Ethereum‘s price finds itself lounging around $3,677, a sprightly little chap that has decided to rise by a pleasing 16.5% this week. It attempts to do the limbo over the $3,800 threshold, only to be playfully shoved back down, like a rambunctious child at a birthday party. 🎉

With a looming big unstaking queue like a queue for tea at a wedding, and the momentum doing a rather tiresome waltz, one can’t help but wonder if this door will swing open to reveal riches or merely close with a huff. Two key metrics might just illuminate this curious dilemma.

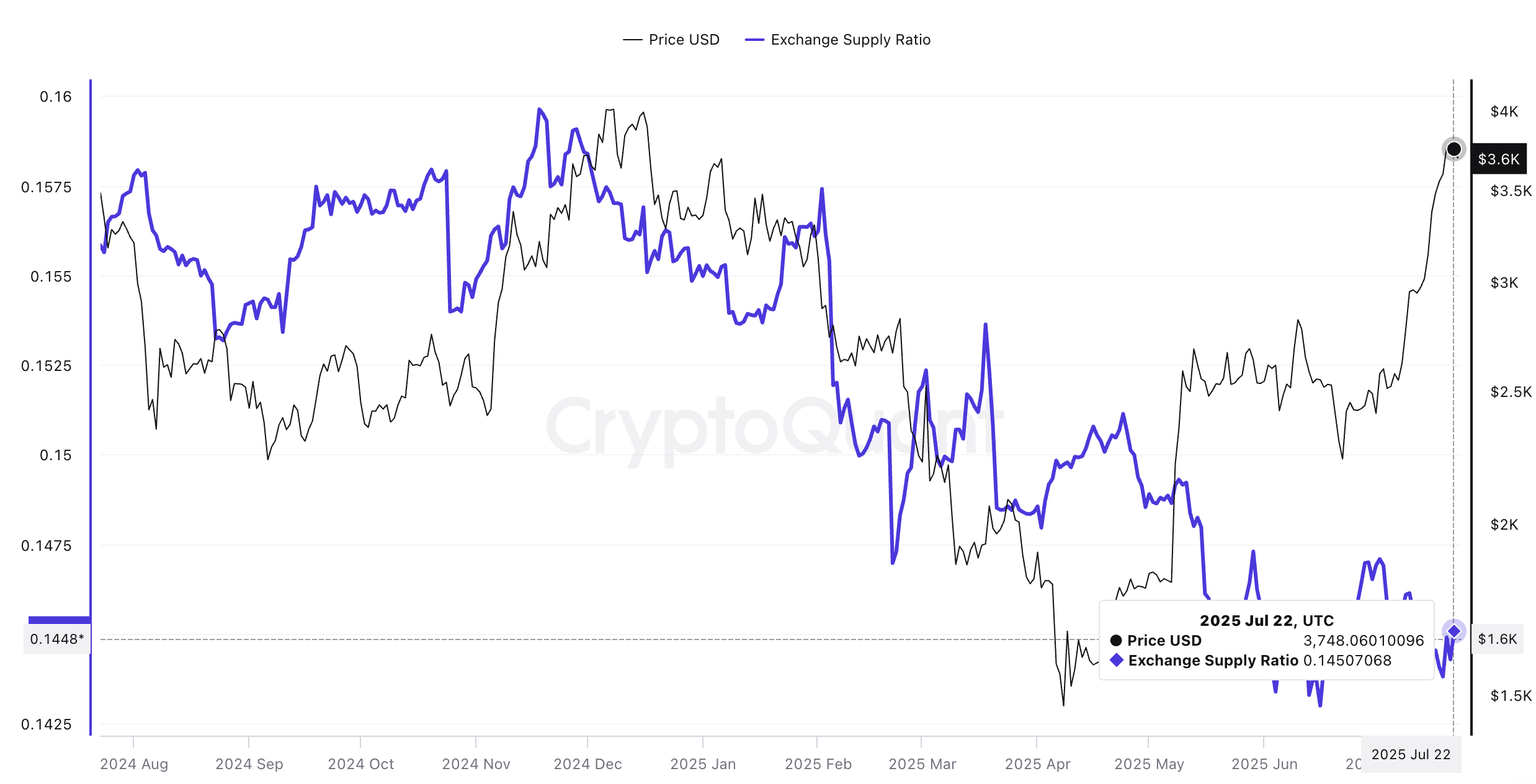

Exchange Supply Ratio Near Lows

The Exchange Supply Ratio (ESR) is currently at a tantalizing 0.145, just a whisper above this year’s low of 0.142. Now, instead of using mere raw exchange balances, we’ve opted for the snazzy ratio approach, which measures exchange holdings against the total circulating ETH, shifting with all that business of staking, burns, and unlocks. 🧐

For those besotted with token TA and market updates: Fancy more token tidbits like this? Subscribe to our delightful Editor Harsh Notariya’s Daily Crypto Newsletter here.

