On a fateful Friday, the price of Ethereum took a nosedive, plummeting over 6%, as if it were a bird that forgot how to fly. This downward spiral began on March 24, when it soared to a lofty peak of $2,105, only to crash down to a dismal low of $1,880—its lowest since March 18. It seems the gains of the past fortnight have been wiped away like a child’s drawing in the rain. 🎨☔

What caused this calamity, you ask? Well, the US decided to drop some hot inflation data, which was about as welcome as a skunk at a garden party. The core Personal Consumption Expenditure Index crept up from 2.7% in January to 2.8% in February, while the headline PCE rose to 2.5%, surpassing the Federal Reserve’s target of 2.0%. It’s like trying to keep a balloon inflated in a room full of sharp objects. 🎈💥

These figures suggest that inflation will stick around longer than an unwanted houseguest, especially with Donald Trump’s Liberation Day tariffs looming on the horizon. Higher inflation means the Federal Reserve might keep interest rates higher than a kite in a windstorm. 🪁

As a result, other risky assets decided to join the pity party. The S&P 500 index dropped by 1.50%, while the Nasdaq 100 and Dow Jones crashed by 2% and 1.2%, respectively. Even Bitcoin (BTC) and Cardano (ADA) couldn’t escape the chaos, joining Ethereum in its downward dance. 💃📉

Ethereum’s price also took a hit as the fear and greed index plummeted to 25, just in time for Trump’s tariffs. Economists are warning that these tariffs could lead to a recession, erasing some of the growth that sprouted under Joe Biden. It’s like watching a garden flourish only to be trampled by a herd of stampeding cattle. 🐄🌾

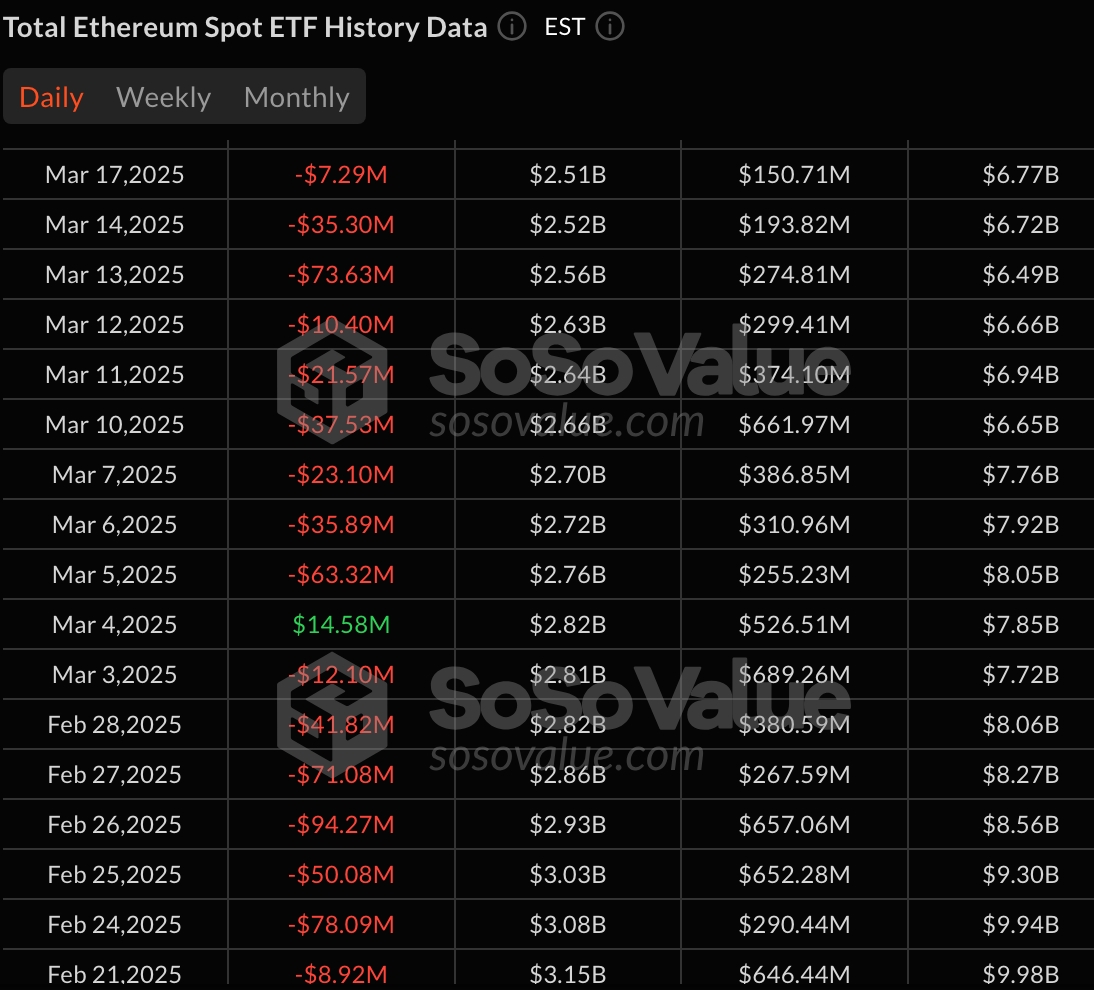

Meanwhile, Wall Street investors are sitting on the sidelines, watching the Ethereum drama unfold like a soap opera. SoSoValue data reveals that spot Ethereum ETFs had inflows just once in March, adding a meager $14.8 million on March 4, only to shed assets since then, leaving a paltry $2.4 billion in cumulative assets. All Ethereum ETFs combined hold a mere $6.86 billion. It’s like trying to fill a swimming pool with a garden hose. 🏊♂️💦

Furthermore, Ethereum has been losing its market share in key industries like decentralized finance, non-fungible tokens, and decentralized exchanges. It’s been outpaced by layer-1 chains like Sonic and Berachain, and layer-2 networks like Base and Arbitrum. Talk about being left in the dust! 🏃♂️💨

Ethereum Price Technical Analysis

ETH‘s price has also crashed for technical reasons, forming a triple-top pattern at $4,000 and a neckline at $2,130, its lowest level since August last year. It dropped below this neckline earlier this month, then decided to retest it like a student cramming for an exam. A break-and-retest pattern is a popular continuation sign, but it has also formed a bearish flag pattern, which sounds more ominous than it is. 🚩

Thus, there’s a risk that the coin could crash to $1,537, its lowest point on October 9. A move above the resistance level at $2,131 would be the silver lining in this cloud of despair. 🌥️✨

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

2025-03-28 21:20