It was in the autumn of 2013, when the young and ambitious Vitalik Buterin, alongside his visionary companions Joseph Lubin, Charles Hoskinson, Gavin Wood, and others, sowed the seeds of what would become the backbone of the global cryptocurrency economy: Ethereum (ETH).

This blockchain, with its pioneering approach to smart contracts, gave birth to a myriad of second-layer blockchains and, in no small measure, shaped the very essence of Web3 as we know it today. In this whimsical guide, U.Today takes you on a nostalgic journey through the key milestones of Ethereum (ETH) and a glimpse into its promising future.

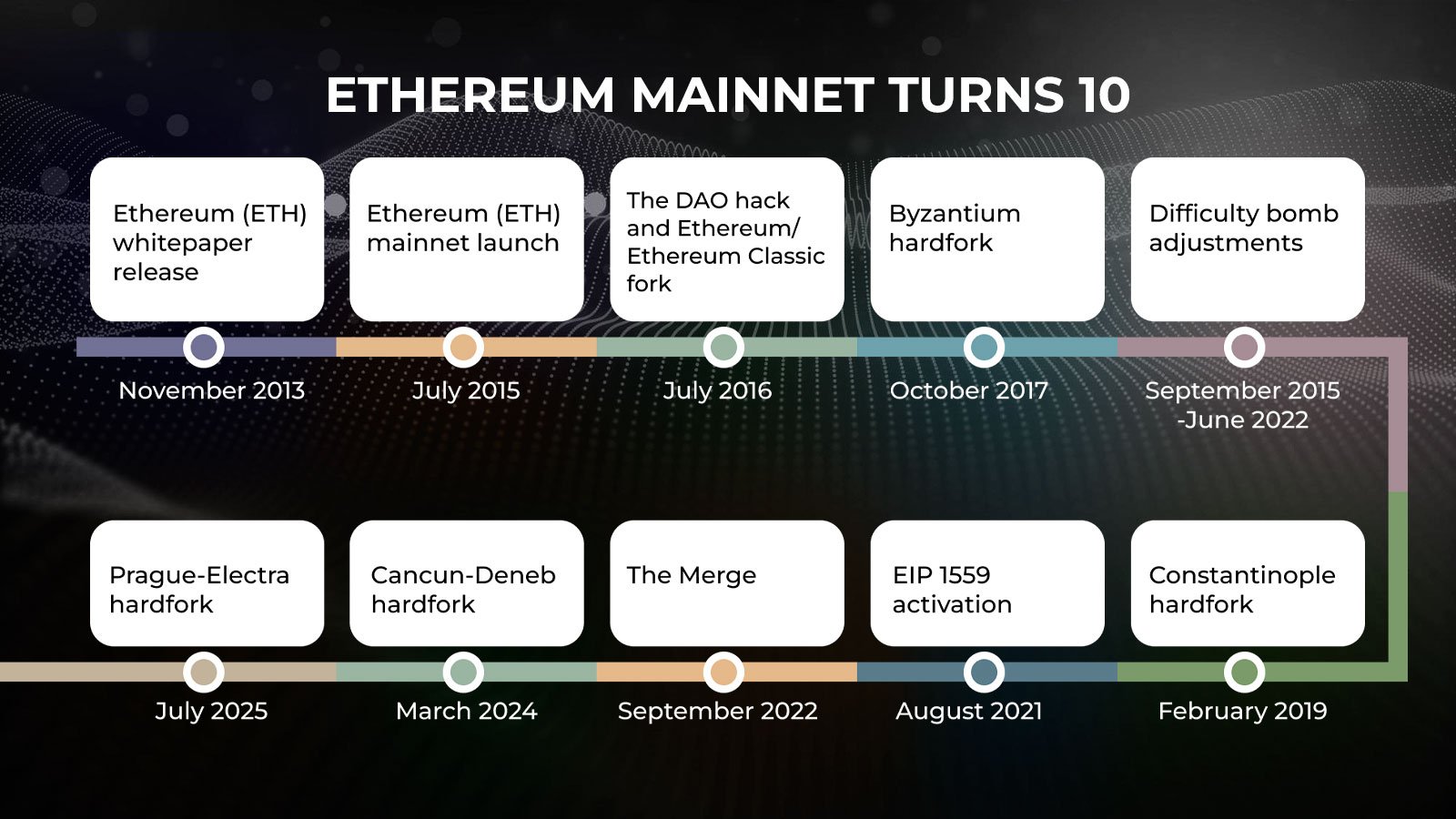

Ethereum (ETH) mainnet is 10 years old: Key milestones

Ethereum, the first and largest programmable blockchain, a decentralized network capable of executing smart contracts, came to life on mainnet on July 30, 2015. Let us recount the principal milestones of this digital odyssey:

