- Ethereum’s CME short pressure has faded, but don’t get too excited—arbitrage has done its job

- ETH fundamentals are still strong, yet a fresh catalyst is needed to make it fly (again)

Ah, Ethereum. The old horse, galloping on the same track as last year, but with a little less baggage dragging behind. After the explosion of short positions on CME Ethereum Futures back in the waning months of 2024, the winds have shifted slightly. Arbitrage trades—those clever little beasts—have mostly unwound, taking with them the weight that has kept Ethereum in a sort of financial limbo.

But let’s not get carried away. The unwinding of these short positions isn’t a signal that ETH is about to conquer new heights. No, no, it’s more of a “clearing of the deck” moment. The real fireworks will need a better spark.

But who’s counting? A little optimism never hurt anyone, right? 😊

Structural Strength vs. Stagnation: The Price Dilemma

AMBCrypto recently chimed in with some optimistic noise, hailing Ethereum’s “resilient fundamentals.” Strong DeFi dominance, growing whale accumulation, and a MVRV Z-Score that’s practically begging for attention. On-chain data is flashing green with signs of re-accumulation and increasing network activity. Surely, something’s brewing, right?

Wrong. Despite all these seemingly good signs, Ethereum’s price has remained largely uninspired. And what’s the real villain behind this? A looming, overbearing wave of short futures positions on CME.

But don’t worry, it’s not because anyone hates Ethereum. No, this was simply institutional traders playing a game of “buy ETH in the spot market while shorting CME futures.” No evil intent. Just an arbitrage opportunity too juicy to pass up.

How the Short Pressure Worked: The Plot Unfolds

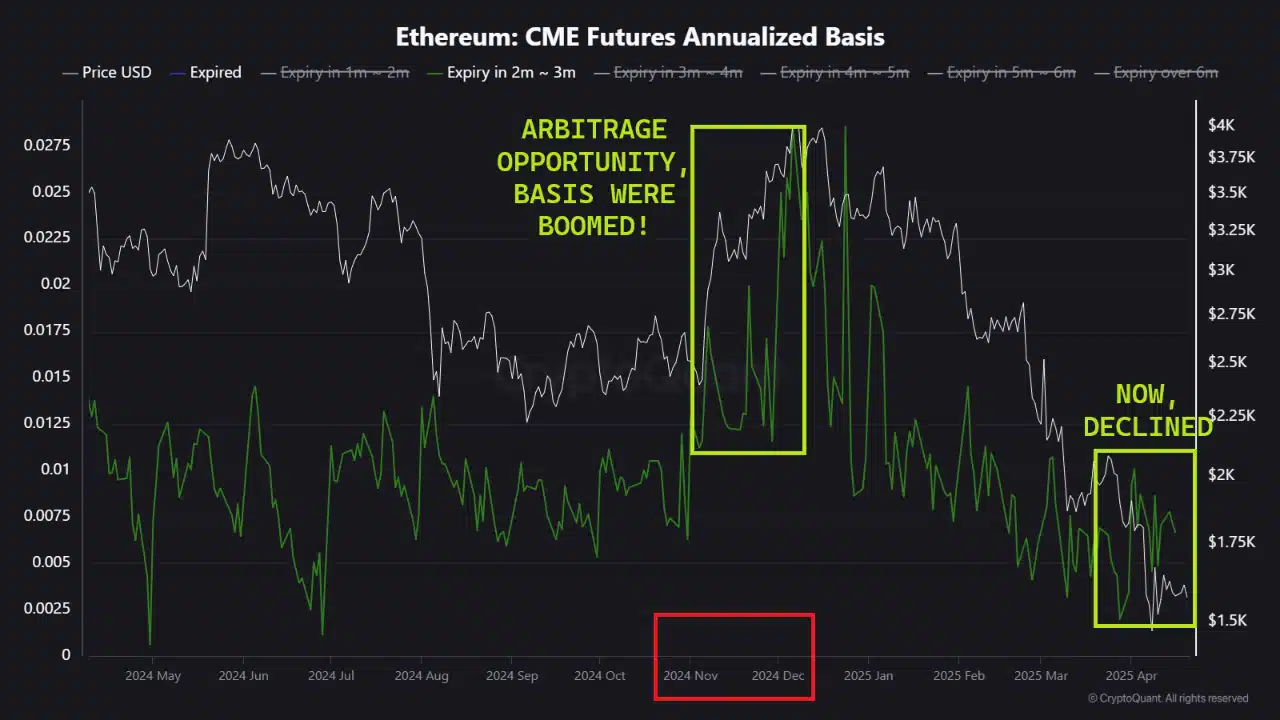

It all started in November 2024, when the CME Futures basis went above 20%—a golden ticket for arbitrage traders. So, what did they do? They bought spot ETH (hello, ETFs!) and shorted CME futures. Was this a bet against Ethereum? Absolutely not. This was a sophisticated play on the pricing discrepancy between the Futures and Spot markets. Just another day at the office for the financial elite.