A low ESR signifies that only a measly portion of supply is perched on exchanges like an awkward guest at a soirée, ready to sell at a moment’s notice. That’s the scene we’re in at the moment!

The charts suggest that previous ESR highs often heralded Ethereum price pullbacks, much like the loud “ding” before the rollercoaster plummets. Hence, low ESR levels are akin to a cup of herbal tea, exuding confidence and calmness. ☕

If our dear ESR decides to climb while prices nosedive, it usually hints that unstakers or large holders are cheerfully migrating their tokens to exchanges, preparing for a dip—a bit like an overzealous gardener anticipating a storm.

Funding and Open Interest

Currently, open interest has reached approximately $55.9 billion, suggesting that many futures positions are having a merry time at the market fair. The funding rate is lounging around a paltry 0.01%, still cheerful but lower than recent spikes (anything above 0.02% might have us biting our nails, suggesting high Long leverage). 😬

The prevailing market structure indicates traders are leaning long—quite optimistic about prices climbing higher—without needing to cough up a hefty premium to remain there. This reveals a healthy scenario, and the ETH price rally appears to be a gourmet dish prepared à la carte! 🍽️

In this grand tapestry of funding, which is akin to the fee that longs and shorts natter over to keep perpetual prices near the spot, open interest reflects the total value of all open contracts as they vivaciously jostle for attention.

