Behold, Ethereum, that enigmatic beast of the blockchain, has conjured a multi-month bull flag on the weekly chart-a cryptic omen suggesting it may yet ascend to realms untouched, or perhaps just the fever dream of a caffeine-fueled analyst. If the gods of technical analysis nod in approval, a 76% surge could follow, though one might question if this is a prophecy or a parable for the desperate.

- Ethereum, now 16.7% shy of its lofty peak, stumbles like a drunkard at a crypto cocktail party.

- A bull flag, that most sly of chart patterns, whispers of a 70% rally. Or is it a trickster’s taunt?

Ethereum (ETH), per crypto.news, wavered at $4,120 Wednesday, a 6% dip from its Friday crescendo of $4,382. At this price, it languishes 16.7% beneath its August zenith of $4,946-a fall from grace, or perhaps a divine intervention from the crypto pantheon.

Over the weekend, ETH plummeted to $3,574, a victim of the broader market’s panic, incited by Mr. Trump’s tariff tantrum over Chinese goods. Rare earth minerals and AI software? Tragic, really. The world weeps for lost GPUs.

Though U.S. officials chatter with China ahead of the November deadline, the market remains as jittery as a chihuahua in a thunderstorm. The Crypto Fear & Greed Index, still in “fear” territory, suggests investors are clutching their wallets like a monk clings to his rosary.

Yet, Ethereum’s weekly chart tells a different tale-one of bullish audacity. From a technical standpoint, ETH carves a “highly bullish setup,” a phrase that sounds less like analysis and more like a spell from a grimoire. If confirmed, this pattern could propel ETH toward a new all-time high, or perhaps just the delusions of a sleep-deprived trader.

Ethereum Price Analysis: A Theatrical Performance

Ethereum now resides within a bull flag, that classic continuation structure resembling a bear wearing a bull’s costume. This formation, born after a strong upward surge, signals bulls regrouping for another charge-like a Roman legion before a final, desperate battle.

Currently, ETH tests the flag’s lower boundary at $3,875, a level as crucial as a life raft in a sea of uncertainty. Should it hold, the bullish narrative persists. A breakout above $4,440 would validate the flag, potentially sending ETH toward $7,245-a 76% leap that might make even Warren Buffett laugh (or cry).

Technical indicators, those mystical guides of the market, hint at a breakout. The Aroon Up, at 42.86%, and Aroon Down, at 0%, suggest momentum shifts like a pendulum in a haunted clock tower. Meanwhile, the RSI, now in neutral territory, implies room for growth-or perhaps just a brief respite before the chaos resumes.

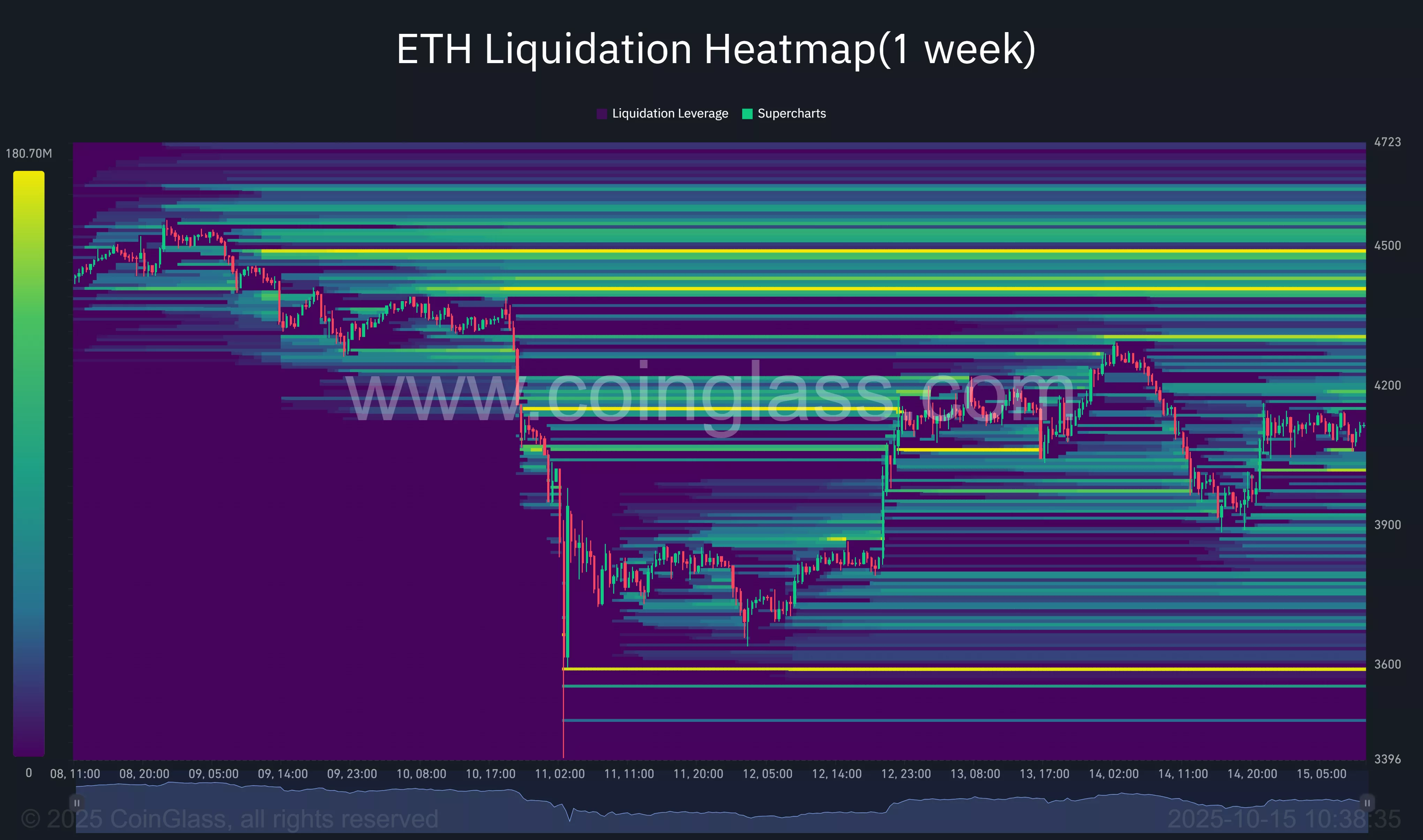

Yet, the weekly liquidation heatmap warns of volatility. Between $4,100 and $4,250 lies a cluster of long liquidations, a short-term resistance zone as treacherous as a minefield at a wedding. Bulls must conquer this zone to reclaim $4,250, a feat that could signal the start of a “broader reversal”-a phrase that sounds less like strategy and more like a bureaucratic memo.

If bulls triumph, Ethereum may break free from its consolidation cage, eyeing $4,450-$4,600. Or perhaps it will crumble like a house of cards at a poker game. The future remains as clear as a crypto analyst’s crystal ball: cloudy, expensive, and utterly useless.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-10-15 10:18