Too Lazy to Read? Let’s Boil This Down ⏩

- Wise men in smoky backrooms whisper: May is Ethereum’s favorite month for financial wizardry. Some await a glorious surge—assuming ETH can finally muscle past its eternal “crucial resistance” (a phrase now more tired than a miner at halving).

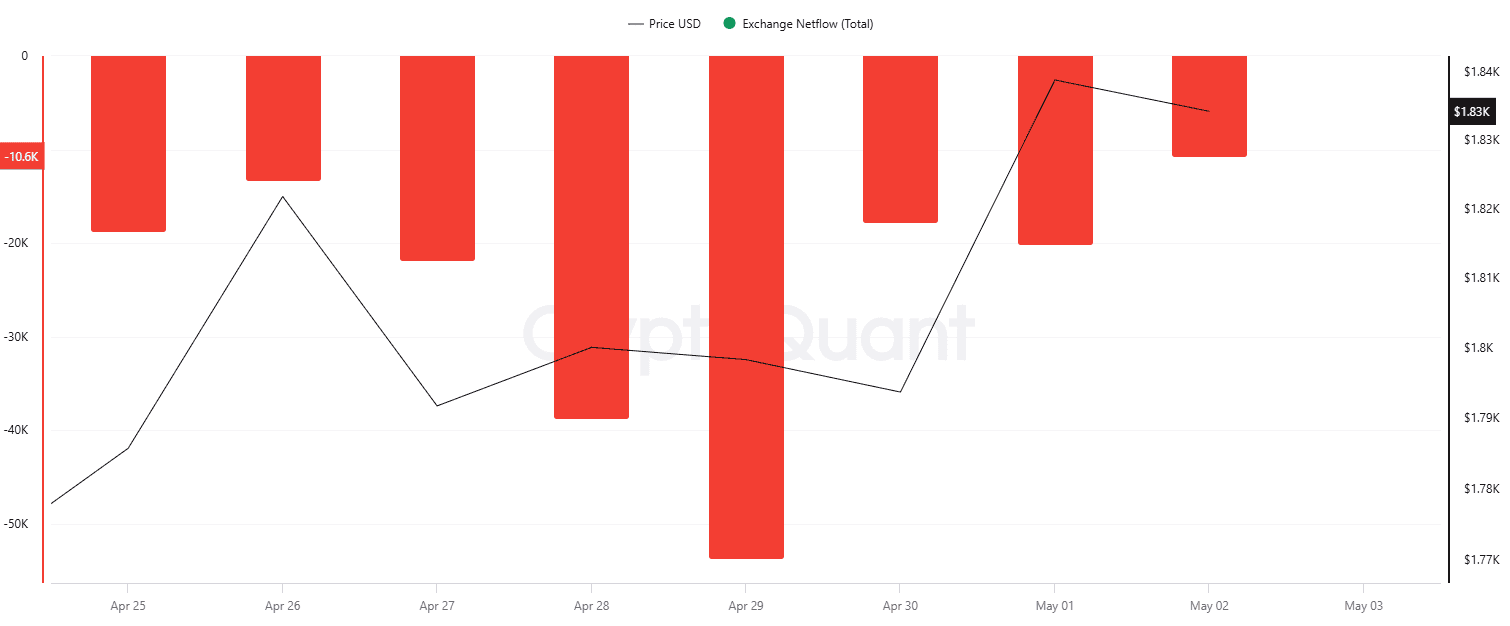

- ETH is leaking away from exchanges faster than vodka at a Russian wedding, as investors clutch their tokens tightly to chest—usually a sign they aren’t planning to dump anytime soon.

The Eternal Question: Where Drag Ye Next, O Ethereum?

Ethereum, that sullen prince always in Bitcoin’s shadow, staged a robust rebellion—rising by 16% over a mere two weeks, swaggering above $1,800. Yet, let’s not romanticize—the last several months were as lackluster as a poet’s supper: lean and dry.

“ETH has been bleeding for five months,” barked Carl Moon, a digital preacher with 1.5 million Twitter congregation. February alone resembled a Dostoevsky winter—prices collapsed, dreams froze; a drop of nearly 32%. Grim, even by Russian standards.

But May! Oh, intoxicating May! Carl assures us, history kneels to its feet: out of ten glorious Mays, ETH tripped only three times. The rest? Average gains of 27.31%. Think of those numbers—not bad for something not grown from tilling real soil.

X user SHERIFF, not to be outdone, waved his badge and declared ETH suffered in seven of the past eight months. “Dead” volatility, he called it—like a provincial town where nothing moves but the wind. Still, he insists, these stagnant moments are when “the next big move brews.” Optimism, or madness? In this market, who can tell?

Enter Merlijn The Trader, comparing Ethereum to the mighty Bitcoin of 2020-2021: “Back then, no one looked—then BOOM! $64K.” He says ETH now displays similar patterns: compression, longing, tension like a spring. “I’m loading ETH”—and with such faith, one almost forgives his wild optimism.

2020: Bitcoin lingered at $8K… Ignored by many. Then, out of boredom or spite, it rocketed to $64K.

Now: Ethereum, same old dance—accumulation, compression, and (perhaps?) explosion is loading…

History, don’t fail us now. I’m all in. —Merlijn The Trader (@MerlijnTrader) May 1, 2025

CRYPTOWZRD, swooping in like a wizard late to the party, peered into his mystical charts. He muttered something about resistance at $2,120. Break that, he claims, and it’s a quick sprint (or drunken stagger) towards $2,800.

Flight From the Exchanges 🚪

What stirs the hopeful hearts of these analysts? ETH’s “netflow” is surging away from exchanges. Investors are moving their coins out of centralized hands, tucking them under digital mattresses. Why? If you’re planning to sell, you leave your goods at the market. All this token-hoarding gives hope that selling pressure will slacken—and prices just might rise. Or perhaps we’re all simply collecting tokens like Soviet-era stamps, waiting for a glorious future that never arrives.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-05-02 20:53