As the global markets lurch like a drunken sailor under the harrowing implications of Trump’s audacious “Liberation Day” tariffs, we find ourselves engulfed in the darkest minutes of crypto’s latest soap opera. While Bitcoin clings to its dignity, Ethereum is experiencing a veritable bloodbath, prompting the pertinent inquiry: Why the lavish theatrics with ETH whilst BTC remains relatively unscathed? Buckle up, dear reader, as we embark on this tumultuous journey! 🚀

Market Mayhem: A Rapid Drop Across Risk Assets

In a remarkable display of synchronised despair, almost every major market has taken a tumble this past week, as though a very naughty child has pulled the rug from under the economy’s feet. The US has crumbled by a mere 0.68%, Europe, with its flair for dramatics, has plummeted by 4.65%, while China, the rising dragon, felt a pang of humility at 3.28%. Even Australia, the land down under, has not escaped, posting a loss of 1.21%. Quite the affair! 🎭

Now, let’s gallivant over to the commodity brigade: since April began its unfurling dance, the WTI Crude Oil price has slid gracefully down by nearly 13.79%. And, in a shocking twist of irony, even gold—the perennial darling of safe havens—dropped by over 4.74% between April 3 and 7. Talk about a family reunion gone wrong!

In the crypto realm, the uptight atmosphere has not been exempt from such calamity. Over the past week, both Bitcoin and Ethereum curiously fell by at least 1.1% and a staggering 11%, respectively. Poor ETH—someone get it a stronger drink! 🍸

It certainly appears that the economic upheaval has unfairly targeted Ethereum while gifting Bitcoin a rather indulgent spa day. Let’s dig deeper, shall we?

Capital Flows Dry Up: Ethereum Feels the Squeeze

According to the studiously published graphs that you simply must peer at, the ETH market witnessed inflows amounting to a jaw-dropping +15.5B/month at its zenith but is now floundering amid outflows of -$6B/month. In contrast, Bitcoin, that suave charmer, has indeed slowed its inflows, yet still lingers in the positive territory at +6B/month. Bravo, Bitcoin! 🥂

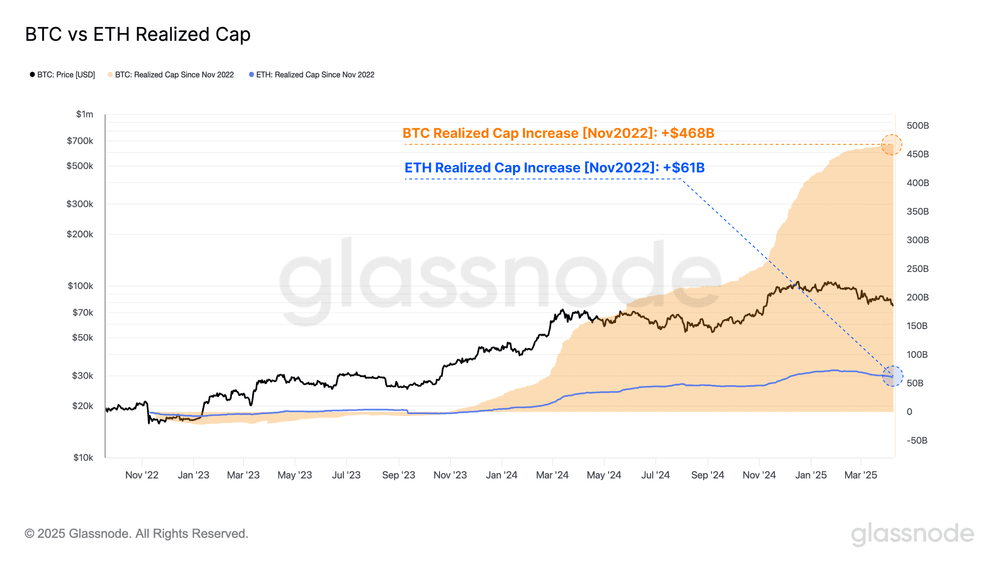

The BTC vs ETH Realised Cap chart requires a close-up analysis, revealing that since late 2022, Ethereum’s realised cap has only blossomed by +32%, from $183B to $244B. Meanwhile, Bitcoin has strut its remarkable growth by +117%, boasting a rise from $402B to $870B. Just look at that difference—one is growing, the other is… shall we say, uniquely positioned?

