Ah, dear reader, behold the audacious Abraxas Capital, a veritable titan in the realm of investment management, with a staggering $3 billion under its watchful eye. In a move that could make even the most stoic investor raise an eyebrow, they have decided to shower a princely sum of $837 million upon the ethereal Ethereum (ETH). This bold venture has not only inflated their portfolio to a dizzying $950 million but has also ignited a flurry of speculation among analysts, who now ponder the imminent arrival of an altcoin season. How delightful! 🎉

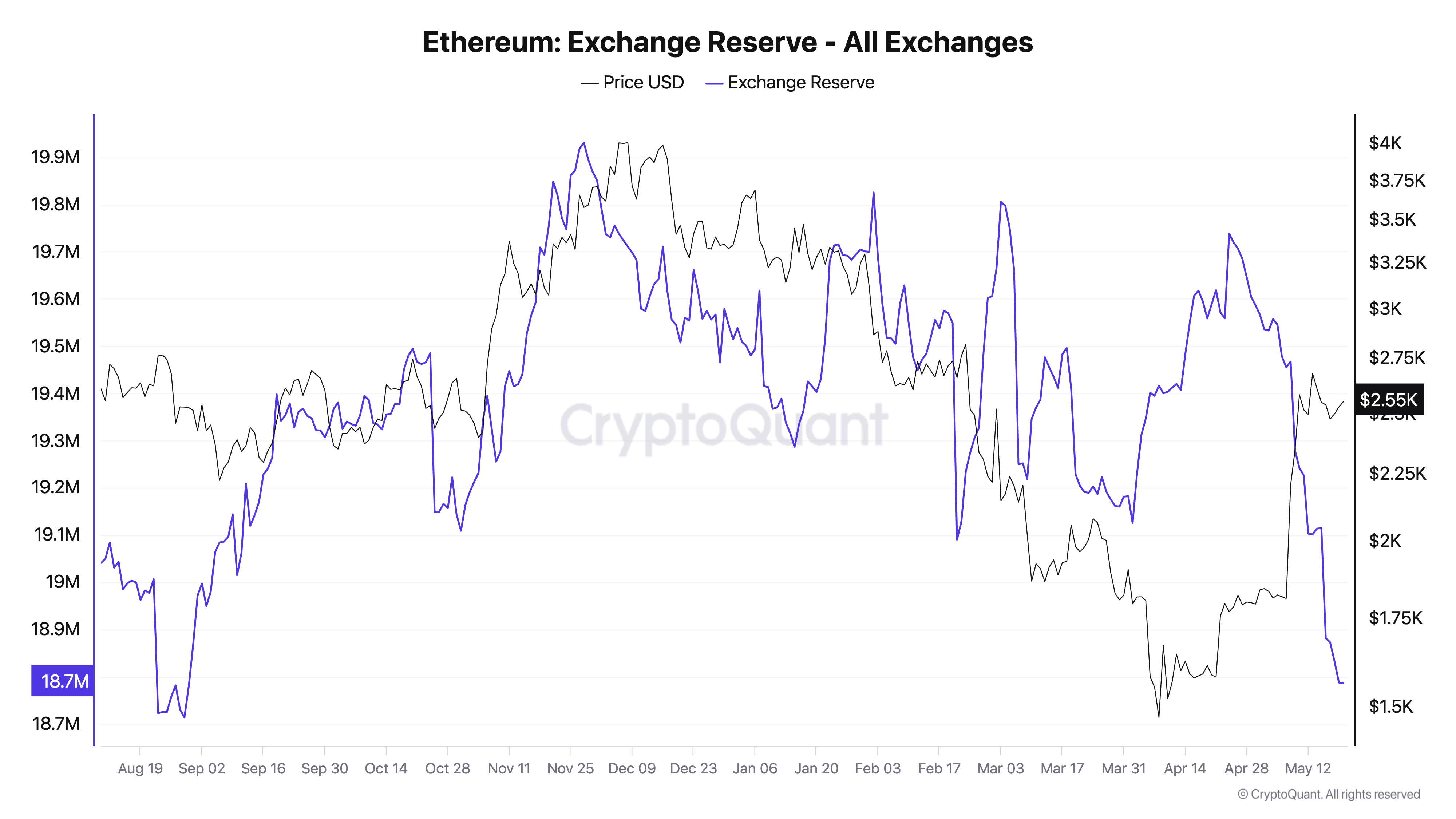

It is worth noting, with a hint of irony, that this decision comes at a time when Ethereum is basking in the glow of renewed interest. Traders, like moths to a flame, have been flocking to buy ETH, resulting in exchange reserves plummeting to their lowest levels in nine months. Who knew that scarcity could be so enticing? 😏

