Ethereum, that capricious creature, has charmed its way into a 68% ascent over the past three months, much to the delight of its near-term admirers. Alas, the last week has seen a bit of a stumble, a loss of 4.7%, and a stubborn flatness over the last 24 hours, as if the digital darling were taking a well-deserved nap. 🛌

This little siesta has placed Ethereum squarely in a realm of uncertainty, a delicate waltz between bulls and bears, each eager to lead the dance. While such a tango could end with either partner leading, two on-chain metrics hint at a potential victory for the bulls. 🐂🐻💃

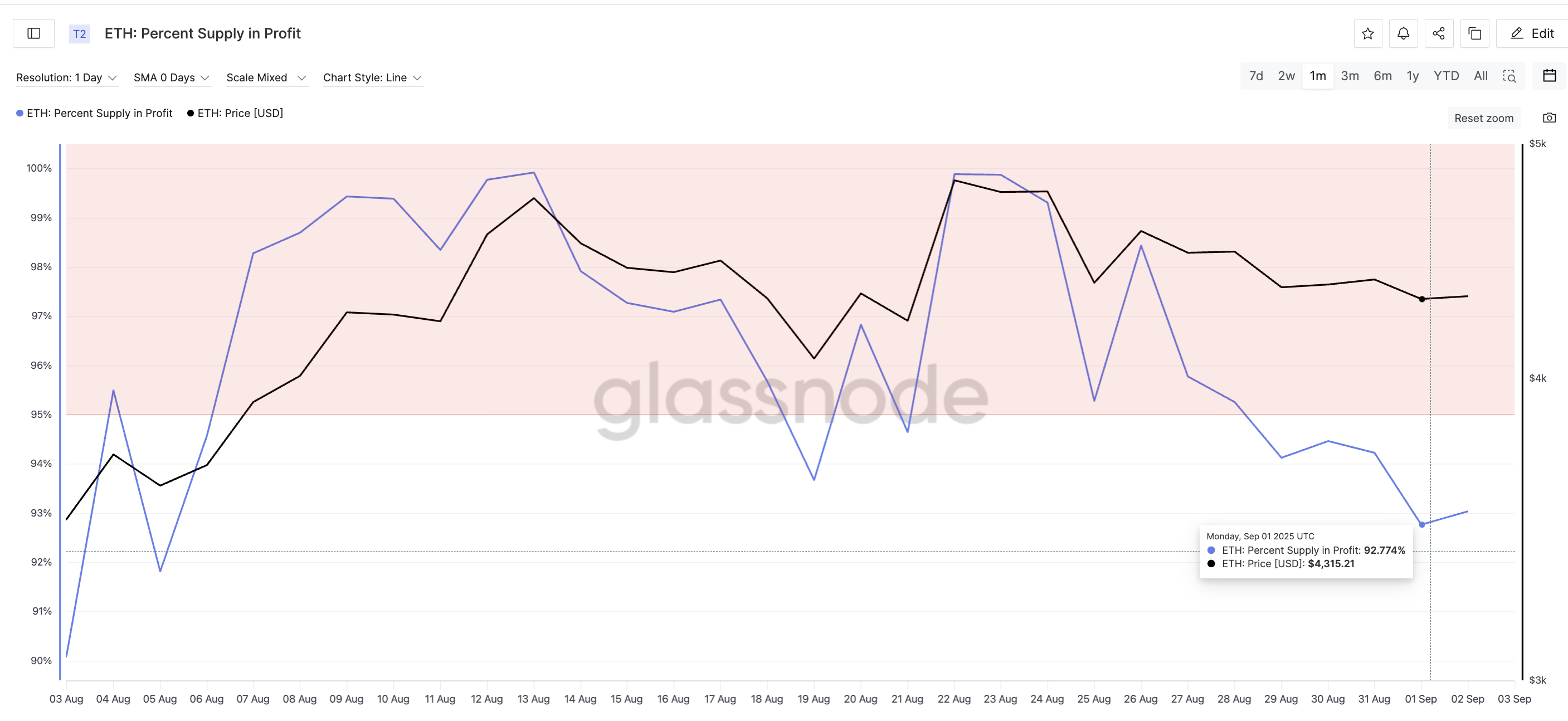

Metric 1: Profit Supply Drop Points To Seller Exhaustion

The percentage of ETH supply in profit has dipped from a lofty 98.4% on August 26 to a more modest 92.7% on September 1, marking its second-lowest point in a month. Typically, such a decline would signal a frenzy of profit-taking, but history whispers that once profit supply hits these local lows, ETH tends to soar. For instance, when the ratio dipped to 91.8% earlier in August, ETH ascended from $3,612 to $4,748-a staggering 31% rise in just eight days. 🚀

