In the grand city of Paris, where the croissants are flaky and the pigeons are suspiciously well-fed, the Blockchain Group has decided to play a rather audacious game of Bitcoin poker. They’ve announced plans to raise a staggering €300 million (or about $340 million for those who prefer their numbers in dollars) to expand their Bitcoin treasury. This is not just any old crypto move; it’s like a cat deciding to take a swim in the Seine—bold and slightly bewildering!

With a treasure chest already brimming with over $154 million in Bitcoin, Blockchain Group is not just doubling down; they’re doing a full-on somersault into the crypto pool. They proudly declare themselves Europe’s first dedicated Bitcoin treasury company, and this new fundraising escapade positions them to be the puppet masters of institutional crypto adoption across the continent. 🎭

Now, how they’re raising these funds, who they’re cozying up to, and what it all means for Europe’s crypto landscape is worth a good old-fashioned nosy poke. While the U.S. is hogging the limelight, Europe might just be quietly assembling its own band of Bitcoin superheroes. 🦸♂️

Here’s the scoop you didn’t know you needed!

Borrowing from Wall Street’s Playbook

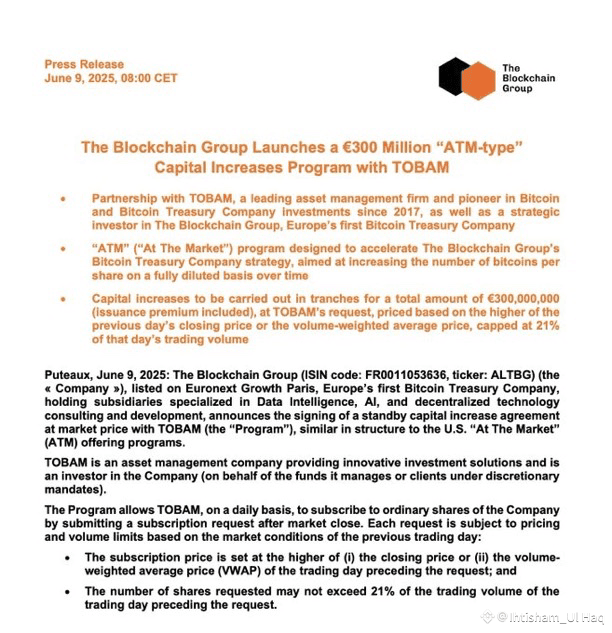

Now, here’s where it gets even juicier—like a ripe peach in a summer market. The structure of this capital raise is inspired by the U.S. market’s At-The-Market (ATM) model. Yes, you heard that right! Blockchain Group will sell shares directly at market prices, in tranches, and only under certain limits. No wild dumping here; they’re releasing shares gradually, based on the previous day’s closing price or the volume-weighted average price, whichever tickles their fancy more. And there’s a cap: no more than 21% of that day’s trading volume. It’s like a well-mannered dinner party where everyone gets a slice of the pie without anyone getting too stuffed! 🥧

This clever mechanism is designed to raise capital while keeping the market balance intact. They plan to start small, with a mere €500,000, and then scale up like a well-trained circus elephant.

This kind of fundraising is as rare as a unicorn in a field of horses in European crypto firms. So yes, it’s a clear sign that Blockchain Group is ready to break out of the local mold and start playing on a much larger field—perhaps one with a few more dragons. 🐉

With TOBAM on Board, the Stakes Just Got Higher

But wait! The Blockchain Group isn’t going solo on this adventure. They’ve teamed up with TOBAM, a well-known asset manager, to ensure that the capital raise is handled with the finesse of a cat burglar. TOBAM will help steer the new capital toward growth and profit-generating strategies, like a wise old owl guiding a flock of confused ducklings. 🦉

This move is all about long-term business development, with Bitcoin as the strategic core. And honestly, who doesn’t love a good core strategy? 🍏

Strategic Vision Comes from the Top

Alexandre Laizet, the company’s Deputy CEO and head of Bitcoin strategy, has been vocal about this capital raise on social media, which is basically the modern-day town crier. He’s made it abundantly clear: this is about more than just growing the treasury; it’s about global expansion. 🌍

He’s pointed out that the company doesn’t waver in managing Bitcoin investments, focusing firmly on yield and results. He believes the ATM program will further cement their role as a top player in Europe’s Bitcoin market. And if that doesn’t sound like a power move, I don’t know what does!

Valentin Kosanovic echoed this sentiment, calling the program a major step forward for the company’s global operations. For him, it’s about staying laser-focused—“121%,” in his words—on making Bitcoin a core driver of value. Because why settle for 100% when you can go over the top? 🎯

Move Aside, MicroStrategy!

The timing of this announcement is as telling as a cat’s disdain for water. Just days ago, MicroStrategy, the reigning champion of corporate Bitcoin holders, announced plans to raise $1 billion for more Bitcoin. Blockchain Group’s raise may be smaller, but it’s a clear signal that Europe isn’t sitting this one out, twiddling its thumbs. 👐

Meanwhile, U.S. spot Bitcoin ETFs have been seeing outflows—over $47 million on June 6 alone. But firms like Blockchain Group are pushing forward, not reacting to short-term moves, but acting on long-term conviction. It’s like watching a tortoise outpace a hare, and we’re all here for it!

With this new capital program, Blockchain Group is raising the stakes for institutional crypto strategy in Europe. We’re all on the edge of our seats for what’s next! 🎉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-06-09 11:53