- Ethereum ETFs just grabbed $104M—yes, billion with a ‘B’ vibes—pushing assets to $6.14 billion. Billions! Makes my last bank statement look like a joke. 😅

- Meanwhile, Bitcoin ETFs (hi, BlackRock’s IBIT) hauled in $422.5M. It’s the popular kid at prom, and ETH is clinging to the punch bowl.

So, May 1st: A big day for anyone who likes their markets with a sprinkle of FOMO and a dash of volatility. Ethereum ETFs welcomed a charmingly humble $6.5 million. The data, served up by Farside Investors (because apparently, we need a Farside now—what’s next, The Upside Down?), confirms it.

Ethereum ETF update

Let’s roll out the red carpet for Fidelity’s Ethereum Fund (FETH): the only one that bothered to show up, dragging in the full $6.5M inflows. Gold star, FETH. The others? Nope. Not today, thank you.

Grayscale’s ETHE, meanwhile, did that thing where it walks in the room and leaves $12 million behind, like someone dramatically ripping off a Band-Aid. But don’t worry, its new sibling—the spot ETH ETF—vacuumed back up exactly $12 million. Family drama, ETF-style. Had enough excitement yet?

The rest of the Ethereum ETFs? They put their ‘out of office’ on and watched Netflix. Zero shifts.

What about Bitcoin ETF?

Just when ETH thought it was making moves, Bitcoin struts in with its swoon-worthy $422.5 million net inflows. (You can almost hear ETH crying in the bathroom.)

BlackRock’s IBIT was basically the Regina George of this story, pocketing $351.4 million like it’s nothing. Grayscale’s new BTC ETF got its moment with $41.9 million. Bitwise’s BITB? $38.4 million. Fidelity’s FBTC, a casual $29.5 million. Even VanEck got invited: $21.9 million.

And then, the old-timer GBTC dragged itself into relevance again with a $16 million snack, while Franklin’s EZBC and Invesco’s BTCO basically did the ETF equivalent of splitting an appetizer—$10.6M and $8.72M, respectively. The other funds? Just lurking in the shadows, watching the cool kids.

So yes, in case it wasn’t clear: Bitcoin’s still the market’s main character while Ethereum is struggling to get a decent subplot.

Ethereum vs. Bitcoin price update

Let’s get petty: ETF money rolled in as Bitcoin clocked $96,850.00—a 0.72% gain. ETH eked out a polite 0.18%, standing awkwardly at $1,834.35. 😂

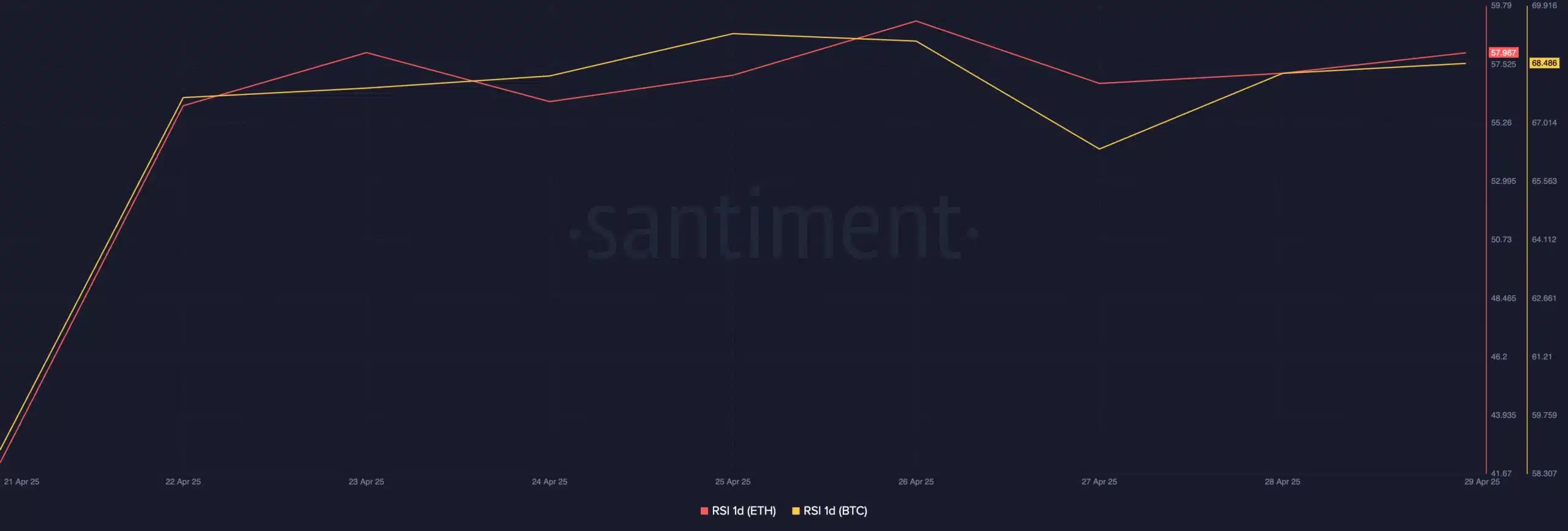

Technicals were doing that subtle head-nod thing—RSI for both? About 57. Which in technical speak is “Maybe you should buy, darling, but only if everyone else is.”

Basically, the charts are gently whispering: “There might be hope.” And yes, investors are now acting like they’re all in on the next GameStop—momentum building, chins up, YOLO mode engaged. At least for now…

What’s more?

Wait, there’s more! ETH ETFs suddenly developed a personality and pulled in a further $104 million in 24 hours—according to SoSoValue data (not to be confused with VeryImpressiveValue). That makes total net asset value a casual $6.14 billion. The ratio? 2.83%. Feels oddly specific, doesn’t it?

ETH ETFs have now persuaded history to cough up $2.4 billion in total net inflows. Institutional interest, darling. Is this the turnaround scene where ETH runs back to Bitcoin in the rain?

If this keeps up, ETH could start flirting with the $2,000 line. But if anyone starts panic-selling, we could see ETH getting ghosted all the way down to $1,730. Typical.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-05-03 11:12