This drop suggests that a wave of sellers has already taken their leave, leaving ETH with fewer holders who might panic-sell. In essence, the selling intensity has likely diminished just as Ethereum finds itself consolidating at a crucial breakout zone. A bullish omen, indeed. 🍀

Desire more cryptic insights? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

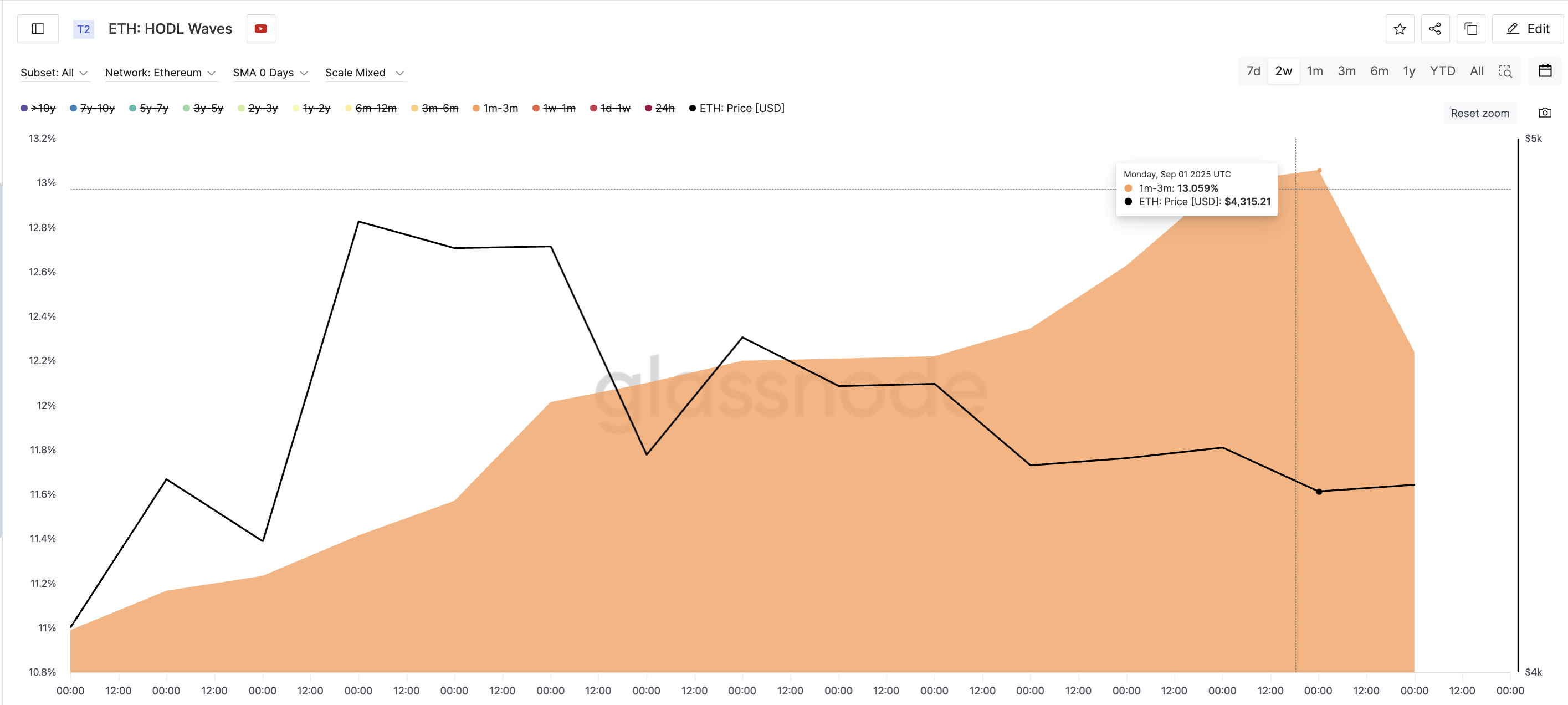

Metric 2: Short-Term Holders Accumulate Despite Gains

Perhaps the most intriguing detail is that the group most inclined to cash out-those holding ETH for one to three months-has been quietly amassing more supply. Their share has risen from 10.9% to 13% in just two weeks, despite ETH’s impressive 20% monthly gains and a 68% surge over three months. 🤔

This accumulation by typically quick-to-flip traders signals a growing confidence in further upside. Coupled with the low profit-supply reading, this HODL Waves data paints a picture of reduced sell pressure and a stealthy build-up of demand behind ETH’s consolidation. HODL Waves, you see, measure the distribution of a cryptocurrency’s supply based on the age of coins held in wallets. 🕵️♂️

