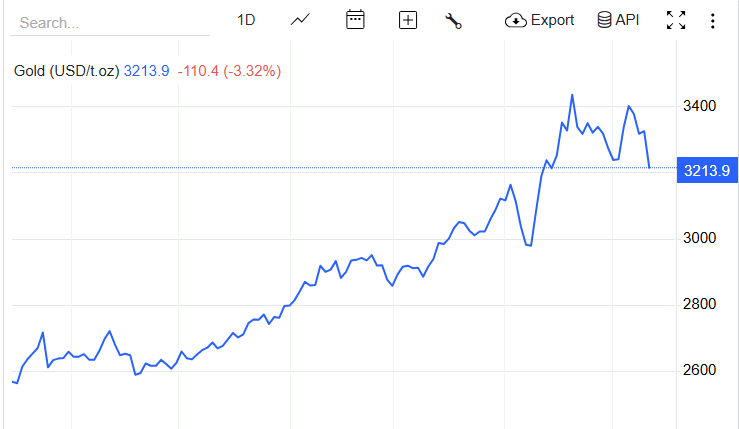

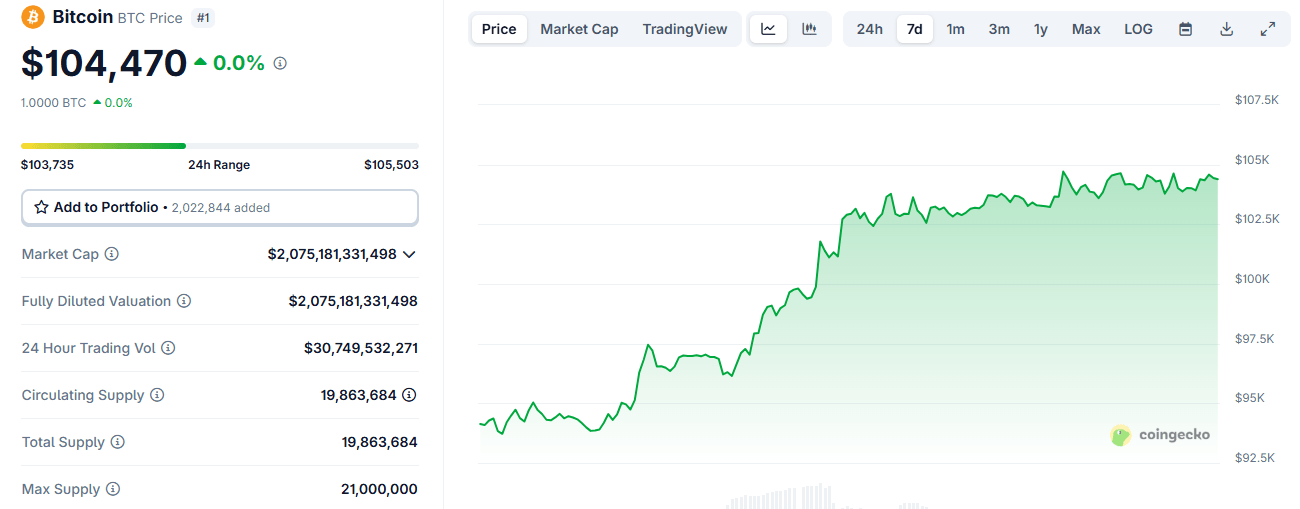

The twelfth of May: gold—ancient, trusty, as if the sun itself melted into cubes—lost over $100, waning a humble 3%. It slipped from $3,323 to a more self-effacing $3,215 per ounce. Meanwhile, bitcoin sat at the table with the composure of a poker grandmaster, trading above $104,000, chewing a blade of digital grass and muttering: “What’s volatility?” 🤔

Trade War Cools; Gold Catches a Cold

At dawn, gold tiptoed down the stairs, whispering a soft decline, its worth bruised by whispers out of Shanghai and Washington that tariffs might just be old news. While gold slunk away, the restless spirit of bitcoin did a little jig, entirely unamused by diplomatic progress—are we sure it reads headlines at all?

Bitcoin, that misunderstood enfant terrible dubbed “digital gold,” indulged in a steady existential shrug upwards of $104,000. Investors, once married to safe-havens, now appear to ghost gold in favor of crypto’s enfant sauvage. Is bitcoin the new safe-haven, or just really stubborn at reading the room?

Back in April, our tragic hero—bitcoin—chose a path less trodden, blithely ignoring trade war melodrama. According to the chroniclers at Coingecko, bitcoin soared beyond $100,000 on May 8 and, much like a forgetful landlord, simply refused to come down.

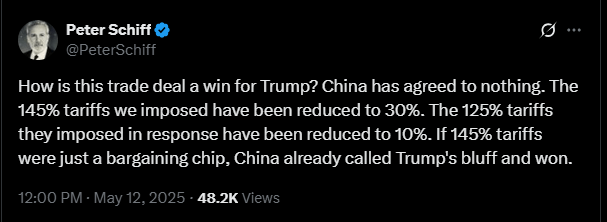

In the Swiss neutrality of Geneva, where even the chocolates are diplomatic, US and China officials agreed to a 90-day tariff ceasefire. The stakes? The US drops tariffs to 30%, China to a meager 10%. A “mechanism” for chatter was promised, though no word if this includes carrier pigeons or encrypted memes.

Market revelry was soon overwhelmed by gold’s brooding demise. The precious metal, long coddled by conflict, now pouted as détente proved bad for business. Peter Schiff, that tireless bard of bullion and nemesis of bitcoin, admitted the truce may just douse the gold fever. 💔

Schiff, whose attitude toward trade wars is second only in ferocity to his attitude toward crypto, declared the victorless peace a defeat for America. May he never negotiate summer holidays with his relatives.

“This ‘great’ deal just freezes Trump’s war for 90 days. In other words, déjà vu with fewer fireworks. America pays 30% tariffs, China shoulders a mere 10%. Let the aggrieved accountants rejoice.”

As if to thumb their noses at yellow metal, markets waltzed anyway. Hang Seng tangoed 3% higher. European indices practiced polite optimism. Across the Atlantic, rumor had it US indices were warming up with a 2% jig of their own. Party like it’s 1929—but with better coffee. ☕️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-05-12 17:37