Darling, FLR, the darling token of the oh-so-chic EVM-based Layer 1 blockchain network Flare, is simply having a moment, climbing nearly 10% in the past 24 hours. 🌟

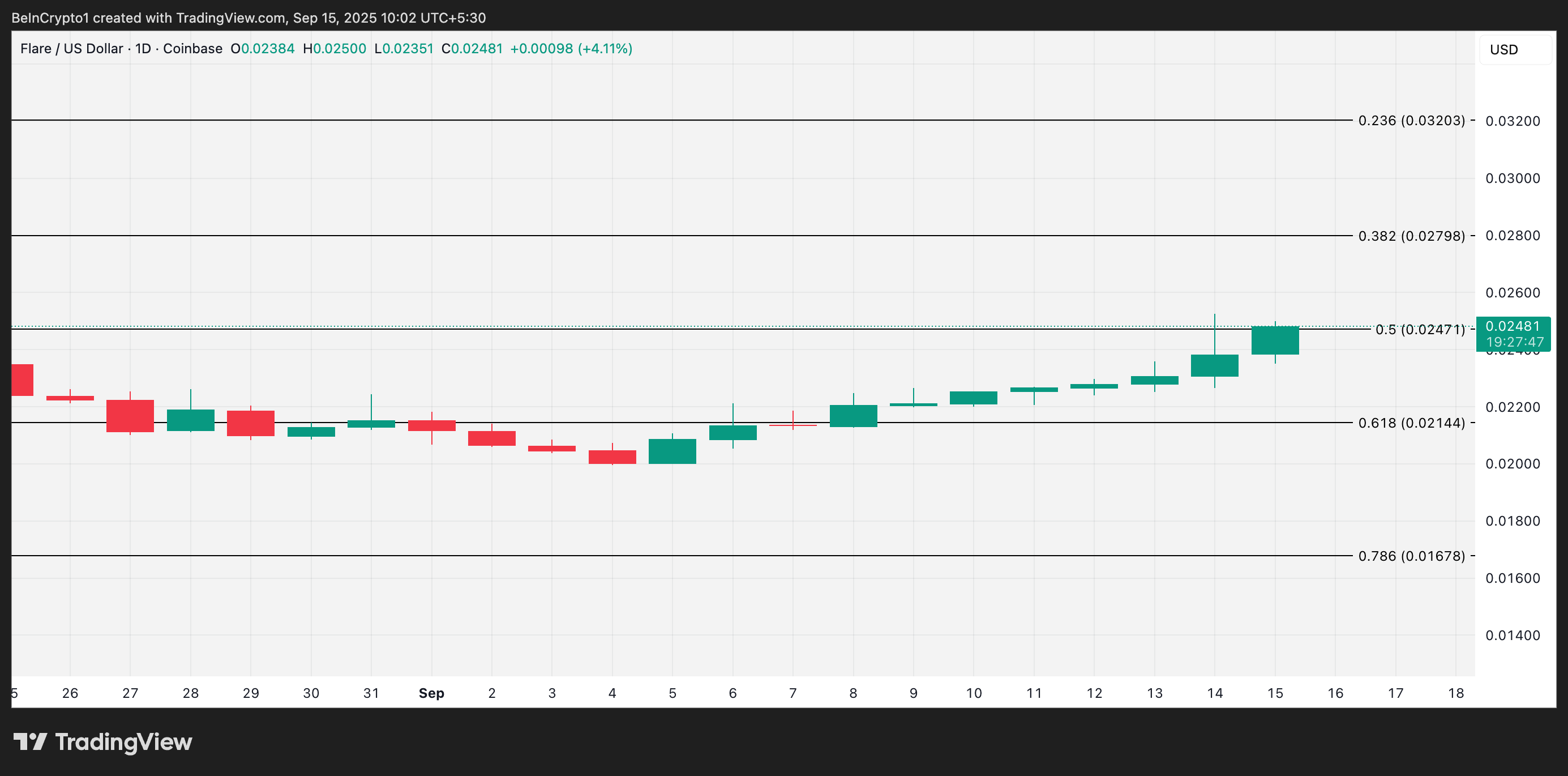

Since early September, this little minx has been steadily rising, and recent price action suggests it might just sashay to a two-month high of $0.02798 in the coming trading sessions. How utterly thrilling! 🎭

