So, it looks like Ethereum (ETH) has decided to pull itself together and show the market who’s boss. After a rollercoaster of a week, the second-largest cryptocurrency is back on track, having surged over 5% on Monday, November 24, 2025, hitting a solid $2,922 during mid-North American trading hours. It’s like ETH woke up and said, “Alright, let’s do this.”

ETH: Is It Finally Ready to Break Some Records?

After taking a nosedive last week (we’re talking bloodbath levels here, folks), Ethereum decided to kick off the last week of November with some positive energy. On the weekly chart, ETH bounced back from a critical support level around $2,850-one that’s been around for years like your favorite pair of jeans that still somehow fit.

At this point, it’s looking like Ethereum might be gearing up for a new all-time high. Next stops? $3,968 and $4,758. I mean, who wouldn’t want to see ETH hit those levels? Let’s cross our fingers, shall we?

Why You Should Care About ETH’s Bounce

ETH on Exchanges? Nah, They’re Just Leaving

If you’ve been paying attention to market trends (or you just like pretending you know what’s going on, like me), you’ll notice that Ethereum supply on centralized exchanges has dropped massively since mid-August 2025. Normally, when this happens, it’s a good sign. Like, “Hey, maybe we’re gonna make some money here!”

And here’s a twist for you: this drop in ETH supply is happening right when Bitcoin’s dominance is starting to slip. BTC dominance has gone from a comfy 61% to a chill 58%, which means we’re more likely to see an altcoin rally soon. Can I get a hallelujah for altseason 2025?

The Fed Is Ready to Party with Some Liquidity

But wait, there’s more! The U.S. Fed is planning on unleashing some serious liquidity into the market. Yes, they’re opening the money gates with Quantitative Easing (QE) starting December 1, 2025. That’s going to pump up the market-and possibly ETH-like your favorite energy drink before a workout.

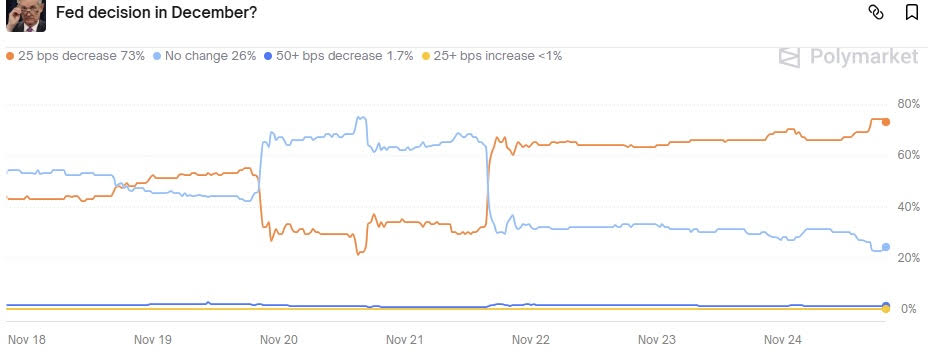

To add some spice to the situation, Polymarket traders are betting on another 25 basis point rate cut in December. It’s like the Fed is just handing out free money. And we all know what that means: more liquidity = more chances for ETH to bounce higher. So, get ready for some action!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-11-24 22:19