Ah, the Ethereum price! A tale of woe and wonder, much like a poet’s heart, fluttering in the winds of fortune. In recent weeks, it has found itself in a more favorable position than in the bleak first quarter of the year. Yet, our beloved “king of altcoins” seems ensnared in a Sisyphean struggle, perpetually rebuffed at the fateful threshold of $2,700. 🎢

After basking in the warm embrace of bullish momentum, Ethereum has faced a rather dramatic descent, plummeting back to where it began the week. Below lies the secret behind ETH‘s ongoing battle against the $2,700 wall. Spoiler alert: it’s not a happy ending! 😅

What’s Happening To ETH’s Price Above $2,700?

On May 24, the oracle of blockchain analytics, Glassnode, unveiled fresh insights into the Ethereum price’s recent escapades. According to this digital seer, the next significant milestone for ETH hovers around the mystical realm of $2,800. 🧙♂️

The reasoning behind this revelation is the enigmatic cost-basis distribution of the ETH supply. This metric, known as cost basis distribution (CBD), reveals the total Ethereum supply held by addresses with an average cost basis nestled within specific price brackets. Sounds fancy, right? 🤓

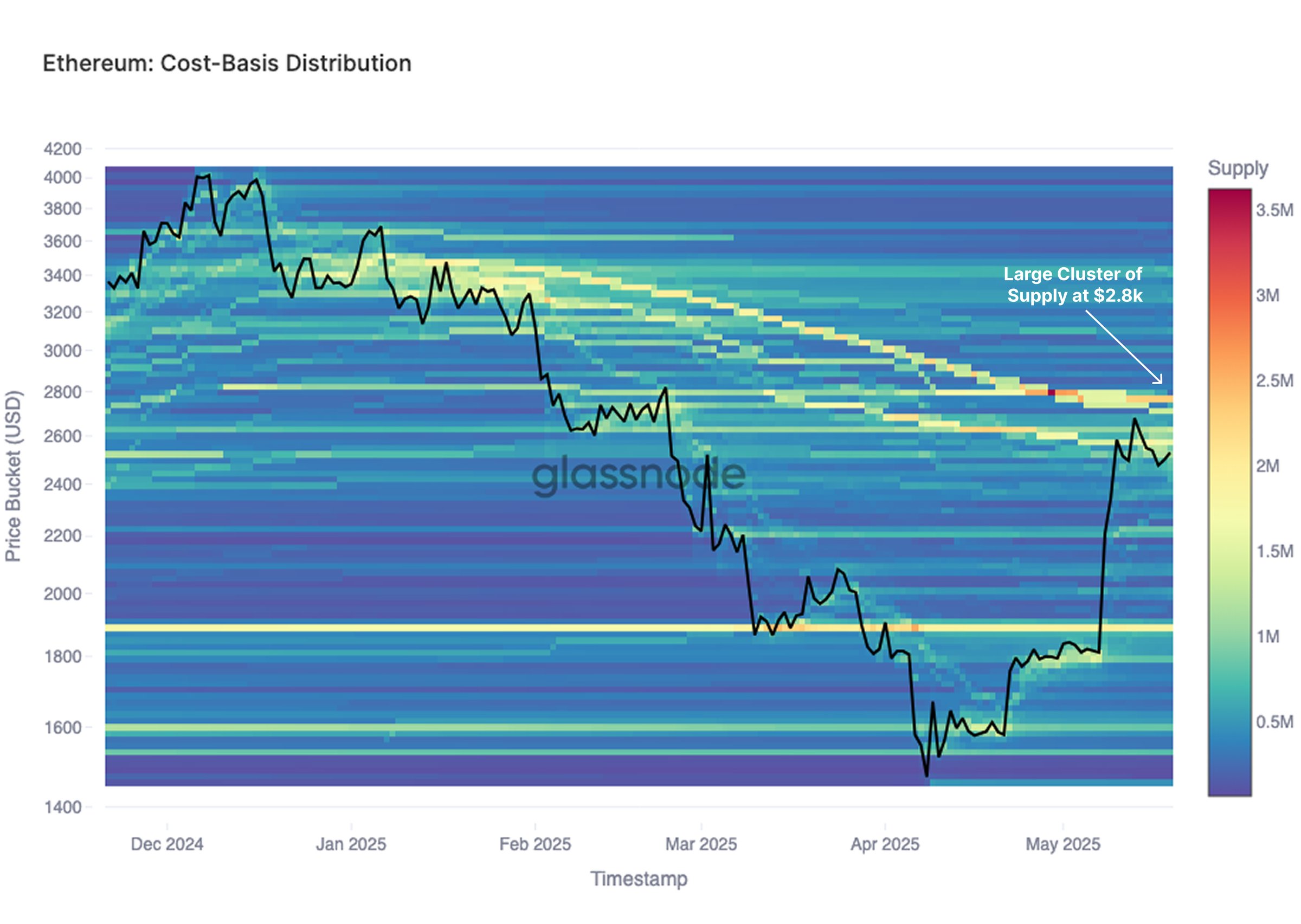

As depicted in the chart above, the CBD metric employs a heatmap with fixed price bracket levels (on the vertical axis) for a given period (on the horizontal axis). This indicator offers a glimpse into the shifting sands of investor cost basis over time. 🏖️

Glassnode has noted a significant cluster of investor cost-basis distribution around the $2,800 price level. In layman’s terms, many investors decided to hop on the Ethereum train at this price point. 🚂

But wait! There’s more! Glassnode warns that as Ethereum approaches the CBD cluster around $2,800, it may face a wave of sell-side pressure. Why, you ask? Because those once-drowning investors are eager to offload their assets near breakeven. Talk about a dramatic plot twist! 🎭

This on-chain revelation sheds light on why Ethereum has been facing rejection above the $2,700 mark in recent weeks. For our second-largest cryptocurrency to break free from this supply barrier, the demand for ETH around the CBD cluster must triumph over the selling pressure. A tall order, indeed! 🏆

However, if Ethereum continues to grapple with significant selling pressure around the $2,800 level, it may tumble to the next support level. As the wise analyst Ali Martinez pointed out on the social platform X, the next major support cushion for ETH lies around $2,380. 🛏️

Ethereum Price At A Glance

As of this writing, the Ethereum token is valued at around $2,0, reflecting a less than 1% decline in the past 24 hours. A real nail-biter, isn’t it? 😬

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-26 06:28