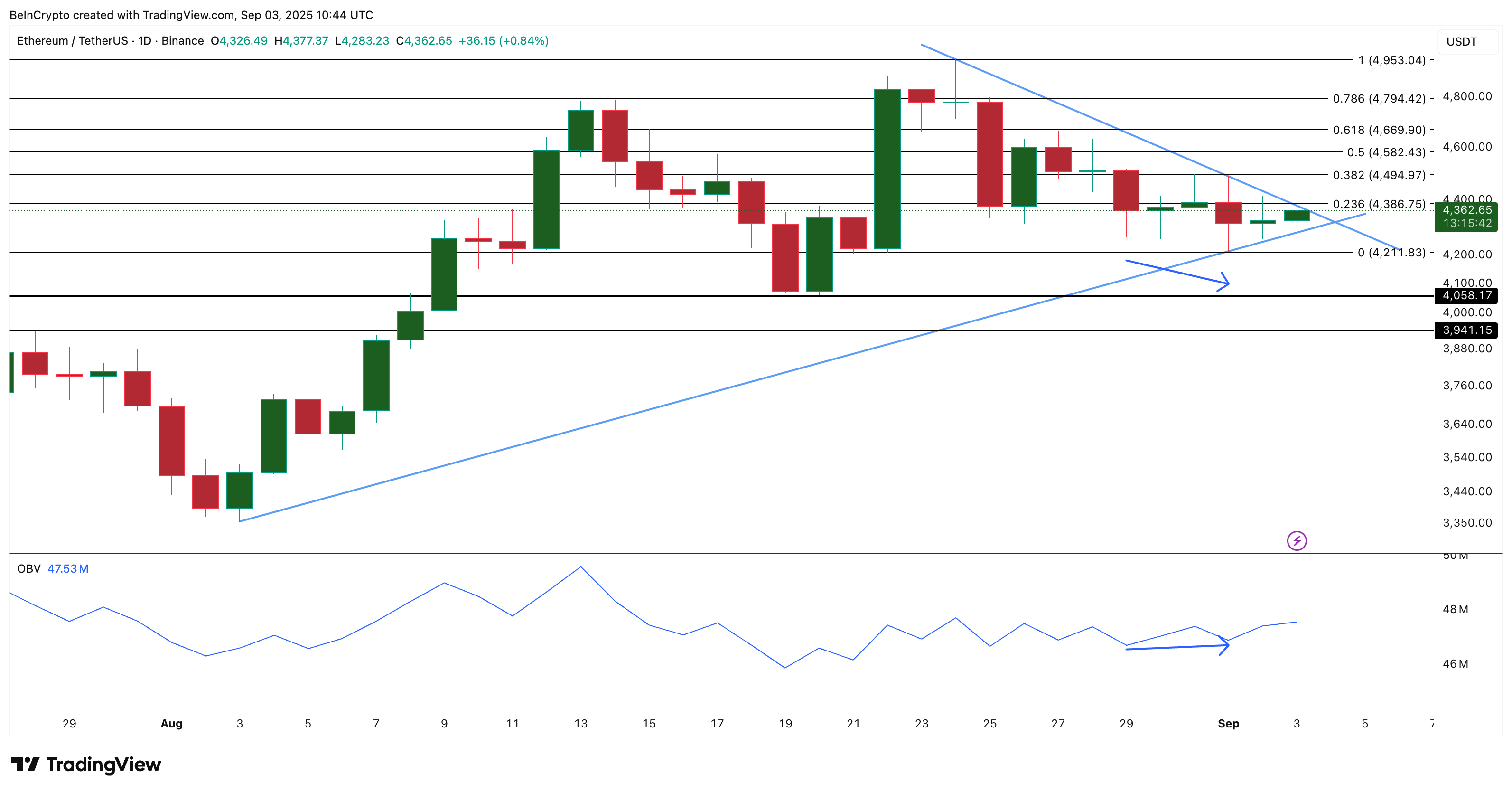

Ethereum Price Action And OBV Confirm Accumulation

On the chart, ETH dances within a symmetrical triangle, supported near $4,211 and resisted at $4,386. Despite the formation of lower lows during this consolidation, On-Balance Volume (OBV) has been making higher lows. OBV, a clever tracker of whether trading volume is buyer- or seller-dominated, suggests that accumulation continues beneath the surface. 🏗️

The OBV metric corroborates our earlier observations regarding HODL waves, reinforcing the notion that a bullish breakout is on the horizon. 🌄

The alignment of Ethereum’s price action and volume signals bolsters the case for a bullish breakout. A close above $4,494 could pave the way for $4,669 as the next resistance level, with $4,794 as the extended target. Conversely, a dip below $4,211 would weaken the setup, and $4,058 stands as the deeper support should the bears reclaim the stage. 🐻🔥

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Witch Evolution best decks guide

2025-09-04 00:07