- ETH took a dive, down 3.95% in the last 24 hours.

- Ethereum whales seem to have developed a sudden case of “sell fever,” offloading a whopping 684.1k ETH.

Ah, Ethereum! A majestic creature, once soaring, now caught in a repetitive, tiresome dance between $2.4k and $2.7k. For three weeks, it’s been trapped within this tedious parallel channel. Investors, ever so patient, have begun to twitch with impatience. They are selling, darling, selling—perhaps more out of boredom than reason.

And then, as if the universe itself conspired to intensify the spectacle, a couple of long-dormant Ethereum whales have reentered the stage. According to on-chain analyst @ai_9684xtpa (not the kind of username you’d take to dinner), these two grand behemoths of the blockchain have begun to offload their treasure troves. In the last day alone, they’ve sold 1.546.67 ETH. A rather anticlimactic total, don’t you think?

One of these mighty beasts made a deposit of 959.69 ETH, worth a cool $2.54 million, to OKX, leaving them with a rather laughable 50,704 ETH tokens. That’s still $132 million in their pocket, but who’s counting? Certainly not us, the mere mortals.

The second whale, possibly taking a break from knitting or something equally calm, sold 587 ETH through Kraken. This whale, by the way, has been on a selling spree since March, shedding 14,398 ETH, equivalent to $28.47 million. That’s a lot of fish to fry—or, perhaps, a lot of fish to sell.

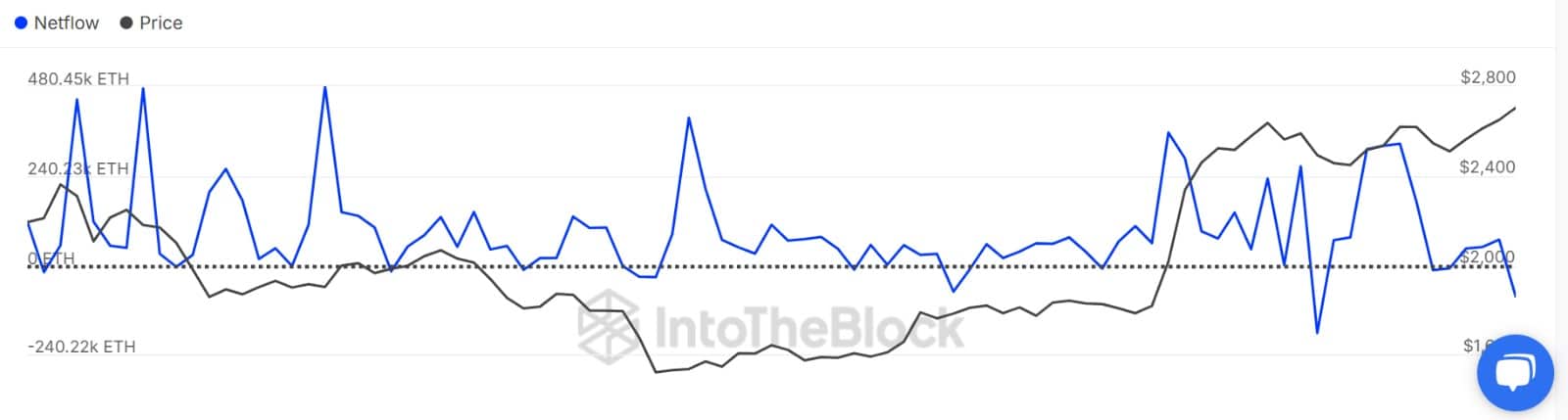

These are not isolated events, no. Far from it. Ethereum whales have collectively sold 684.1k ETH tokens in the last 24 hours. Can you hear the wailing of the blockchain as it bleeds out? A massive exchange outflow has ensued, triggering large holders’ netflow to plummet into negative territory. A glorious -83.5k. When this metric turns red, it means whales are running for the hills, leaving the poor little fish (aka retail investors) behind.

What does this tell us? It’s a display of profound pessimism. The whale trust in Ethereum is plummeting faster than you can say “to the moon.” They’re clearly not here for a long time—just a good time to sell, apparently.

But wait, there’s more! Sellers have taken over the market. A quick glance at the Taker’s buy-sell ratio reveals that sellers have, in fact, taken the reins. A weekly low, no less! When this metric drops into the abyss of negativity, it means buyers are far less enthusiastic than the sellers, leaving ETH with no one to hug it and whisper sweet nothings in its ear.

This increasing tide of sellers has pushed the exchange supply ratio to its highest point in a week. So, what’s the takeaway? The ETH market is filled with those who prefer to flee, and this additional sell pressure risks pushing prices lower. As they say, an oversupply is never good—unless you’re selling hotcakes. Sadly, ETH isn’t a hotcake, and demand doesn’t seem too keen on keeping pace.

The Impact on ETH

Let’s get straight to it: this selling frenzy has had a rather unflattering effect on Ethereum’s price. It’s down 3.95% as of now. It’s like watching a stock tumble, only this one does it with less grace and more dramatic whale floundering.

If this continuous wave of selling persists, ETH could soon tumble out of its cozy $2.4k to $2.7k range and nosedive toward $2324. It’s a possibility that’s looking increasingly likely, given the current trend.

On the other hand, if the market can somehow manage to swallow this sell-side pressure, ETH might just hold its ground in this range—at least for a little while longer. A breakout, however, would require a breather from the relentless selling activity. Everyone needs a little rest, even whales.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-31 04:10