Why Are Investors Buying Ethereum?

Once upon a time, in the year 2025, Ethereum found itself in a bit of a pickle, grappling with lackluster price performance and an avalanche of selling pressure. Yet, like a phoenix rising from the ashes, it experienced a renaissance following the Pectra upgrade, which sent its price soaring and investors scrambling to get a piece of the action. Oh, the drama! 🎭

A recent report from BeInCrypto revealed that over 1 million ETH were whisked away from exchanges in the past month. Furthermore, data from CryptoQuant indicated that exchange reserves have dwindled to levels not seen since the balmy days of late August 2024. Could this be a harbinger of bullish tidings? Only time will tell!

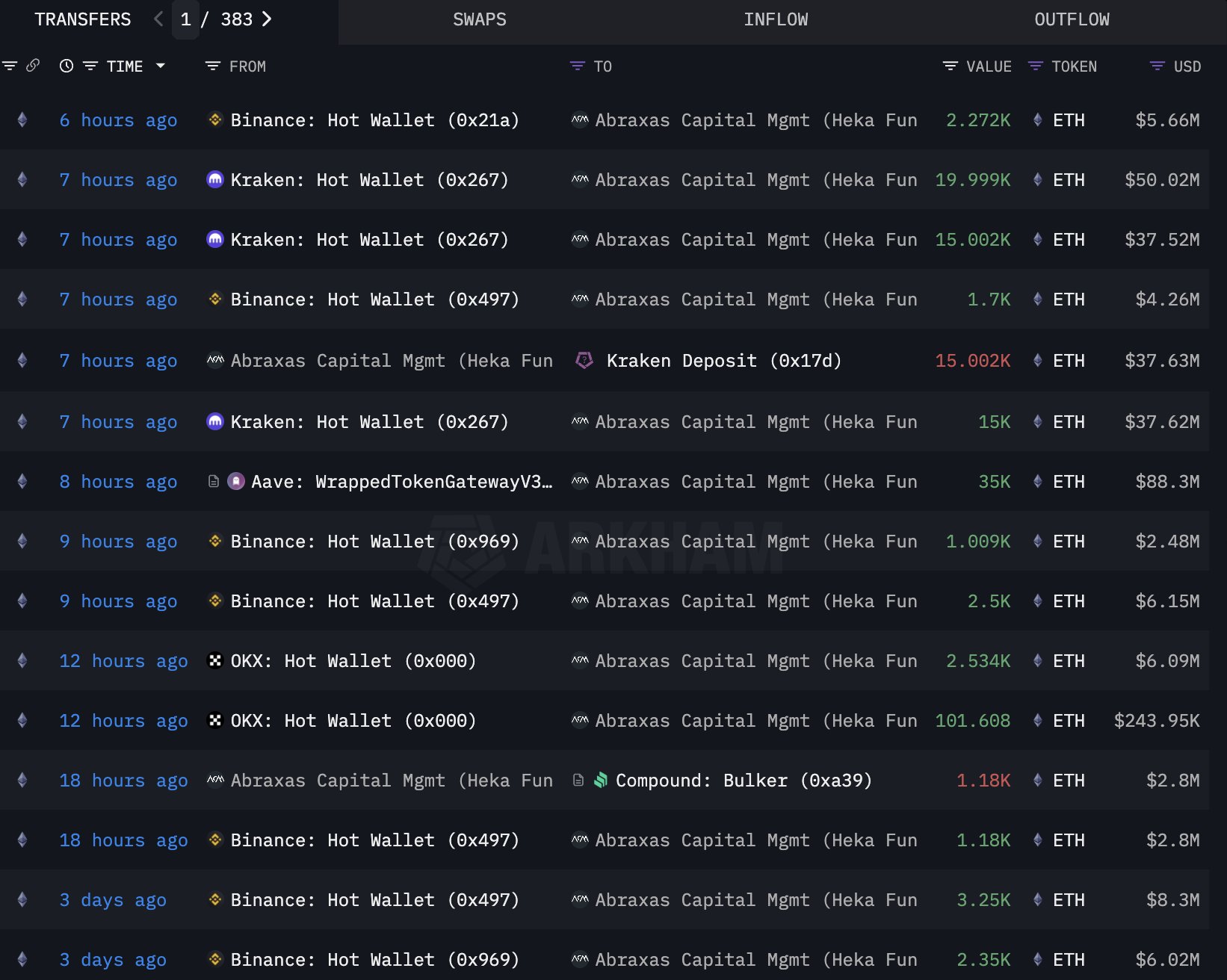

Among the eager buyers, Abraxas Capital shines like a diamond in the rough, employing an aggressive accumulation strategy that would make even the most seasoned investor blush. According to the ever-watchful Lookonchain, the firm has recently acquired 46,295 ETH, a purchase worth a staggering $115.3 million. Talk about commitment! 💪

This acquisition follows a brief three-day hiatus, during which one might imagine the firm pondering the existential questions of life. Nevertheless, since the dawn of May, they have amassed a jaw-dropping 350,703 ETH, with an average purchase price of $2,386, already reaping an unrealized profit of $50 million. Not too shabby, eh? 💸

In a twist of fate, the firm has also pivoted away from Bitcoin, as reported by BeInCrypto, significantly reducing its Bitcoin holdings and redirecting capital toward Ethereum. A bold strategy, indeed!

Abraxas Capital’s newfound focus on Ethereum aligns splendidly with the ambitions of its Alpha Ethereum Fund, which made its grand debut in July 2023. This fund, employing conditional leverage through options and yield-generation strategies, aims to outshine ETH’s native price performance. In fact, in 2024, the Alpha Ethereum Fund basked in glory with a 62.7% gain, outpacing Ethereum’s own 50.9% increase. Bravo! 👏

