Oh, the drama of Ethereum! It leaps 20% to $4,300 in a month while institutions sharpen their knives and whales sip champagne. What could possibly go wrong? Or right? Who knows with this delightful chaos?

Ah, Ethereum (ETH), that ever-so-dramatic diva of the crypto stage, is once again making headlines-likely because it has nothing better to do. After climbing from June’s tragic lows of $2,100 to its current theatrical heights above $4,300, one might think all is well in the kingdom of blockchain. But alas, dear reader, beneath this glittering façade lies a tale of tension, greed, and shorts so short they might as well be wearing tights.

The Battle Royale: Bulls vs. Bears 🐂🐻

Whales and institutional buyers are piling into ETH like guests at an open bar, fueling what can only be described as a “momentum party.” A cool $378 million in stablecoins flowed into Ethereum over the past 24 hours alone-clearly, someone believes this show isn’t over yet. Meanwhile, bearish traders sit on the sidelines, clutching their pearls and muttering about corrections that never seem to arrive.

But here’s where things get deliciously absurd: institutional shorts have reached record highs. Yes, you heard me correctly. According to Bitcoinsensus, these brave souls are betting against Ethereum through CME futures like gamblers convinced they’ve cracked the code to roulette. One wonders if they’re aware that fortune favors the bold-or perhaps just the slightly less foolish.

Institutional Shorts on Ethereum Hit Record Highs

CME data shows Ethereum shorts by institutions just reached an all-time high.

ETFs are stacking $ETH… while futures markets are heavily betting against it. One side is about to be very wrong.

– Bitcoinsensus (@Bitcoinsensus)

Ah, but what happens when prices rise despite such pessimism? Why, a short squeeze, of course-a financial firework display where those who bet against success must scramble to cover their losses. Should this occur, we may see ETH ascend even higher, leaving skeptics to wonder if they’ve been living in a comedy of errors.

Of course, should ETH stumble below $4,200, long positions worth over $2 billion will vanish faster than trust in a Ponzi scheme. Truly, the stakes are Shakespearean.

Ethereum’s Technical Tightrope Walk 🤹♂️

Ethereum’s recent movements resemble a drunken tightrope walker attempting to balance between triumph and disaster. Earlier in August, ETH wobbled under $2,500 thanks to geopolitical uncertainty courtesy of Mr. Trump’s tariffs. Yet, like any self-respecting drama queen, it recovered swiftly and now struts proudly above such indignities.

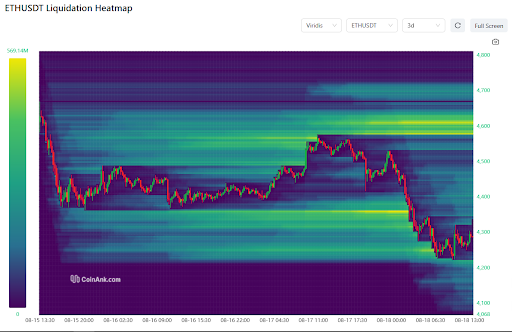

Analysts point to $4,200 as the magic number-a line in the sand separating hope from despair. Cross it downward, and liquidations will cascade like champagne corks at a billionaire’s birthday bash. On the other hand, resistance looms between $4,550 and $4,571, a tantalizing threshold that could lead to dreams of $5,000 if breached.

Currently, Ethereum flirts dangerously with rejection at $4,788 and teases a retest of $3,875. Should the bulls fail to defend this critical zone, our protagonist may find itself wandering toward $3,293-a journey no optimist would envy.

Traders Tiptoe Through the Minefield 💣

With short interest soaring, Ethereum trading has become akin to juggling flaming torches while blindfolded. Analysts warn that slipping below $4,200 could trigger forced liquidations, sending volatility skyrocketing and prices plummeting back toward $3,800. In short, tread carefully, dear investor; this is not a game for amateurs.

And yet, for all its peril, Ethereum’s year-to-date performance remains impressive. Could ETF inflows and whale confidence propel ETH to $5,000? Perhaps. Or perhaps the bears’ warnings of impending doom will prove prescient. Either way, one thing is certain: the spectacle continues.

So, shall we place our bets? Will Ethereum soar to new heights or crash spectacularly? Only time-and human folly-will tell. Until then, enjoy the show. 🎭

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

2025-08-18 18:05