Bitcoin (BTC) likes to call itself “digital gold,” but let’s face it—it’s like comparing a double rainbow to a Snapchat filter. Amid Trump’s second-term trade war drama, institutions are ditching Bitcoin for the glittery stuff you dig out of a cave.

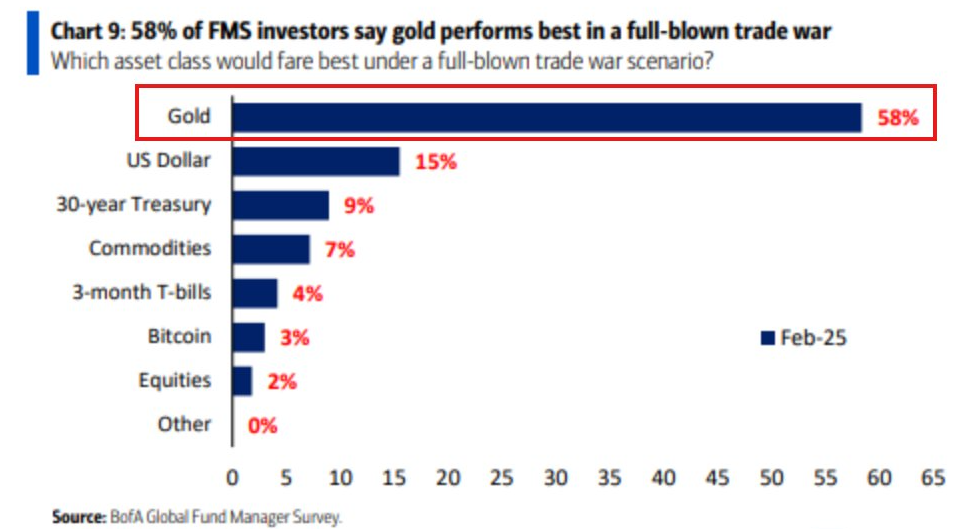

A Bank of America (BofA) survey shows 58% of fund managers backing gold as their trade war BFF, while Bitcoin, bless its little crypto heart, squeaked in with just 3%. Spoiler alert: 3% wouldn’t even get you a participation ribbon.

