Ah, the whimsical dance of Ethereum, that fickle maiden of the crypto realm! On the fateful Saturday, September 25th, she pirouetted back above the $4,000 mark, as if the ground beneath her had suddenly sprouted roses. Yet, mere days prior, she had stumbled-oh, the horror!-below that sacred threshold, a spectacle not witnessed in fifty moons. Despite the weekend’s lethargic liquidity, she rallied with a 2.2% flourish, as if buoyed by the invisible hands of on-chain spirits. 🧙♂️

Coinmarketcap, that venerable chronicler of digital fortunes, tells us of her ascent from the depths of $3,927 to the lofty $4,021 by evening’s glow, all while trading volumes slumbered at a mere $29 billion-a 49% decline, no less. But fear not, for the on-chain metrics whisper of a frenzy in the staking contracts, as if the very ether itself were alive with activity. 📈

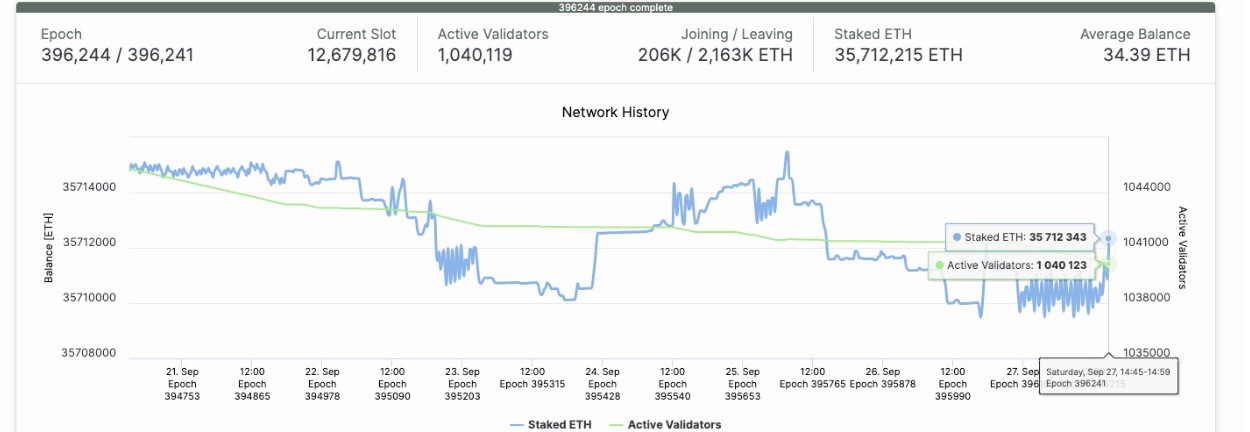

Behold! Ethereum staking deposits swelled by 2,589 ETH (~$11 million) on Saturday, Sept 27 | Source: Beacoincha.in. A treasure trove, indeed! 🤑

The sages at Beaconcha.in, with their scrolls of official data, proclaim that 2,589 ETH were offered to the staking gods in the last 24 hours, bringing the total sacrifice to 35,712,343 ETH. At current valuations, this hoard is worth nearly $11 million, a sum that has, in its voracious appetite, devoured the impact of those rapid liquidations. Meanwhile, poor BTC remains shackled below $110,000, a prisoner of its own red candles. 🔴

T Rex’s $32 Million BitMine ETF: A Corporate Feast for ETH

And lo, another wave of whale-sized inflows crashed upon Ethereum’s shores as T Rex unleashed its 2x BitMine ETF (BMNU), a beast that devoured $32 million on its maiden voyage. This derivative, a double-edged sword, offers corporate titans a taste of Ethereum’s glory through BitMine’s stock. 🦖💼

Bloomberg’s oracle, Eric Balchunas, proclaimed that BMNU’s $32 million haul was the third-greatest first-day feast among the 650-odd ETFs birthed in 2025, surpassed only by the XRP ETF and the fabled Dan Ives ETF. A triumph, despite the market’s sullen mood since ETH’s August peak of $4,953. 🎉

Huge Day One volume number for T Rex’s 2x BitMine ETF $BMNU with $32m, making it the 3rd best first day of any of the 650-ish ETFs launched this year after XRP ETF and Dan Ives ETF.

– Eric Balchunas (@EricBalchunas) September 26, 2025

Ethereum’s $4,000 Tightrope: Will She Falter or Fly?

Ethereum’s rebound above $4,000, supported by staking inflows and ETF fervor, is a testament to the bulls’ stubborn resolve. Yet, the technical omens remain as clear as a Gogolian nightmare. A rising wedge pattern, formed in September’s mists, looms like a specter, threatening a descent to $3,200 should the bears awaken from their slumber. 📉

Ethereum (ETH) Technical Price Analysis | Source: TradingView. A chart fit for a madman’s study! 📊

The Bollinger Bands, ever widening, scream of volatility, yet ETH clings to the lower band at $3,916, a precarious perch. A close above $4,000 might embolden the bulls to charge toward the 20-day moving average at $4,373. But should $3,916 fail, a plunge to $3,500-or worse, the wedge’s $3,200 target-awaits. The RSI, at 38, whispers of oversold conditions, a siren call to speculative souls seeking a bargain. 🕳️

If ETH consolidates above $4,000 and breaches $4,373, the bulls may face another trial at $4,500. But should she falter, the abyss beckons. Will she soar or stumble? Only the noseless noses of the market know. 🦅🤡

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- M7 Pass Event Guide: All you need to know

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

2025-09-27 22:57