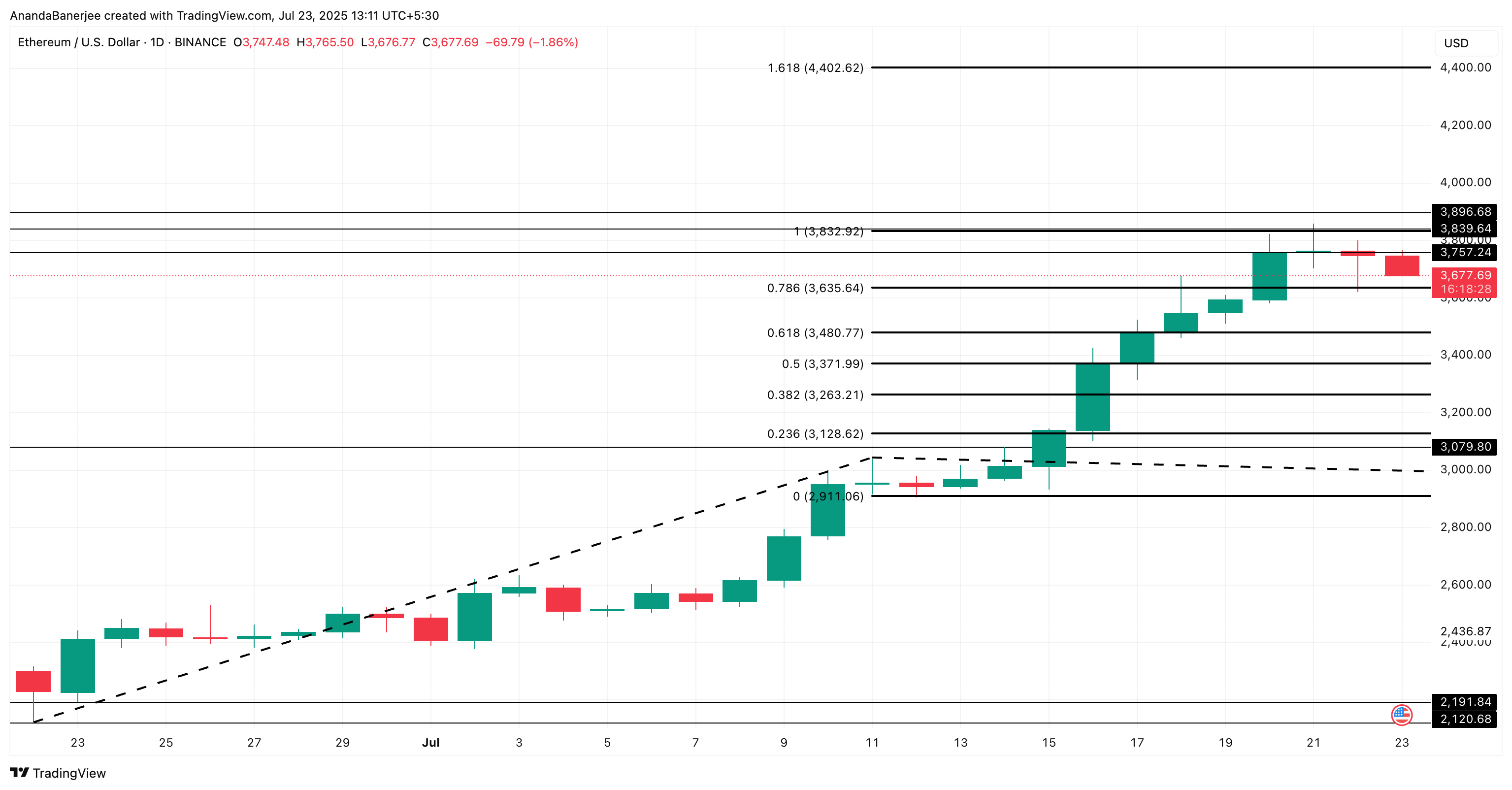

Ethereum (ETH) Price Needs To Beat Key Levels

As it currently stands, ETH is vacillating within the key ranges of $3,832 and $3,635 (the 0.786 Fib level). The upper level, being resistance, hints that the real challenge looms just beyond the “$3,800 door.” Nevertheless, simply breeching the $3,832 resistance like a youthful lord shouting “Geronimo!” might not yield the desired outcomes. 🎈

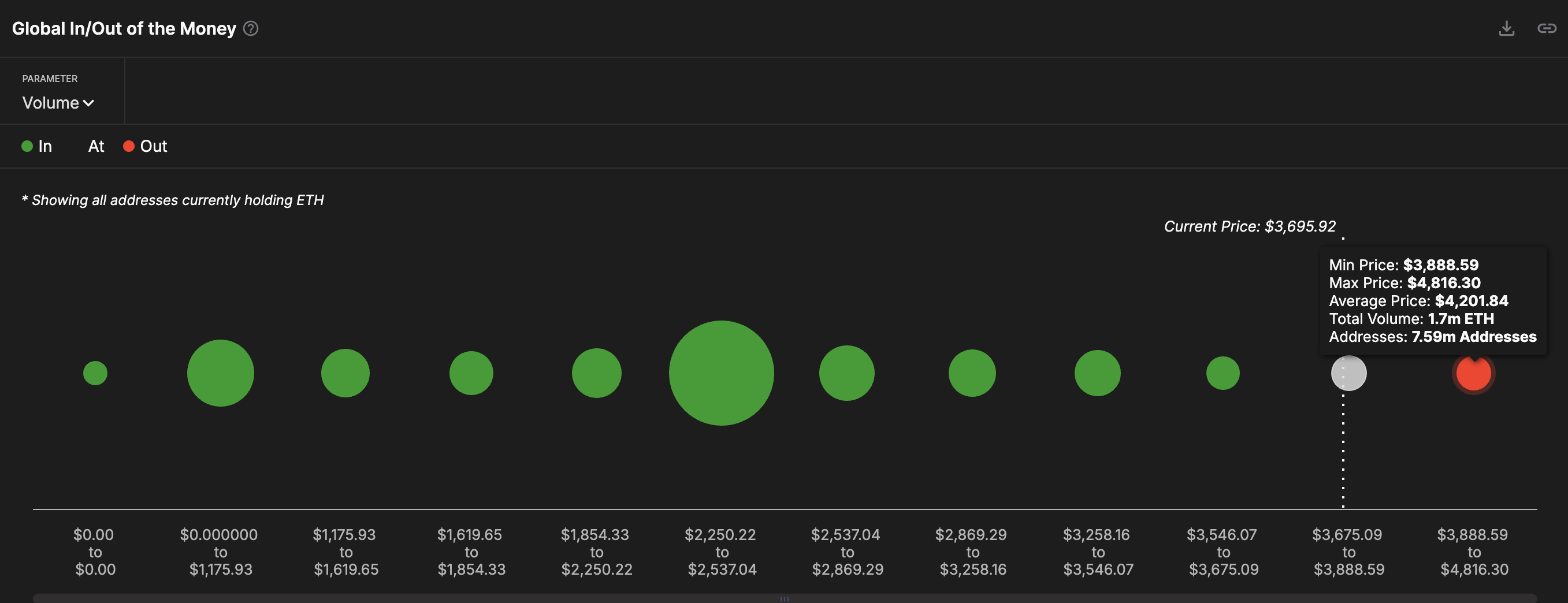

There is a rather cliquish holder cluster above $3,888 that also needs to be breached. Perhaps this explains why quick jaunts above $3,800 tend to fizzle out; many wallets are stuck at break-even there and are all too eager to sell into the strength, rather like mice eyeing a particularly pungent cheese.

A daily close beyond $3,896 would fling the doors wide open to a flamboyant $4,402 (the 1.618 extension). Should ETH find itself correcting again, $3,635 is the first support, followed closely by $3,480. A nosedive beneath those levels, combined with a rising ESR, could see the bullish setup weaken faster than a soufflé in an earthquake.

The Fibonacci levels serve as beacons marking common reaction zones, while the in-and-out-of-money map provides insight into where many wallets found their profit. These zones often double as real resistance or support, thus validating our charming Fibonacci levels. 📊

However, all this jazz might come crashing down if ETH decides to plummet below $3,128 or the 0.238 Fib extension level—thus proving that the markets remain as unpredictable as a cat among canaries. 🐱💨

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-24 00:41