In a twist of fate, US Spot Ethereum ETFs have danced through 15 consecutive trading days, raking in a staggering $837.5 million since the fateful day of May 16.

Ah, the inflow streak began just a week after Ethereum’s Pectra Upgrade, a momentous occasion that catapulted EIP-7702 transactions to nearly 1,000 daily, all while enhancing wallet features without a single address change. Talk about a glow-up!

Ethereum ETFs: A Whopping $837.5 Million Inflow Streak!

These inflows represent a delightful 25% of all net inflows since the funds made their grand debut in May 2024. This streak marks Ether ETFs’ longest uninterrupted inflow period since the twilight of 2024. Who knew Ethereum could be so popular?

According to the wise sages at SoSoValue, this positions spot Ethereum ETFs at their highest cumulative inflow value to date, now totaling a jaw-dropping $3.33 billion. 💸

Leading the charge is BlackRock’s ETHA fund, which has contributed nearly $600 million during this surge. While ETHA is basking in the limelight, Grayscale’s dual offerings, ETHE and ETH, are hoarding a larger asset base, with $4.09 billion in AUM compared to ETHA’s total. It’s like a crypto popularity contest!

Meanwhile, Fidelity’s offering is trailing behind with a mere $1.09 billion, while other funds are still trying to break the $250 million mark. Not to mention, this surge coincides with a 38% rally in the price of Ether over the past 30 days. Coincidence? I think not!

Key drivers of this phenomenon include renewed institutional interest, optimism around Ethereum’s long-term fundamentals, and the network’s recent Pectra upgrade. Analysts are practically giddy about the Ethereum price outlook. 📈

$ETH Giant Fractal Is Screaming

Range → Shakeout → Breakout → Parabola

We’re seeing the same structure play out almost candle for candle

Only difference now

The base is 100x larger

The fundamentals are 10x stronger$5k – $6k EASY THIS CYCLE

— Crypto Eagles (@CryptoProject6) June 2, 2025

But hold your horses! Analysts at JPMorgan have noted that while institutional allocations are rising, user activity on the Ethereum network has yet to accelerate post-upgrade in any meaningful way. It’s like throwing a party and no one shows up!

“Neither the number of daily transactions nor the number of active addresses saw a material increase post recent upgrades,” JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in the recent report. Ouch!

If the current pace continues, the streak could cross the $1 billion mark by next week. Such an outcome would further underline a sharp pivot in sentiment after a relatively muted start for Ether ETFs. Who would have thought?

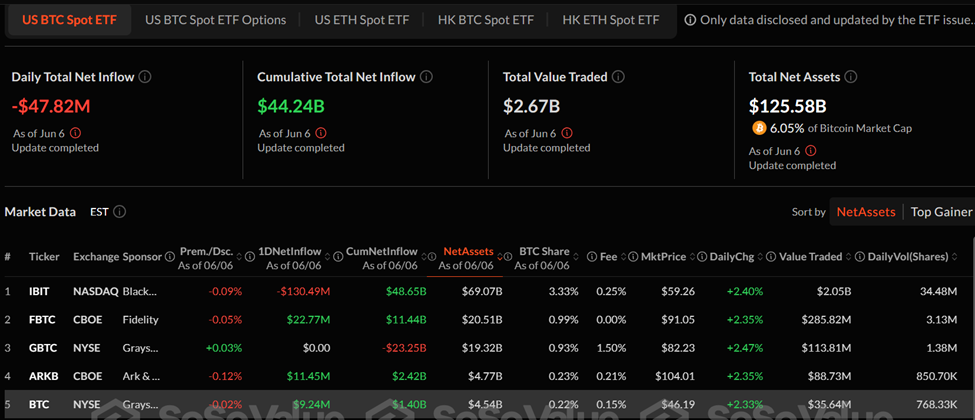

Bitcoin ETFs: Retreating After Record Highs

While Ethereum ETFs are riding high, the same cannot be said for their Bitcoin counterparts. Spot Bitcoin ETFs saw their most recent inflow streak break on May 29, when a staggering $346.8 million exited the market in a single day. Yikes!

Since then, Bitcoin ETF flows have turned as volatile as a soap opera plot twist, with cumulative inflows falling by more than $1 billion. This drop is from $45.34 billion on May 28 to $44.24 billion as of Friday’s trading session. Drama!

BlackRock’s IBIT remains the category leader by a wide margin, managing a cool $69 billion in assets. Fidelity’s FBTC and Grayscale’s GBTC follow with $20.51 billion and $19.32 billion in AUM, respectively. It’s a tough crowd!

The market also experienced brief turbulence after a heated online exchange between President Donald Trump and Elon Musk triggered a broader sell-off in crypto markets and equities. Who knew Twitter could be so powerful?

Spotlight on Staking and ETF Innovation

As investor interest in Ether ETFs accelerates, some analysts argue that future inflows will depend on whether staking functionality is introduced. James Seyffart, ETF analyst at Bloomberg, recently highlighted regulatory workarounds being employed to launch staking-enabled ETFs. Innovation at its finest!

ETF provider REX Shares has already filed for Ethereum and Solana staking ETFs, and the first such products may arrive in the US within weeks. Exciting times ahead!

Growing demand is also reflected in broader Ethereum adoption metrics. According to Santiment, Ethereum holders have now surpassed 148 million. That’s a lot of wallets!

As crypto markets attempt to rally at the end of the work week, crypto networks continue to grow over time. Here are the total amount of holders for select top caps:

Ethereum $ETH: 148.38M Holders

Bitcoin $BTC: 55.39M Holders

Dogecoin $DOGE: 7.97M Holders

Tether…— Santiment (@santimentfeed) June 6, 2025

This signals long-term conviction in the asset. Comparatively, Bitcoin has 55.39 million holders, while other popular assets like Dogecoin, XRP, and Cardano report between 4 and 8 million holders. The more, the merrier!

With Ether ETFs now delivering their strongest performance to date, the spotlight is firmly on whether this momentum can persist. Will it last, or is it just a summer fling?

Perhaps, staking-enabled offerings might drive the next wave of institutional adoption. Stay tuned!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-06-08 14:32