- ETH shoots above realized price, long-term holders scratching their heads in disbelief (profit? In crypto?!), with institutions flexing harder than a bodybuilder at Venice Beach 🍾

- Binance’s ETH volume explodes—institutions pile in faster than folks at an open bar after the Pectra upgrade 🍻

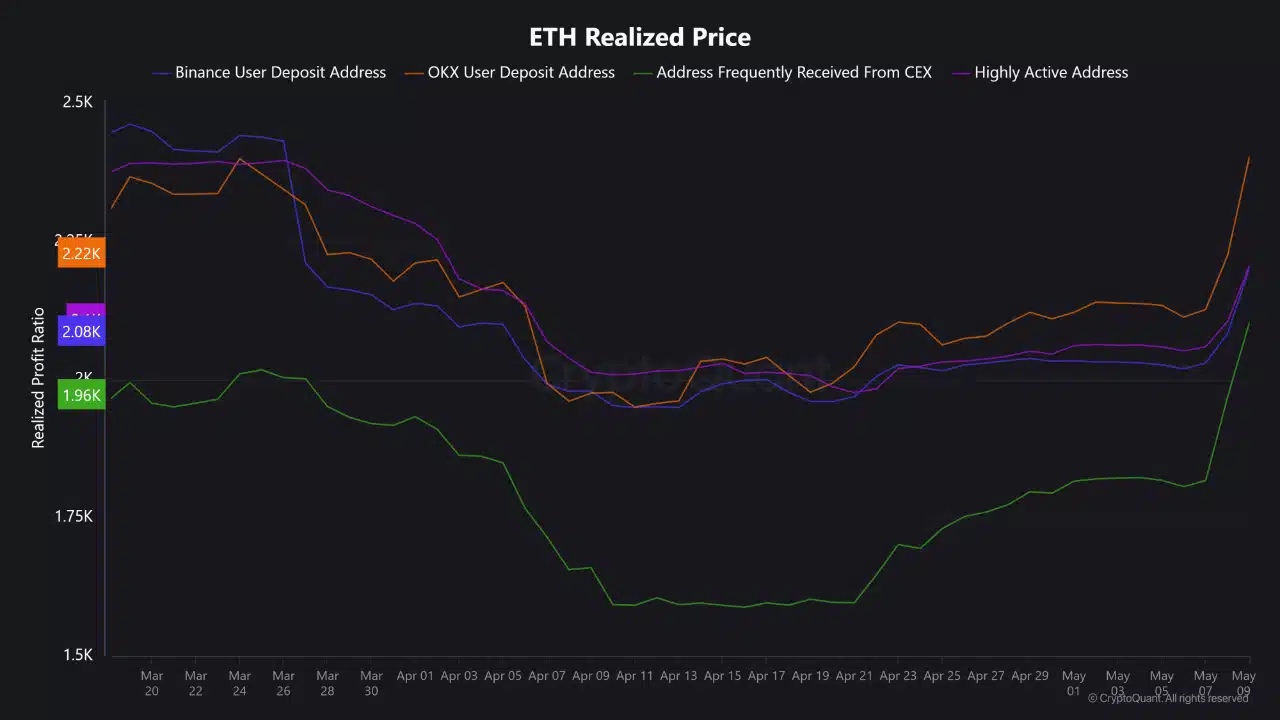

Stop the presses, call your mother, and go check that MetaMask wallet you haven’t looked at since Dogecoin topped TikTok trends — Ethereum [ETH] just pole-vaulted over its own realized value like it’s trying out for the Crypto Olympics. We’re not talking hops; we’re talking an actual positive shift, where people who bought ETH and forgot about it (or just bravely hodled through every crash) are now peeking at their wallets and whispering, “Wait… is this profit?”

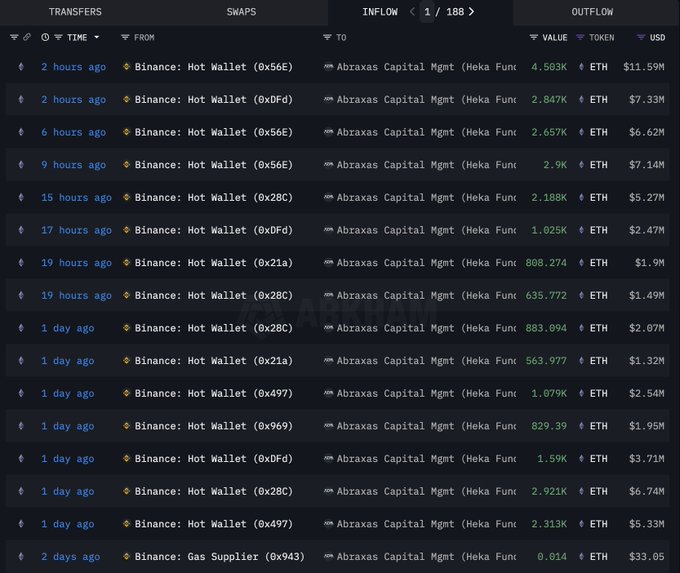

If you want to find the hotspot, look no further than Binance. Trading volume’s through the roof, profits are being taken, and everybody’s acting like ETH is handing out golden tickets to Willy Wonka’s DeFi factory. It’s the kind of liquidity that would make a swimming pool jealous, and institutions are stampeding back to ETH like it’s the last open Starbucks in Manhattan after a blackout.

ETH long-term holders: “Did I just win?”

At the time of this cryptic scribbling, Ethereum was basking above $1,900. The average Johnny or Jane Accumulator is suddenly winning — yes, even that address that bought in after watching one too many tweets from “CryptoGuru42.”

Historically, when price climbs over realized value, long-term holders get, well, slightly smug. There’s a whiff of confidence in the air, or is that just the sweet smell of paper gains?

The chart doesn’t lie (but TA does, sometimes) — most accumulating wallets were loading up below $1,900. Now, with prices north of that line, these wallets are looking like financial psychics. Institutions and swing traders are circling ETH like seagulls at a boardwalk, and the retail crowd? Still sitting this one out—possibly buying NFTs of socks somewhere else.

Make no mistake — this party isn’t powered by wild retail FOMO. The big fish are pushing this ETH ship forward (because whales need something to whale about).

Binance: The Vegas of ETH Trading

Binance, never knowingly underhyped, is hosting the main ETH event. The inflows? Impressive. The outflows? Even faster. Everyone’s in such a hurry, you’d think they were dodging gas fees at rush hour.

Let’s break it down (preferably with jazz hands): traders on Binance scooped up ETH during its dip like bargain hunters on Black Friday. Now that the price is up, profit-taking is in vogue — but don’t be fooled, this isn’t panic selling. If anything, it’s a show of sophisticated sabermetrics and high-frequency “I’ll have what she’s having.” Abraxas Capital, for one, just hoarded ETH with all the subtlety of a raccoon in a garbage can.

Ethereum’s Big, Bouncy Price Outlook 🥳

Ethereum’s pumped to $2,600, celebrating the Pectra upgrade like it just got a new haircut and wants you to notice. Bulls are partying, the charts are blushing.

But the RSI? Oh, it’s up there — above 80, which according to every technical analyst ever means, “Maybe take a breath, champ.”

Meanwhile, the MACD is still whistling a cheery tune, so if there’s a dip, odds are it’ll be as quick as a slapstick gag. ETH sat at $2,518 last we checked, with bulls holding the stage and a pause or two coming as everyone recovers from both the rally and the new upgrade. Still, nobody’s leaving until the fat protocol sings. 🎭

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-05-11 12:15