FLR Eyes Higher Ground as Buyers Dominate Market

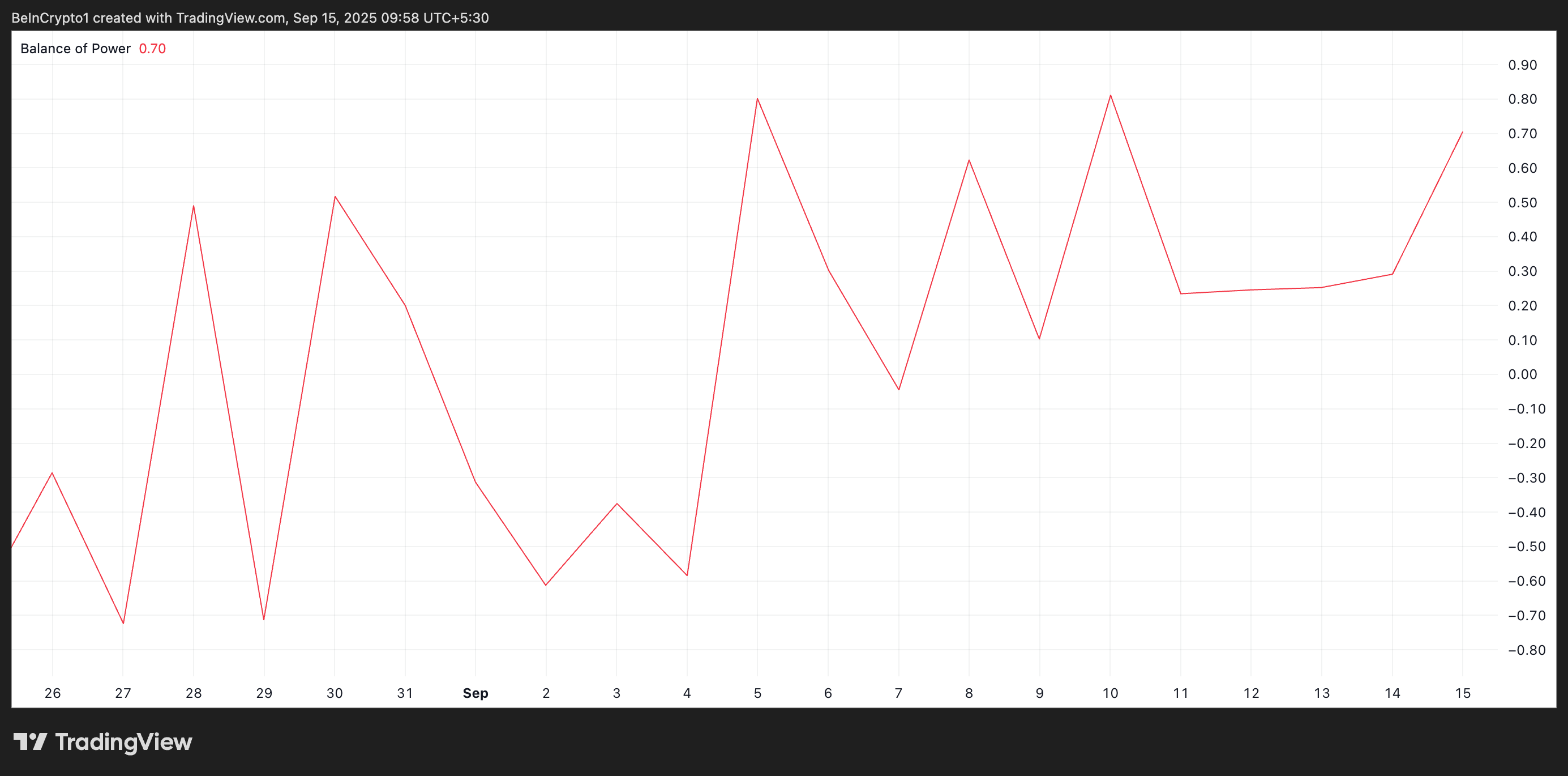

The token’s Balance of Power (BoP), my dear, is positively radiant on a one-day chart, indicating that buyers are throwing their hats (and wallets) into the ring. At 0.70, it’s clear the bulls are having a ball. 💃

For token TA and market updates: If you simply must have more of these delectable insights, do sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. 📩