Does ETH Accumulation Signal an Incoming Altcoin Season?

Meanwhile, the crypto community has taken note of Abraxas Capital’s fervent focus on Ethereum, with some daring to speculate that these maneuvers could herald the dawn of an altseason. How thrilling! 🌅

Atlas, a sage analyst, posited that Abraxas’ ETH activities are not your run-of-the-mill high-risk gambles; rather, they signify a burgeoning institutional interest. He believes Ethereum is on the cusp of becoming the “institutional darling” of this cycle. How romantic! 💖

He further elaborated that the firm is following a well-trodden path, reminiscent of Alameda Research’s exploits in 2021, by acquiring Ethereum early, stoking positive market narratives, and then gracefully rotating into altcoins to ignite an altseason. A masterclass in strategy!

“ETH rotation is the signal – altseason is the real move. The same machine that ignited 2021 is back with deeper pockets,” he declared, with a twinkle in his eye.

The prospect of an altcoin season is a tantalizing thought for many in the industry. Tracy Jin, COO of MEXC, shared with BeInCrypto that early signs are already emerging: Bitcoin dominance has taken a noticeable dip, the altcoin market cap has surged, USDT dominance is waning, and altcoin charts are displaying promising price structures. How delightful! 🎈

“Ethereum’s performance is another signal pointing to the potential start of altseason. While large short positions among ETH traders and persistent bearish sentiment previously indicated a continuation of the downtrend, a surge in risk appetite has renewed interest in ETH and smaller altcoins,” Jin disclosed to BeInCrypto.

She concluded with a flourish, noting that while it is still technically “Bitcoin season,” the groundwork for an altcoin rotation is unmistakably taking shape. If capital continues to flow in this direction, the first phase of altcoin season could commence sooner than one might expect. How exhilarating! 🎊

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-05-20 11:52