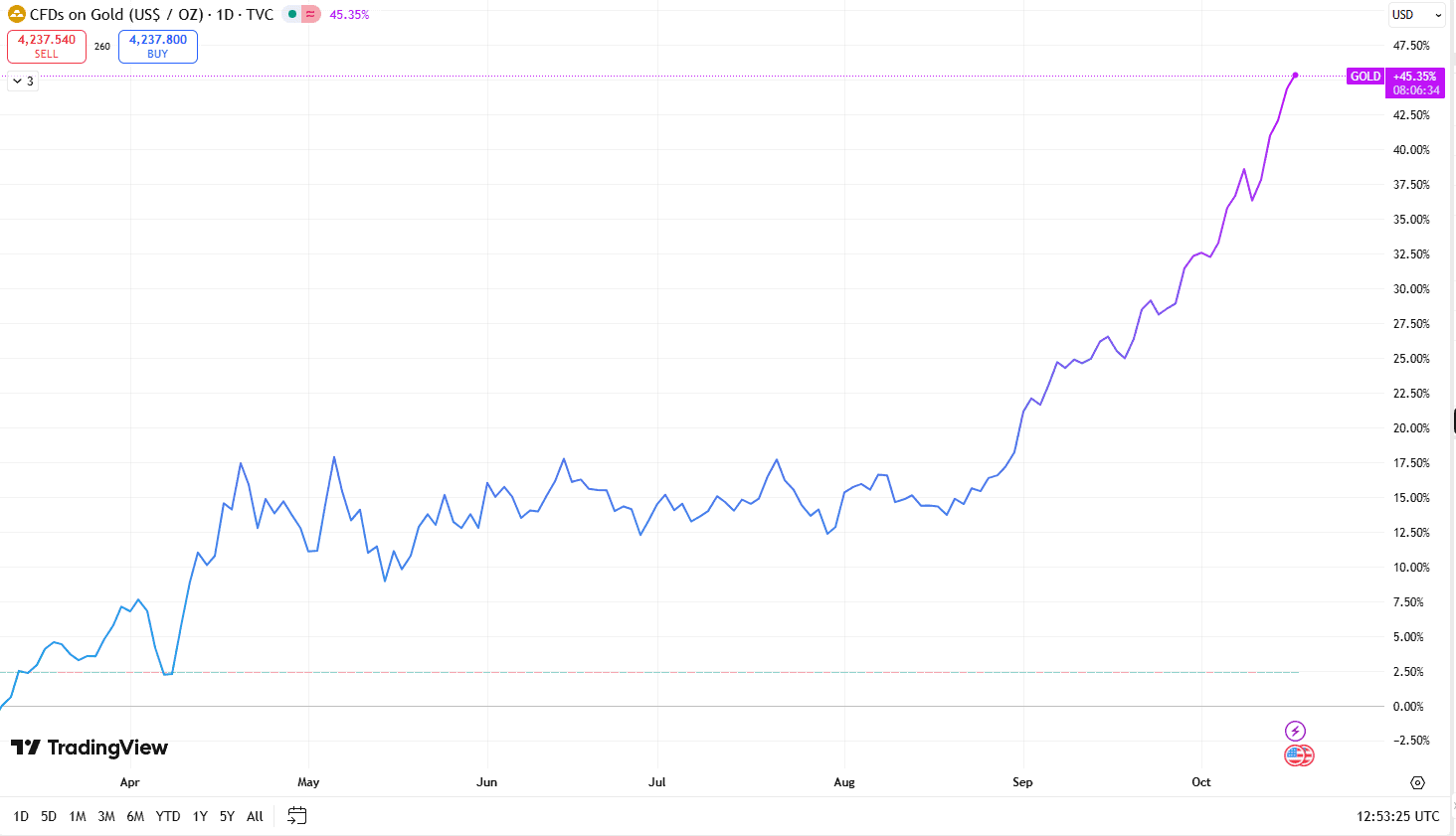

In this age of trembling portfolios and existential dread, gold’s ancient allure shines brighter than ever. Its stability? A relic. Its credibility? A myth. And yet, here we are, clutching bars like talismans against the storm of crypto chaos. Or is it just the storm inside our wallets?