The BoP, you see, is all about who’s wearing the trousers-buyers or sellers. A positive BoP? Darling, it’s a bullish affair, with buying pressure outshining selling pressure like a diva on stage. 🎤

A negative BoP, on the other hand, is rather like a damp squib, indicating sellers are calling the shots, often leading to price declines or periods of consolidation. How dreary. 🌧️

FLR’s current positive sentiment suggests buyers are positively frolicking, pushing the price higher and making a sustained rally look like a done deal. 🏇

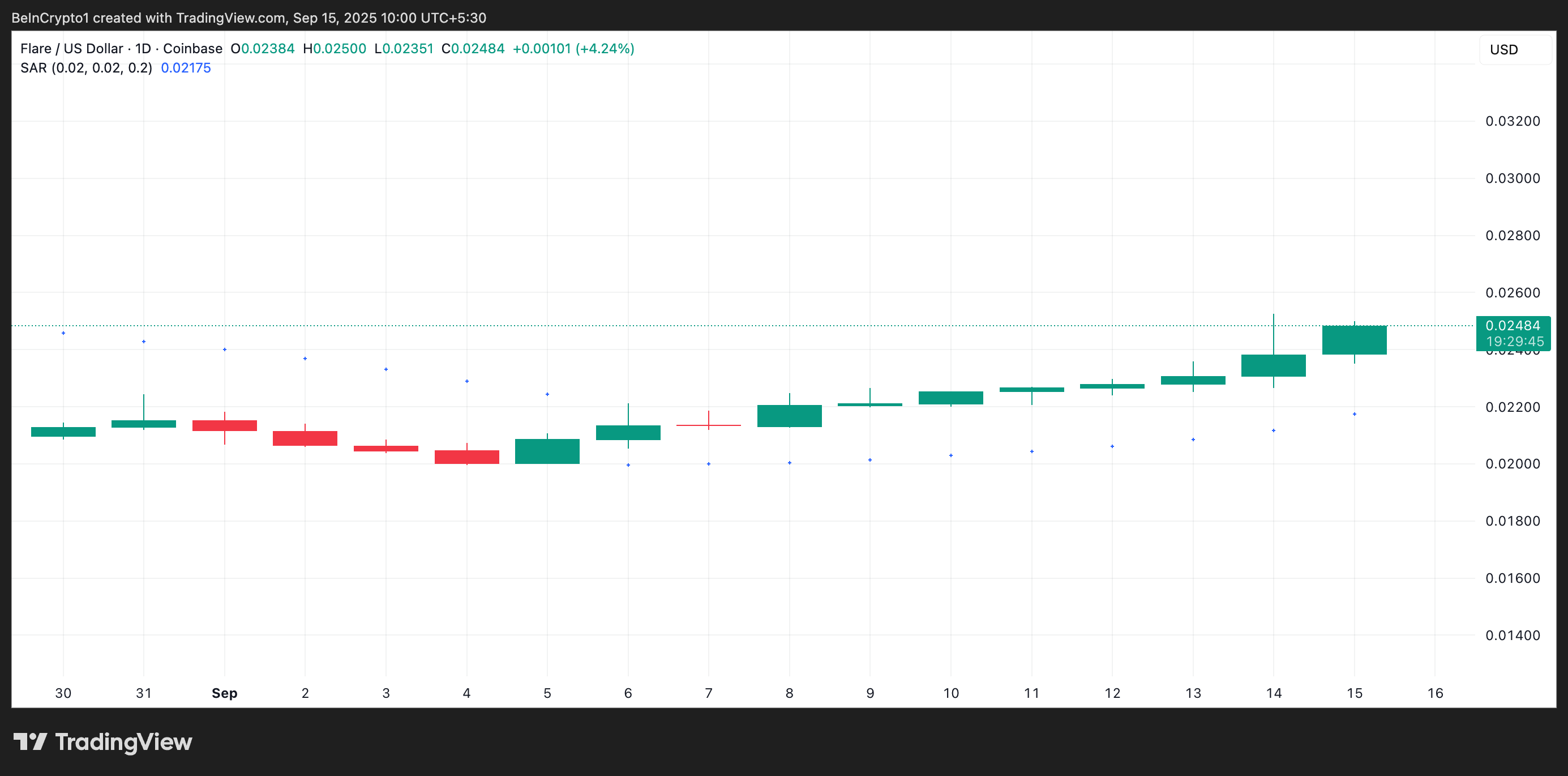

And let’s not forget, on the daily chart, the token is sitting pretty above its Parabolic Stop and Reverse (SAR) indicator, adding a touch of glamour to this bullish outlook. The SAR, at $0.02175, is acting as a safety net for buyers-how very thoughtful! 🪂