- Ethereum (ETH) whitepaper release — November 2013

- Ethereum (ETH) ICO and mainnet launch — July 2014-July 2015

- The DAO hack followed by Ethereum/Ethereum Classic fork — June-July 2016

- Byzantium hard fork — October 2017

- Difficulty bomb adjustments — September 2015-June 2022

- Constantinople hard fork — February 2019

- EIP 1559 activation — August 2021

- The Merge — September 2022

- Cancun-Deneb hard fork — March 2024

- Prague-Electra hard fork — July 2025

Over these 10 years, Ethereum (ETH) has solidified its position as the cornerstone of the global digital assets economy, despite the relentless competition from Solana (SOL) and its own Layer-2 platforms like Polygon (POL), Optimism (OP), Arbitrum (ARB), and Base (BASE).

Yet, Ethereum (ETH) remains the dominant blockchain for decentralized applications of all types, a testament to its enduring relevance and adaptability. 🌟

What is Ethereum?

Ethereum (ETH) is a programmable blockchain, a decentralized protocol capable of running smart contracts — isolated, autonomous software programs. Thanks to this capability, Ethereum (ETH) serves as the “world computer” for decentralized applications or dApps.

Launched on mainnet in 2015 after a successful $18 million initial coin offering (ICO), Ethereum (ETH) was the brainchild of six co-founders: Vitalik Buterin, Gavin Wood, Joseph Lubin, Mihai Alisie, Anthony Di Iorio, and Charles Hoskinson. Vitalik Buterin, often hailed as Ethereum’s (ETH) inventor, was joined by Gavin Wood, the first CTO, and Joseph Lubin, who founded the major Ethereum (ETH) development studio ConsenSys.

Ethereum (ETH) revolutionized the use of blockchains for decentralized applications, expanding its technical role far beyond mere transactions, a common feature of early-stage blockchains like Bitcoin (BTC), Litecoin, or XRP Ledger (XRPL).

Ethereum turns 10: Why this matters

The 10th anniversary of Ethereum (ETH) is a monumental milestone for the entire cryptocurrency ecosystem and the decentralized applications scene globally. Here’s why:

- Sustainability. Ethereum (ETH) has created sustainable and balanced technical and economic systems that do not rely on external fundraising.

- Leadership. Despite fierce competition in the blockchain sector, Ethereum (ETH) remains the largest blockchain by Total Value Locked (TVL), the number of active dApps, and various activity metrics.

- Flexibility. Ethereum (ETH) quickly adapts to changes in the blockchain landscape, introducing more features and refining its technical design.

- Ecosystem. Ethereum (ETH) has spawned an array of Layer-2 blockchains and the Ethereum Virtual Machine (EVM), an execution engine for smart contracts.

Ethereum (ETH) and its stack — Solidity, Hardhat, Typescript — continue to serve as the gateway to blockchain development for the new generation of engineers. 🚀

Ethereum (ETH) blockchain 10 key milestones: Overview

In this brief overview, we will explore the major events that shaped Ethereum (ETH) and paved the way for its technical excellence.

Ethereum (ETH) whitepaper release

The Ethereum whitepaper was released by Vitalik Buterin in November 2013. At the time, Buterin was a 19-year-old software engineer in Canada and the co-founder of Bitcoin Magazine. The whitepaper proposed a new blockchain platform designed to transcend Bitcoin by enabling programmable smart contracts.

Buterin envisioned Ethereum as a decentralized world computer where developers could build trustless applications. Key figures and co-founders included Gavin Wood, Joseph Lubin, Mihai Alisie, Anthony Di Iorio, and Charles Hoskinson. Their shared vision aimed to overcome Bitcoin’s limited scripting capabilities and create a more flexible, general-purpose platform.

Ethereum aimed to democratize blockchain development by allowing anyone to deploy decentralized applications (dApps), not just facilitate on-chain transactions. The whitepaper heralded a new era of decentralized finance, governance, and digital infrastructure. 🌐

Ethereum (ETH) mainnet activation

The Ethereum (ETH) mainnet launched on July 30, 2015, with the release of its first live version, Frontier. The Ethereum Foundation, a non-profit based in Switzerland, coordinated development and community efforts leading up to the launch. The platform introduced smart contracts and the Ethereum Virtual Machine (EVM), enabling decentralized applications (dApps) on-chain.

Ethereum’s ICO (initial coin offering) took place from July 22 to September 2, 2014, accepting Bitcoin (BTC) in exchange for Ethereum (ETH). The initial rate was 1 BTC for 2,000 ETH, and the sale raised around 31,000 BTC (about $18 million). Over 60 million ETH were distributed to contributors, making it one of the most successful and influential token launches in crypto history.