Gold’s price, climbing like a drunkard’s hope, whispers: “Trust the old, not the new.” But Bitcoin, that sly fox, claws at the gates with Hyper’s promised upgrades. Will it reclaim its throne or remain a jester in a crown of code? Only time-and perhaps a few more cups of coffee-will tell.

Geopolitical Turmoil: The Great Divorce of Investor Faith

Gold, that stubborn relic, thrives in chaos. It is the bedrock of panic, the velvet glove of fear. Bitcoin? A digital mirage, dancing on the edge of volatility. While gold hoards its dignity, Bitcoin flirts with disaster, its price swings wilder than a toddler’s tantrum. Both claim to be safe havens, but only one hides under the bed when the lights go out.

The Federal Reserve, that temple of economic wisdom, admits the economy is “stalled.” A word so innocuous it could describe a sloth on Valium. In such times, Bitcoin’s volatility is not a feature but a bug-a glitch in the system that makes investors reach for gold like a priest for incense.

Gold’s strength? Centuries of trust. Bitcoin’s? A mere blink in history. Yet here they stand, titans of value, one forged in fire, the other in code. Which will prevail? Perhaps the answer lies not in their worth, but in the madness of those who chase it.

Gold’s market? A monastery of calm. Bitcoin’s? A circus of chaos. But when the music stops, even the most jaded investor might trade their tent for a chalice of gold. Or perhaps they’ll bet on Bitcoin’s next act-a gamble as foolish as it is thrilling.

Bitcoin Hyper ($HYPER): The Digital Wizardry of Our Time

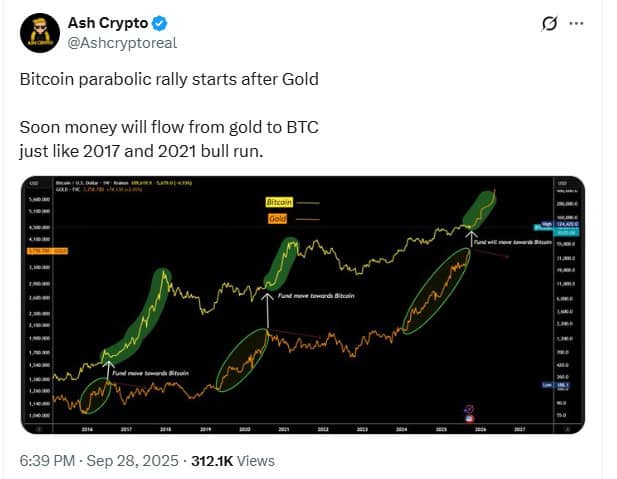

Bitcoin’s original vision? Fast, cheap payments. Alas, it became a store of value, a digital gold for the impatient. But when uncertainty strikes, investors flee from digital dreams to physical rocks. A tragedy, really.

Enter Hyper, the knight in shining armor (or a Layer 2 on Solana). It aims to revive Bitcoin’s lost glory with wrapped $BTC, DeFi, dApps, and staking. A buffet of buzzwords served with a side of optimism. And let’s not forget the $379K whale feast-that’s not a meal, it’s a premonition!

With a price prediction of $0.2 by year’s end (up 1423% from $0.013125), Hyper’s promise is as alluring as it is reckless. Will it deliver? Or is it just another crypto fairy tale? Only the market knows, and the market is a fickle lover.

Don’t miss your chance to join the presale. After all, what’s life without a little madness? 🚀

Even as gold reasserts its dominance, Bitcoin’s comeback story simmers like a pot of boiling tea. One day, it may bubble over-or crash into the floor. The choice is yours. But remember: do your own research. This isn’t advice; it’s a confession. 🙏

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-10-16 18:12