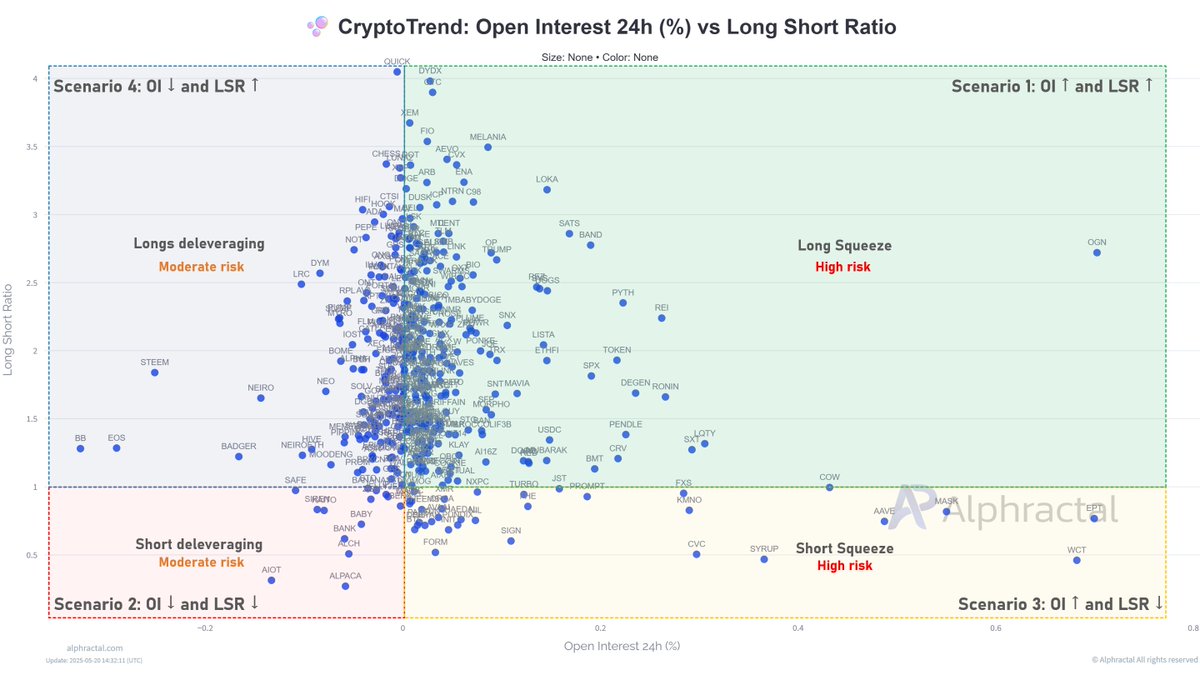

Two critical indicators that help track leveraged positions are Open Interest (OI) and the Long/Short Ratio (LSR). Open Interest reflects the total number of outstanding derivative contracts that have not been settled, while the Long/Short Ratio shows whether traders are more inclined to hold long or short positions. According to an analysis 📊 shared by Alphractal, there are four key scenarios that unfold when OI and LSR move in various combinations. Each scenario can help traders understand where the market is heading and where potential risks may lie, or so they say. 🤷♂️

Scenario 1: Open Interest Rising, Long/Short Ratio Rising

The first scenario occurs when both Open Interest and the Long/Short Ratio are rising. This means that more contracts are being opened, and traders are increasingly favoring long positions. Alphractal explains that this pattern often signals growing optimism, with traders expecting prices to rise. Cryptocurrencies such as ETH, TRX, UNI, DOT, CHZ, WIF, VET, SAND, LAND, EGLD, INJ, SUN, FET, LTC, and TRUMP are current examples fitting this scenario. While the market may be in an uptrend, the risk of a sudden reversal increases if this optimism becomes excessive. A sharp drop in prices could trigger a long squeeze, where many overleveraged long positions are liquidated rapidly, potentially accelerating the downward movement. 🚀💥

Scenario 2: Open Interest Falling, Long/Short Ratio Falling

In the second scenario, both OI and LSR are falling, indicating that traders are closing their positions and reducing their long exposure, or possibly increasing their short exposure. This behavior reflects a cautious or bearish sentiment in the market. Alphractal identifies coins like BNX, KAITO, ZEC, IP, EOS, BB, ALPACA, STO, and BABY as fitting this profile. This scenario often signals overall deleveraging, where the market is shedding risk. Although bearish pressure may still dominate, if the sentiment becomes overly negative, it could set the stage for a bullish reversal once selling pressure diminishes. At the same time, lower leverage typically results in reduced volatility and fewer sharp price swings. 📉😢

Scenario 3: Open Interest Rising, Long/Short Ratio Falling

The third scenario is characterized by rising Open Interest and a declining Long/Short Ratio. In this case, more contracts are being opened, but traders are increasingly betting against the market by taking short positions. Alphractal points out that this represents a buildup of bearish positions with new capital flowing in to bet on downside moves. Examples of assets in this category include XMR, AAVE, MASK, ORCA, and CVC. If buying pressure enters the market unexpectedly, these short positions could be squeezed, forcing traders to buy back at higher prices and leading to a rapid upward move. This setup often has a high probability of a bullish reversal due to the potential for forced liquidations. 🐻➡️🐂

Scenario 4: Open Interest Falling, Long/Short Ratio Rising

The fourth and final scenario involves falling Open Interest combined with a rising Long/Short Ratio. This means that although overall market participation is declining, those who remain are increasingly taking long positions. According to Alphractal, this scenario may indicate that bullish traders lack strong conviction, as capital exits the market while optimism persists among those still participating. Cryptocurrencies currently showing this pattern include SOL, BNB, XRP, ADA, RUNE, AXS, APT, PEPE, SUI, NEAR, ONDO, TIA, and BONK. Without significant buying strength, this setup is vulnerable to liquidations if support levels fail, and the market may lack the momentum needed for a sustained rally. 🤞🚫🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-05-20 20:39