Gold, that gleaming old fool’s luck, shone like a new brass button in a sunbeam while the mysterious Bitcoin pranced about in the back row, looking about as breezy as a dry whistle at a church social.

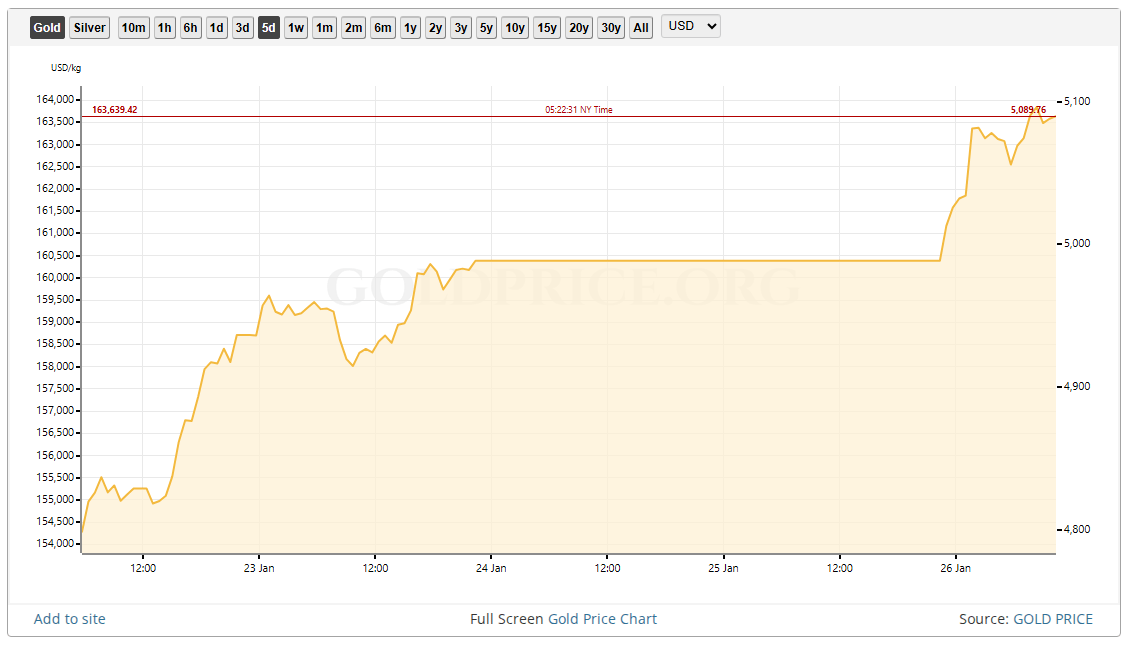

On Monday the yellow metal clambered past the five-thousand-dollar mark, a number that sent market watchers coughing into their sleeves and pretending they always suspected such miracles were possible. Bitcoin, bless its heart, could not keep the pace and wandered far below its own recent bragging rights.

Gold Reaches the Gilded Summit

Safe-haven fancy pushed gold higher, like a mule at a corn booth. It crossed above $5,000 an ounce and flirted with roughly $5,110 at the peak. Silver, too, elbowed its way into the limelight, hopping to fresh tops near $107 an ounce.

Traders pointed to simmering geopolitical frictions and talk of tougher trade moves led by Mr. Trump as fuel for the rally, which is a fancy way of saying folks got scared and decided to bury their money where it won’t bite back.

A weaker greenback made these metals more attractive to buyers overseas, and central banks gave a steady thumbs-up in the back room. Liquidity dried a bit in some corners as money scurried into things that feel as reliable as a clock in a courthouse.)

Bitcoin Trails the Parade

Market numbers show Bitcoin lingering in the mid-80,000s, retreating from the lofty perches it borrowed last year. Word has it the alpha crypto sits about 30% below its October 2025 high, leaving some holders jittery enough to taste their coffee twice in a row.

Volatility was another factor. Where bullion is sought as a steady friend, Bitcoin is billed more as a bold youngster with a taste for risk, and that difference shows up sharp when the markets tighten. Some funds trimmed their crypto holdings, steering away from high-risk gambles as the wind began to howl a little louder.

Why Investors Are Shifting

Analysts and traders framed the choice in plain terms: shelter your nest egg or chase a swing for gains. When headlines growl with worry, money migrates to assets trusted across markets and governments.

Metals fit that ticket snug as a pickup in a dry season. Market chatter hints at fears of a US government funding brouhaha and fresh tariff talk that piles pressure on stocks and adds a dash of urgency to safe-haven buying.

Options and futures trading hint at a more cautious view, with volatility indexes climbing and bond yields dancing to odd tunes that make the yellow metal look like the sturdy stove in a frontier cabin by comparison.

What Traders Are Watching

Market watchers say eyes will stay glued on a few key things: the dollar’s path, moves by major central banks, and any sign that US politics stirs up a bigger hornet’s nest could keep metals shining.

For Bitcoin, network activity, large wallet flows, and regulatory headlines will likely set the tone. Some traders expect swings both ways. Others caution that when risk appetite returns, crypto may bounce hard, but that outcome is about as certain as a river carving a canyon and will depend on a string of policy and macro moves.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Overwatch Domina counters

- Gold Rate Forecast

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- Top 10 Super Bowl Commercials of 2026: Ranked and Reviewed

- ‘Reacher’s Pile of Source Material Presents a Strange Problem

- Honor of Kings Year 2026 Spring Festival (Year of the Horse) Skins Details

2026-01-26 18:40