Bitcoin’s Reality Check: It’s Hard Out Here for a Crypto 😵

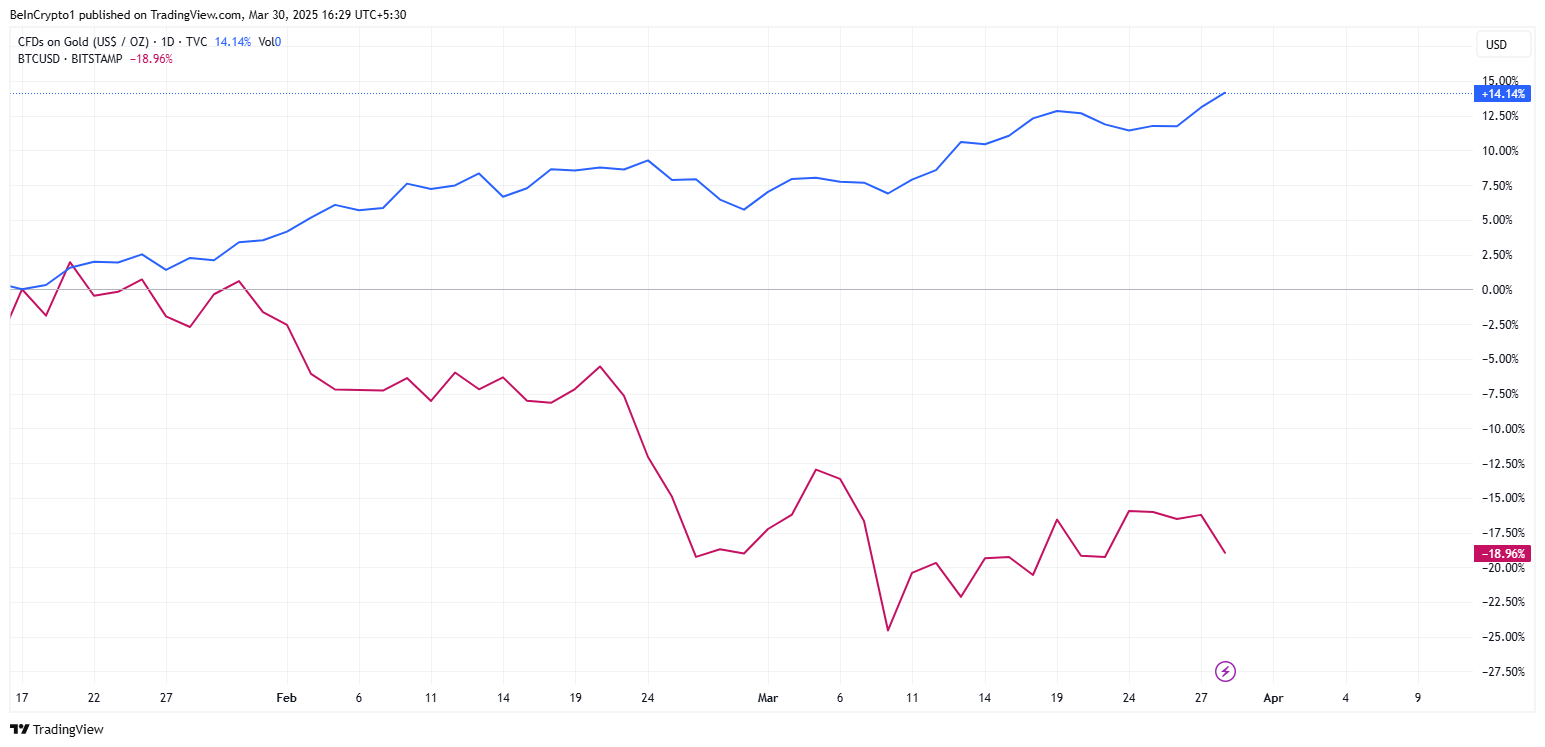

Gold is strutting its crisis-asset stuff, while Bitcoin stands in the corner like a Wall Street intern who just miscalculated the coffee order. Geopolitical drama, America’s wallet looking emptier than usual, and investors panicking have made gold the reigning champ.

“In a recent Bank of America survey, 58% of fund managers said gold performs best in a trade war. This compares to just 9% for 30-year Treasury Bonds and 3% for Bitcoin,” The Kobeissi Letter reported, possibly while clutching some physical gold like a security blanket.

Bitcoin enthusiasts have been touting it as the answer to chaos for years. Meanwhile, 2025 dropped a giant “nope” on that theory. Trust doesn’t just happen overnight—especially with something that still feels like Monopoly money’s rebellious cousin.

The BofA survey also shows T-bonds and even the US dollar experiencing a popularity dip, likely because of the US deficit issue that now exceeds $1.8 trillion. You’d think numbers that big could at least buy us some snacks.

“This is what happens when the global reserve currency acts more like a bratty teenager than the global reserve currency,” snarked one trader who probably stocks up on canned goods “just in case.”

But it’s not Bitcoin they’re choosing. No, institutions are doubling down on shiny yellow rocks like pirates preparing for a treasure hunt. Physical gold purchases are at record levels because apparently, gold doesn’t have a PR problem. 🏅

Bitcoin’s Institutional Barriers: Like Showing Up Without a Tie 😬

Why is Bitcoin missing out on all the institutional love? For starters, it’s just too spritely—its price bounces like a toddler on a sugar high. While long-term Bitcoin believers clutch their wallets and diamond hands, institutions are like, “Yeah, no thanks.”

Gold, on the other hand, has that “safe, predictable dad asset” vibe. You know what you’re getting, and it isn’t going to surprise you with a 30% value plunge because Elon Musk tweeted something shady.

And then there’s Trump’s “Liberation Day” tariff bash coming up. Experts are circling their calendars with anxiety pens, warning us of chaos so intense it makes your awkward Zoom meetings seem trivial.

“April 2nd is shaping up to be nuts. Think election night but on steroids. Ten times more intense than any Federal Open Market Committee snoozefest. Anything can happen,” warned Alex Krüger, who’s probably investing in TUMS along with gold.

Historically, investors panic-buy safe havens during trade drama, and the trend isn’t breaking. Gold is vaulting ahead (pun intended), while Bitcoin nervously scrolls Twitter, trying to figure out where it went wrong.

“Gold isn’t just the inflation hedge anymore; it’s the ‘oh crap, fix everything’ hedge for geopolitical nightmares, economic brawls, and general governmental flailing. Let’s face it—even the dollar can’t keep up,” said trader Billy AU while probably admiring his golden stash.

Bitcoin fans are holding onto their long-term dreams like it’s the final scene of *Titanic*. Sure, the global reserve system may shift someday. Sure, Bitcoin might become the savior of the fiscally conscious. But “someday” isn’t today, and the institutional crowd likes their assets safe, shiny, and drama-free—aka gold.

“We thought Bitcoin ETFs would bring major love to BTC. Turns out some of it was for arbitrage… People like Bitcoin, but maybe not quite as much as we hyped up,” said Kyle Chassé, throwing just enough shade to make Bitcoin blush.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-03-30 15:22