The Parabolic SAR, my dear, is like a dance partner, helping identify potential trend reversals and the overall direction of an asset’s price. When the dots are below the price, as with FLR, it’s a clear sign of an uptrend-buying pressure is the belle of the ball. 💼

This means the bullish momentum is still très forte, and the token may continue its ascent in the short term. 🌅

FLR Climbs, But Bears in Derivatives Aren’t Ready to Quit

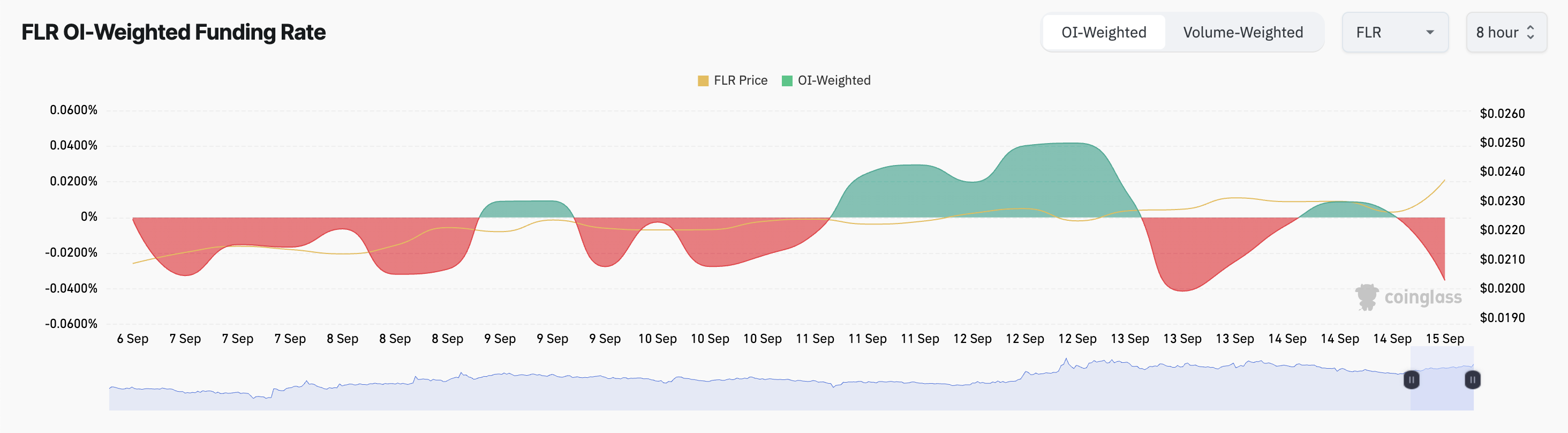

However, my dear, on-chain data reveals that derivatives traders are being rather coy about FLR’s recent rally. The token’s funding rates remain stubbornly negative, even as its price has surged over the past week. At -0.0353%, according to Coinglass, it’s clear the bears aren’t ready to throw in the towel. 🐻

Funding rates, you see, are like a game of pass-the-parcel between long and short positions in perpetual futures markets. A positive rate means longs are paying shorts-bullish sentiment, darling. But a negative rate? Shorts are paying longs, suggesting bearish sentiment or caution in the futures market. How very unnerving. 🤔

For FLR, this negative funding rate implies that while spot traders are driving the price higher, derivatives traders are hedging against a potential pullback, highlighting a delightful split in market confidence. 🪙

FLR Rally Hangs in the Balance-$0.028 Within Reach or Retreat to $0.021?

This divergence between spot momentum and derivatives sentiment could lead to short-term volatility, darling, impacting FLR’s sustained rally. If the bears gain the upper hand and spot traders decide to take profits, the altcoin could retreat to $0.02144. How tragic! 😱

However, a sustained rally could see FLR waltz toward a two-month high of $0.02798. Now wouldn’t that be a spectacle? 🎉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-09-15 13:23