In a whimsical turn of events, US investors, those capricious creatures of the financial world, have decided to shower more affection upon spot Ether exchange-traded funds (ETFs) than their more established Bitcoin counterparts over the last six trading days. This sudden surge in institutional interest in Ethereum is as surprising as finding a butterfly in a coal mine.

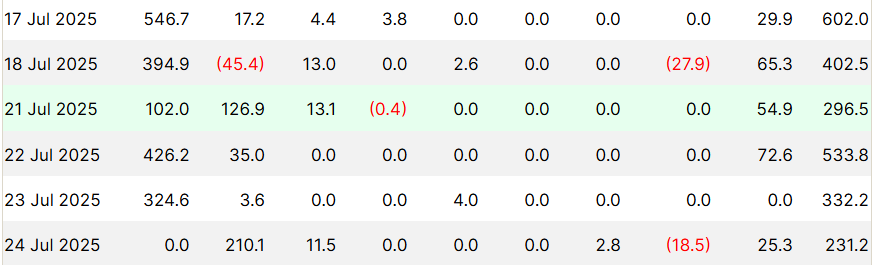

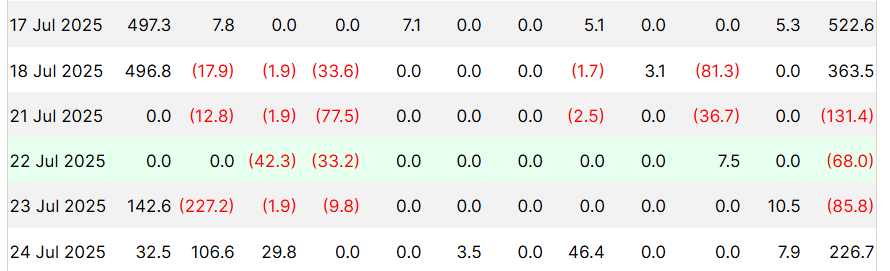

The shift, as dramatic as a Shakespearean tragedy, occurred in the United States, with Ether ETFs amassing a net inflow of $2.39 billion, while spot Bitcoin ETFs managed a mere $827 million during the same period, according to the ever-watchful eyes of Farside Investors. This marks a rare moment where Ethereum, like a rebellious teenager, has taken the lead in ETF flows for six consecutive days.

BlackRock Leads Ethereum ETF Surge

The biggest beneficiary of this Ethereum renaissance was none other than BlackRock’s iShares Ethereum ETF (ETHA), which received a staggering $1.79 billion, accounting for nearly 75% of all Ethereum ETF investments during the period. ETHA, in a feat that would make Houdini proud, became the third-fastest ETF in history to reach $10 billion in assets under management, achieving this in a mere 251 trading days. 🎩✨

Fidelity’s Ethereum Fund (FETH) also had a commendable performance, recording its best-ever day on Thursday with a $210 million net inflow. This surpassed its previous daily record of $202 million, set on December 10, 2024. The performance, much like a well-rehearsed symphony, demonstrates a broadening institutional appetite beyond BlackRock’s dominant market position.

Bitcoin ETF Momentum Stalls

On the flip side, Bitcoin ETFs experienced a slowdown, akin to a car running out of gas on a deserted highway. After enjoying 12 straight days of net inflows, totaling $6.6 billion, the streak came to an abrupt end on Monday with a net outflow of $131 million.

This stark contrast to the earlier enthusiasm for Bitcoin ETFs suggests that investors, those fickle souls, are now casting their gaze more favorably upon Ethereum, particularly from the ranks of large players. The shift indicates strategic asset allocation changes among institutional investors, who are increasingly viewing Ethereum and Bitcoin as distinct investment categories with different risk-return profiles.

Corporate Ethereum Adoption Accelerates

Corporate Ethereum holdings have swelled to 2.31 million ETH, representing 1.91% of the total supply, according to the Strategic Ether Reserves tracking data. BitMine Immersion Technologies, a major corporate buyer, purchased $2 billion worth of Ether in just 16 days, making it the largest corporate holder of ETH. This move, as bold as a king’s decree, aligns with the ETF flow trends, suggesting a coordinated institutional positioning across multiple investment vehicles.

The corporate treasury adoption mirrors similar Bitcoin strategies but focuses on Ethereum’s utility in decentralized finance and smart contract applications rather than purely store-of-value propositions. It’s as if the corporate world has discovered a new flavor of ice cream and can’t get enough of it.

Expert Perspective

Galaxy Digital CEO Michael Novogratz, a man known for his bold predictions, believes Ethereum could reach $4,000 and outperform Bitcoin in the next six months. “ETH will outperform BTC,” he declared, a statement that carries the weight of a prophecy. The forecast reflects growing institutional confidence in Ethereum’s fundamental value drivers beyond speculative trading.

The sustained ETF inflow reversal may signal a broader institutional recognition of Ethereum’s expanding utility in tokenization, DeFi, and enterprise blockchain applications. However, ETF flow patterns remain subject to significant volatility and market sentiment shifts, much like the weather in a temperamental city.

Current trends suggest institutional portfolios are evolving toward multi-asset crypto strategies rather than Bitcoin-only approaches, potentially establishing Ethereum as a complementary institutional holding. In essence, the financial world is beginning to see Ethereum not just as a contender, but as a co-star in the grand drama of digital assets.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-26 23:29