Who Knew Ethereum Could Spark a Drama? Buckle Up, It’s Getting Juicy! 😅

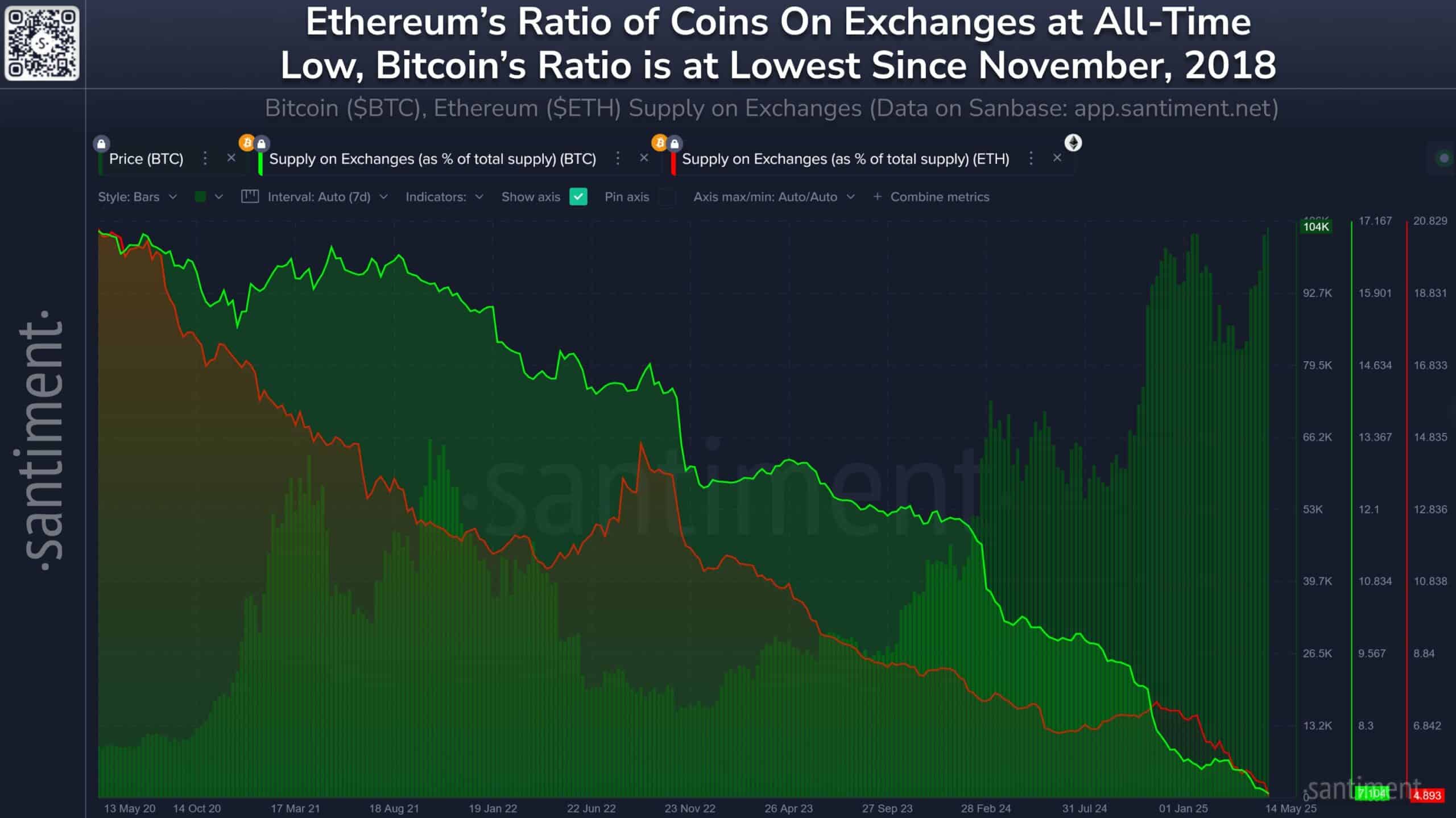

- Ethereum’s exchange supply plummeted to 4.9%. Yeah, it’s like everyone’s just *ditched* centralized platforms. Nice.

- MVRV’s bouncing back, Open Interest climbing—looks like the traders are getting all excited for a bullish breakout. Or maybe just bored. Who can tell?

So, Ethereum’s supply on exchanges? Now it’s at 4.9%. The lowest in over a decade! Over 15.3 million ETH have ghosted from centralized platforms since 2020. What, were they all hiding in the couch cushions? 🛋️

That’s a fancy way of saying: people are holding on tight, not selling, probably to make sure they can brag later about “I knew it” when prices skyrocket. Reduced sell pressure? Check. More long-term hogging? You betcha.

Meanwhile, Open Interest shot up 11.31% to a staggering $16.59 billion. Looks like the derivatives traders are finally showing some spine—probably betting on the next move like it’s the Super Bowl. 🏈

And at the time I’m writing this, Ethereum’s trading at $2,537.15—up 5.37% in a day. Retail, institutional, everyone’s got a twinkle in their eye, thinking, “Yeah, this is the one.”

Ethereum’s User Activity and Big Whale Moves—It’s Like a Party! 🎉

Network activity? Oh, it’s humming. Weekly active addresses went up 6.09%. And get this: new addresses boomed 28.43%. Looks like everyone and their dog is jumping into the Ethereum pool. Waters warm, I guess?

More people joining? Usually means prices might climb, especially if the big wallets—call them whales—are moving around. When whales swim, it’s often a sign the market’s about to get… interesting.

Whale activity? Oh, it’s exploded. Transfers of $1 million to $10 million? +204.68%. Over $10M? Up 240.63%. High-net-worth folks are moving cash like it’s Monopoly money. Meanwhile, even the penny-pinchers—$1 to $10 or $100-$1K—are getting involved, with 40-33% gains. Who knew rich guys liked a good game?

Metrics Showing Ethereum’s Gearing Up for a Bull Run! 🚀

Transaction volume? Soaring! With more active users—yay!—and OI climbing 11.31%, it looks like everyone’s betting on that “up, up, up” trajectory.

Open Interest? Hey, it’s at $16.59 billion. That’s getting serious. People are betting on the future, or maybe just hedging their bets on how high it can go before crashing down. Volatility, baby!

And the MVRV ratio? Back to 27.19%. Profit-taking? A little, but mostly, people are optimistic. So, no mass panic just yet, phew! 💸

Technical Analysis: Ethereum’s Trying to Break Free! 🎯

It recently tried to break out of its downtrend—like a boxer in the 12th round. Hit support at $2,314. Now, it’s eyeing resistance at $2,571 and $2,622—like they’re BFFs. Break through those, and look out, $2,747 and maybe even $2,992 could be next!

Stochastic RSI? Over 70, so it’s bullish—just don’t get overexcited, or it might give you a nasty surprise. Overbought? Maybe. But hey, everyone loves a good rally! 📈

Long story short? ETH’s fundamentals are solid—long-term holders are stashing, user activity is booming, whales are moving, and OI is up. It’s all looking like the setup for a potential breakout. Or a market crash. But hopefully, the first one.

If volume and sentiment stay positive, we’re heading toward the $2,750–$3,000 zone. So keep your fingers crossed, and maybe your eyes on the exit. 🚪

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-20 22:28