The DAO saga

In June 2016, The DAO — a decentralized venture fund built on Ethereum — fell victim to a hack due to a vulnerability in its smart contract code. An attacker exploited a recursive call bug to drain 3.6 million ETH (worth about $60 million at the time and approximately $12 billion in current prices) from The DAO’s funds.

The DAO had raised over $150 million in ETH during its crowdfunding phase, making it the largest crowdfunding project ever at the time. The hack sparked a heated debate in the Ethereum community. Some advocated for immutability (the “code is law” principle), while others supported reversing the hack — reorganizing the Ethereum (ETH) blockchain to restore stolen funds.

Ultimately, Ethereum underwent a hard fork on July 20, 2016, splitting the chain: Ethereum (ETH) with restored funds and Ethereum Classic (ETC), which preserved the original chain and code. 🤔

Byzantium hard fork

The Ethereum Byzantium hard fork was activated on October 16, 2017, at block 4,370,000, as part of Ethereum’s Metropolis upgrade phase. Its primary goals were to enhance network security, privacy, and scalability while preparing the protocol for future consensus changes. Byzantium also introduced features to simplify smart contract development and reduced block rewards from 5 ETH to 3 ETH to prevent Ether from deflation.

Key Ethereum Improvement Proposals (EIPs) included EIP-649 (difficulty bomb delay and block reward reduction), EIP-658 (transaction status codes), and EIP-197/198 (support for zk-SNARKs to enable privacy tech). The latter pair laid the foundation for zero-knowledge technology on Ethereum, ensuring advanced privacy for value transfers.

Byzantium was widely regarded as a smooth and successful upgrade, strengthening Ethereum’s position as a smart contract platform and demonstrating the network’s ability to coordinate complex protocol improvements. 🛠️

Difficulty bomb adjustments

The difficulty bomb was a mechanism in Ethereum (ETH) on proof of work (PoW) that gradually increased the difficulty of mining new blocks. While it aimed to push miners toward proof of stake (PoS), reaching it too soon would have rendered mining unprofitable and threatened ecosystem stability.

To strike a balance, Ethereum (ETH) developers postponed the difficulty bomb five times — in Byzantium (2017), Constantinople (2019), Muir Glacier (2020), London (2021), and Gray Glacier (2022) upgrades (hard forks). When Ethereum (ETH) finally transitioned to PoS, the difficulty bomb became obsolete, as staking systems validate blocks differently.

Constantinople hard fork

The Constantinople hard fork was activated on February 28, 2019, at block 7,280,000, also part of the Metropolis transition. It aimed to improve network efficiency, performance, and future-proofing for Ethereum 2.0. The upgrade was initially scheduled for January but was delayed due to a last-minute vulnerability in one of the EIPs. Constantinople also included a block reward reduction from 3 ETH to 2 ETH, lowering inflation.

Key EIPs included EIP-145 (bitwise shifting for cheaper computations), EIP-1052 (efficient smart contract verification), and EIP-1283 (gas cost improvements for SSTORE operations). EIP-1234 delayed the difficulty bomb, maintaining reasonable block times. As a result, Ethereum became more developer-friendly, cost-effective, and achieved more optimized data logistics. 💻

EIP 1559 activation

EIP 1559, one of the boldest tokenomic upgrades for Ethereum (ETH), completely revamped the network fees design. Instead of an auction-based fees model, it introduced base fees and “miner tips.” The exact amount of fees for each block depended on network activity: the more transactions included, the higher the fees.

EIP 1559, introduced by the London hard fork in August 2021, also pioneered periodic base fee burns. If ETH issuance does not keep up with burn events, ETH becomes increasingly scarce. This mechanism adds another layer of verifiable scarcity to ETH as a token.

EIP 1559 made transaction fees more predictable, improved user experience, and introduced deflationary pressure on the ETH supply. Since activation, millions of ETH have been burned, offsetting new issuance. Although it did not directly lower gas prices, it laid important groundwork for Ethereum’s monetary policy and sustainability. 🔥

The Merge

The Merge, Ethereum’s (ETH) highly anticipated transition from proof of work (PoW) to proof of stake (PoS), was completed on September 15, 2022, at block 15,537,393. It combined Ethereum’s (ETH) original execution layer (mainnet) with the Beacon Chain, which had been running staking architecture since December 1, 2020. This marked the end of Ethereum (ETH) mining and the beginning of a more energy-efficient consensus model.

