Ah, Ethereum – that relentless rollercoaster of volatility. Once again, it’s perched just above the $1,500 mark, like a well-dressed tightrope walker on a windy day. What a week it’s been, filled with more uncertainty than a teenager’s career choice. Global trade tensions and macroeconomic wrangling continue to throw tantrums in the markets, while Ethereum’s price action seems as indecisive as your last-minute dinner plans.

The bulls, bless them, are still trying to claw their way back from the abyss. Yet, their attempts to break through key resistance levels feel about as effective as a paper umbrella in a monsoon. But! Hold your horses, for there are faint glimmers of hope. Should the bulls muster the strength to push ETH past immediate resistance zones, we could witness a miraculous shift to the upside. Or, you know, it could just plummet. But let’s stay optimistic for the moment.

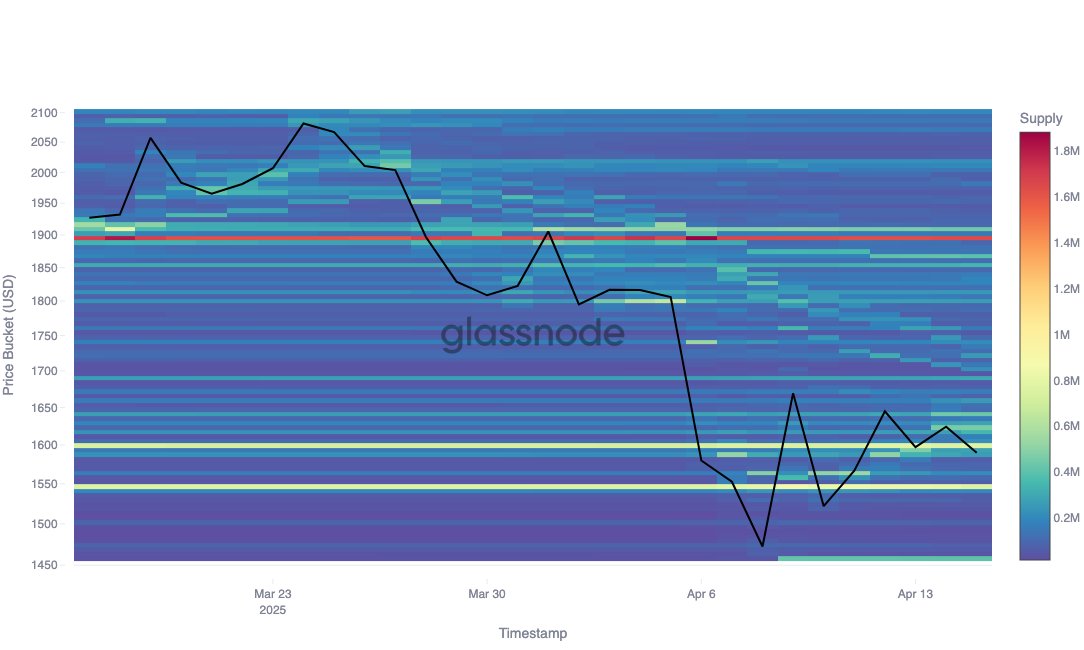

According to the ever-so-reliable data from Glassnode, Ethereum’s Cost Basis Distribution reveals three price clusters that are now the talk of the town. The most significant of them, sitting at a rather precise $1,546, is home to a hefty 822,440 ETH. Should ETH manage to hold or break above this level, we might just see the first signs of a recovery. But, no pressure, right?

At present, however, the mood remains cautiously neutral, like someone who’s just been dumped but is too proud to cry. Bulls need to start winning some rounds before anyone dares to speak of a “recovery.” The longer they linger in this limbo, the more likely it is that we’re all stuck in this downward spiral.

The $1,500 Ethereum Dance: A Few Moves, No Decision Yet 💃🕺

Ethereum’s had quite the tumble, shedding over 50% of its value since February, like a misbehaving child throwing a tantrum in the middle of the store. Now, here it is again, hanging on by its digital fingernails just above the $1,500 mark. Will this be its springboard to salvation, or is it merely a brief pause before the next plunge? No one knows for sure, but analysts are *optimistically* watching for signs of a potential recovery. I mean, who doesn’t love a good underdog story?

Meanwhile, the global economic soap opera continues—tariffs, shifting policies, and other dramas—each subplot adding more tension to Ethereum’s already strained existence. Risk assets like ETH are feeling the heat, and yet some think the worst might just be behind us. I’ll believe it when I see it.

Glassnode’s data provides a rather detailed look at what might happen next. There are three key price clusters: at $1,457, we’ve got about 408,000 ETH; at $1,546, over 822,000 ETH; and at $1,598, a solid 725,000 ETH. These are the battlegrounds where ETH will either stand firm or crumble under the pressure. As for me, I’ll be watching from the sidelines, popcorn in hand.

Should ETH break above $1,600, we might see it make a move toward $1,800, which could then lead to a dramatic rise (or, you know, it could drop to $1,000 and ruin everyone’s weekend). A bit of clarity around those price points would be lovely, but I wouldn’t hold my breath.

ETH, You Must Get Above the $1,700 Wall. But, Will You? 🧱

Here’s the latest in Ethereum’s ongoing saga: it’s currently hovering around $1,580. And no, it hasn’t managed to breach that pesky $1,700 resistance level. So, bulls, take a seat—your momentum is weaker than a cup of decaf coffee. Despite a brief recovery, ETH is having a tough time claiming higher ground. Resistance levels continue to play the role of party poopers.

If the bulls really want to save face, they need to get ETH above the 4-hour 200 MA and EMA, which are chilling around $1,820. Should they manage this, we might see a push toward the $2,000 mark, which, let’s face it, would be more satisfying than finding a dollar in an old coat pocket.

But let’s not get too ahead of ourselves. There’s still the risk that Ethereum could tumble further if it fails to hold $1,500. If it drops through that support level, things could get ugly—I’m talking a potential plunge to $1,400, a price point we’ve seen before, and frankly, it wasn’t a great look.

With macroeconomic chaos and trade tensions looming over us like a dark cloud, investors are, understandably, on edge. The next few sessions will be critical, with ETH hovering between possible recovery and the looming threat of decline. Traders, buckle up—this could get interesting. Or not. But let’s hope so.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-04-17 01:23