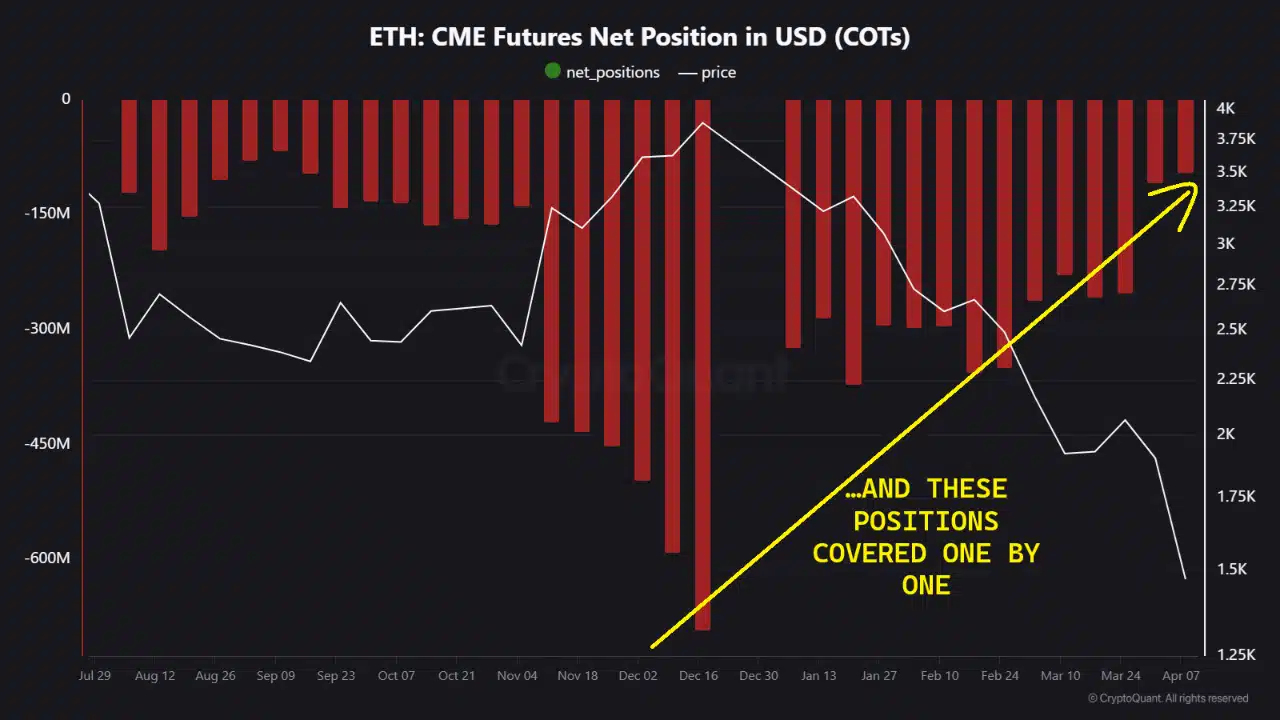

And as the charts show, this was a big deal. With the basis reaching eye-watering levels, the trade was hard to ignore. But as global factors began to shift, the arbitrage trade unwound, causing Ethereum’s spot price to drift downward as positions were covered.

Now, with the CME basis down to a more reasonable 4-5%, the pressure from this trade has evaporated like steam on a chilly morning.

What’s Changed in the Last Two Months?

Simple: the arbitrage window slammed shut. 📉

The CME Futures basis has collapsed, now in line with U.S. Treasury yields, signaling the end of the arbitrage game. Over the past two months, funds have started to unwind their positions—shorts were covered, and spot ETH was offloaded as though it had become a hot potato.

At its peak, those net short positions were worth over $600 million, a hefty sum that has since been progressively dismantled.

But let’s not forget: the price correction we saw in Q1 didn’t happen for no reason. ETF flows dried up, and the spot market felt the weight of this unwinding. It wasn’t pretty, folks.

Not Bullish Yet, But the Deck is Clearer

Let’s get this straight: the unwinding of CME short positions isn’t a “green light” for all-out bullish behavior. It’s more like tidying up after a wild party. Sure, the mess is cleaned up, but no one’s really convinced the fun’s about to start again.

There’s no new rush of buying. No macro-driven demand. No flood of ETF money pouring in. Ethereum’s Futures basis is practically horizontal, and where are those long-term investors when you need them? Hmm, nowhere to be found.

But don’t lose hope entirely. ETH could still react to the right catalysts. A soft pivot from the Federal Reserve, an Ethereum spot ETF approval (or a flood of fresh capital into one), or perhaps a new wave of Layer 2 adoption could be enough to reignite the flames of bullish hope. ⛅️

So, with the structural mess cleared, all we need now is some actual demand to step in. It’s like waiting for a miracle, but hey, it’s always possible, right?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-04-22 08:16