TL;DR

- Ethereum filled the $4,050-$4,100 CME gap after the market took a nosedive.

- Analysts are buzzing about a golden cross and the ETH price finally breaking above a four-year resistance line.

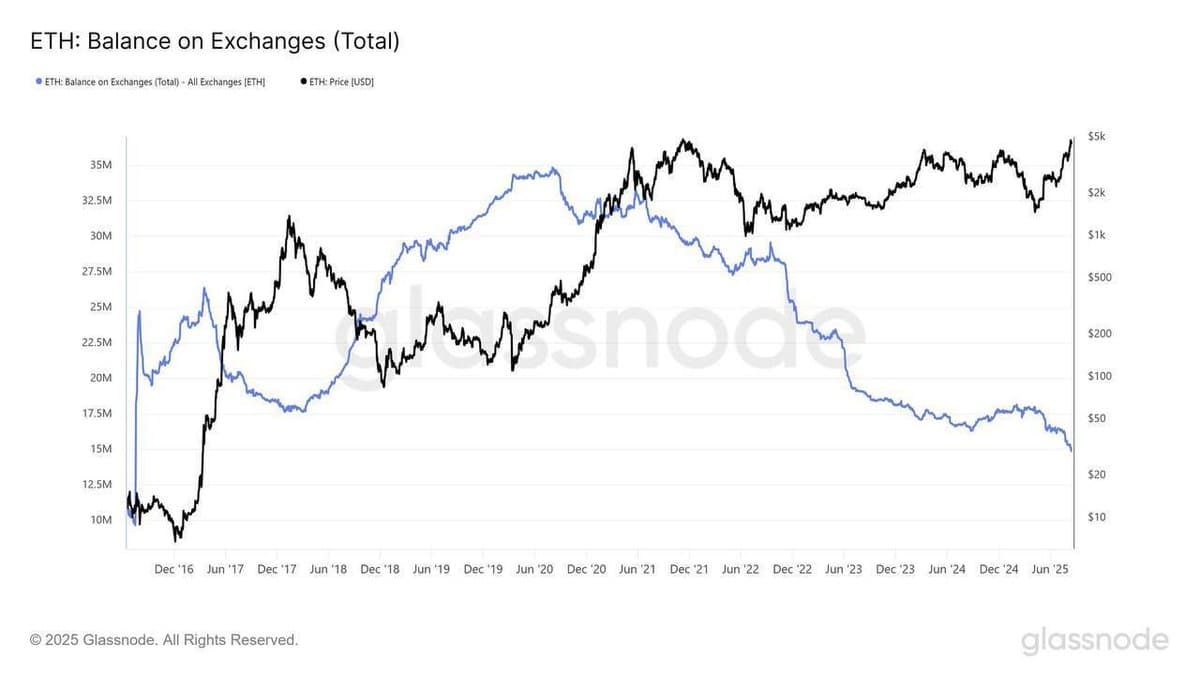

- ETH supply on exchanges is at a nine-year low. The big players are stacking up! 🚀

CME Gap Closed After Market Decline

Well, well, well. Ethereum took a bit of a tumble this week, with long positions being wiped out like a bad hair day. Prices dropped from above $4,600 to just under $4,000, filling the CME gap between $4,050 and $4,100 – something traders have been eyeing like a hawk. 🦅

As of now, ETH is hanging around $4,200, down 1% in the past 24 hours and 9% over the week. Analyst CW couldn’t resist chiming in:

“Long positions on $ETH have been destroyed, and the CME gap has been filled. Now the next target will be the short position.”

$ETH has filled the CME gap.

And a rebound is beginning.

– CW (@CW8900) August 20, 2025

Turns out, CME gaps are like magnets for prices. You know, the kind that just pull everything in. CryptoPotato, ever the reliable source, pointed out that the last time Ethereum filled a gap, it went up by more than 40%. Talk about a comeback story! 💥

The order book is showing that liquidity between $4,200-$4,400 has been gobbled up, meaning that now that the gap is closed, ETH could be ready to push against those short positions. Let’s just hope it doesn’t do a dramatic nose-dive again. 🤞

Long-Term Breakout on Monthly Chart

Now for some real juicy stuff: Analyst Merlijn The Trader spotted a breakout on the monthly chart that’s got everyone buzzing. Ethereum has finally broken through a four-year descending resistance line and is flexing its MACD golden cross. According to Merlijn:

“This isn’t noise. This is liftoff. Next stop: $10,000 Ethereum.”

This is big. After years of being rejected at the same trendline, ETH has finally shoved it aside and said, “We’re going to the moon, baby.” 🚀 The confirmed MACD cross is often seen as a sign that buyers are about to take the wheel for the long haul.

THE $ETH BREAKOUT EVERYONE WAITED FOR.

Ethereum just shattered a 4-year downtrend.

Monthly MACD golden cross → confirmed.

This isn’t noise.

This is liftoff.

Next stop: $10,000 Ethereum

– Merlijn The Trader (@MerlijnTrader) August 19, 2025

Exchange Supply at Multi-Year Lows

Meanwhile, analyst Cas Abbé pointed out that ETH on centralized exchanges has dropped to a 9-year low. That’s right, big players are buying up loads of ETH and taking it off exchanges like they’re stocking up on toilet paper before a storm. 🧻

“$ETH supply on CEX has now dropped to 9-year low. Big money is buying loads of ETH and then taking it off from the exchanges,” he said.

Abbé pointed out that exchange balances are now at levels similar to when ETH was trading around $30. He added:

“This seems like an even bigger supply crunch than BTC, and it has not been fully priced yet.”

With supply drying up and technicals turning positive, Ethereum is on the radar for a potential rally. Stay tuned, this could get interesting. 😎

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-08-20 13:52