ETH Holders in the Red: MVRV Ratio Dips Below 1.0

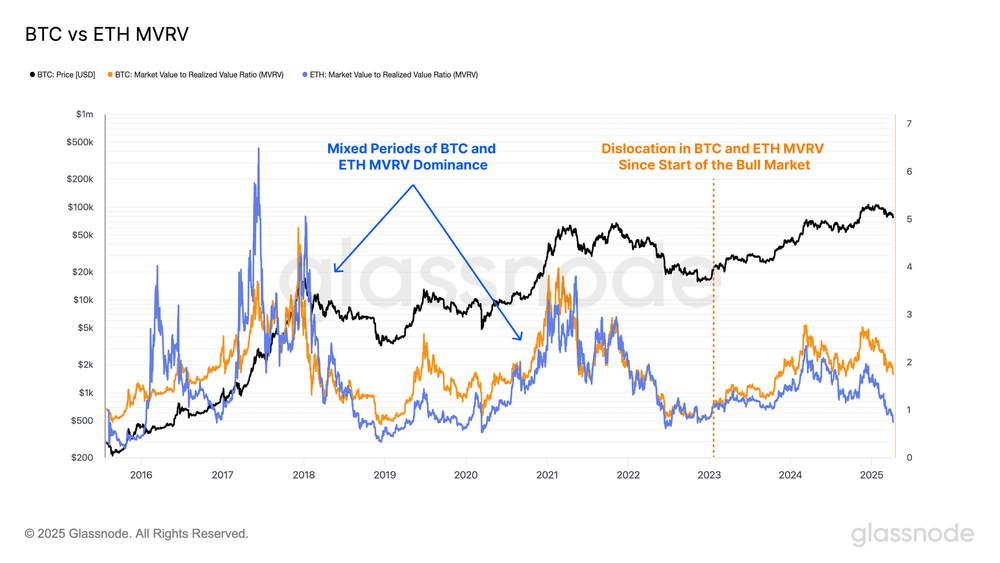

For those unacquainted, the MVRV ratio is akin to the gossip column of crypto—where market value meets realised value. It appears that Ethereum’s glitzy MVRV ratio has slipped beneath the coveted 1.0 mark, whereas Bitcoin is basking in its glow above that threshold. 🎉

This illuminates an unpalatable truth: average ETH holders are various shades of unhappy while their BTC counterparts are still reveling with paper profits. A classic case of the grass being greener, don’t you think?

Bitcoin Dominance: 800+ Days of Outperformance

Statistics reveal that Bitcoin holders have lumbered through 812 consecutive days with higher average profit than their ETH-ensnared comrades. This long-term drama has understandably inflated the cloud of negativity surrounding our beleaguered Ethereum.

- Also Read:

- 🚀 Trump’s Tariff Pause Sparks Market Surge; XRP, ETH Lead Crypto Rally

- 🤑

ETH/BTC Pair Signals Alarming Divergence

Since September 2022, the ETH/BTC pair has plunged by at least 75%, and recently, this duo reached a rather melancholic 0.02207. With this divide, Ethereum obviously struggles to keep up with its more flamboyant counterpart, Bitcoin. This is starting to feel like a classic case of “my friends are cooler than yours!”

What’s Next: Can ETH Recover Its Momentum?

Alas, the current report details that ETH investors have been forced to reckon with realised losses of $564M, in contrast to a relatively mild $240M for Bitcoin during this latest melodrama. In times past, ETH would occasionally sparkle brighter than BTC, but it seems this cycle prefers to snuff out any flashiness. 🤷♂️

In summation, with sentiment waning and capital flows evaporating at an alarming rate, Ethereum’s struggle may continue unless a wave of bullish momentum reappears on the horizon. The plot thickens!

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Is it better to buy Bitcoin or Ethereum? While Ethereum prides itself on robust fundamentals, Bitcoin reigns supreme with its wide-reaching appeal.

What will the price of Ethereum be in 2025? Based on our incredulous predictions, the ETH price could possibly reach a staggering $5,925. 😲

How much would the price of Ethereum be in 2040? Based on our latest whimsical analyses, Ethereum could potentially sparkle at a luxurious $123,678. 💰

How much will the ETH coin price be in 2050? By 2050, a single Ethereum could skyrocket to an astronomical $255,282. We might even need a new currency altogether! 🌌

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- M7 Pass Event Guide: All you need to know

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Brawl Stars Steampunk Brawl Pass brings Steampunk Stu and Steampunk Gale skins, along with chromas

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

2025-04-10 12:00