The primary motivations behind The Merge were to significantly reduce Ethereum’s (ETH) energy consumption, improve network sustainability, and lay the foundation for future scalability upgrades like sharding — splitting the blockchain into an ecosystem of interconnected shards (subblockchains). PoS also enhanced Ethereum’s (ETH) security and economic model by reducing ETH issuance and enabling ETH staking as a form of network validation.

The Merge reduced Ethereum’s (ETH) energy usage by over 99.9% and ushered in a new era of eco-friendly blockchain operation. The transition from one type of blockchain consensus to another was a groundbreaking move for Ethereum (ETH), unmatched by any other blockchain in three years. 🌱

Cancun-Deneb hard fork

The Cancun-Deneb upgrade, also known as Dencun, was activated on March 13, 2024, at block 19,078,888. It was one of the first upgrades to separately affect the execution layer (Cancun) and consensus layer (Deneb). The most anticipated feature of Dencun was EIP-4844, also known as proto-danksharding, which introduced a new transaction type called “blobs.”

The upgrade aimed to improve data availability and significantly reduce Layer-2 transaction fees. With EIP-4844, large data chunks used by rollups are stored more efficiently, paving the way for future full sharding. The largest EVM Layer-2s, such as Optimism and Arbitrum, benefited the most from EIP-4844 going live.

Dencun enhanced Ethereum’s performance for rollups, made the network cheaper for users, and demonstrated Ethereum’s ability to implement complex changes across both consensus and execution layers. 📊

Prague-Electra hard fork

Activated on May 7, 2025, the Prague-Electra (or Pectra) hard fork was among the most ambitious changes in Ethereum (ETH) design post-Merge. It included 11 EIPs focused on functionality, security, operability, and cost-efficiency for Ethereum (ETH) and its second-layer solutions.

Key changes included EIP-7251 “INCREASE_MAX_EFFECTIVE_BALANCE” and EIP-7702 “Set EOA (Externally Owned Account) account code,” which raised the maximum validator balance to 2,048 ETH and blurred the line between smart contracts and on-chain accounts on Ethereum (ETH). Externally owned accounts (on-chain wallets) were equipped with functions previously exclusive to smart contracts.

Pectra also improved BLS signatures and streamlined validator operations. This upgrade builds on the improvements introduced by Dencun and its EIP-4844. 🛠️

Ethereum (ETH) price: How has it changed in 10 years?

Ether (ETH), the core native cryptocurrency of the Ethereum (ETH) ecosystem, serves as a gas cryptocurrency, staking asset, and was a miner reward in proof-of-work Ethereum from 2015 to 2022.

Ethereum (ETH) price dynamics often indicate the start of an altcoin season — when it surges to the highs of the previous cycle, it signals that liquidity is flowing from Bitcoin (BTC) to altcoins.

| Ether ICO price | ETH Price (2018 high) | ETH Price (2021 high) | ETH Price (current value) | Gap to ATH, % |

| $0.311 | $1,431 | $4,891 | $3,776 | 23.21 |

Thus, Ethereum (ETH) remains the largest cryptocurrency that has not yet set a new all-time high in this cycle. Bitcoin (BTC), BNB, and XRP have all set new records in 2025. 📈

Bonus: What’s next for Ethereum?

Ethereum (ETH) core developers have already outlined the next steps for its development. In late Q4, 2025, the activation of the Fulu-Osaka (Fusaka) hard fork is expected. Fusaka aims to introduce Peer Data Availability Sampling (PeerDAS) — validators will be able to check blobs off-chain instead of downloading full datasets, saving network resources and making validator operations more cost-effective.

Additionally, the EOF update will change how the Ethereum Virtual Machine handles smart contract bytecode, making it more performant and cost-effective.

Expected in H1, 2026, the Ethereum (ETH) Gloas-Amsterdam (Glamsterdam) upgrade will introduce reduced slot times and Enshrined Proposal-Builder separation (ePBS) to further accelerate scalability and cost-effectiveness. Block time will drop to six seconds, while the increased gas limit (to 45 million gas) will ensure more powerful computational design. ⚡

Wrapping up: Understanding Ethereum (ETH) disruption and ecosystem effect

In 10 years of mainnet activity, Ethereum (ETH) has evolved into the largest ecosystem in the blockchain world. Introduced in 2013 as the “world computer,” it has onboarded thousands of dApps and spawned dozens of Layer-2 networks.

Since its mainnet activation on July 30, 2015, Ethereum (ETH) has undergone over 20 hard forks to adapt to changing demand, competition, and growing transactional volume. Constantinople, London, Dencun, and Pectra are among the most ambitious of these upgrades.

Ethereum (ETH) continues to shape the future of decentralized finance and technology, a testament to its enduring innovation and resilience. 🌟

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-08-02 16:39