In a galactic twist straight out of the Hitchhiker’s Guide’s “Don’t Panic!” chapter, Ethereum did an impromptu swan dive, which Standard Chartered immediately declared to be the kind of rare cosmic anomaly that sends institutional investors reaching for their towels (and wallets).

Tuesday saw Ethereum despondently sliding to $4,547, leaving traders to squint and check if their monitors were upside down. It managed a somewhat unenthusiastic wiggle, down just 0.64%, while Bitcoin decided to lead by example, scoring a less-than-inspiring 1.47% nosedive to $110,765, which, if you listen closely, sounds suspiciously like a very expensive joke. 🥲

The entire crypto market cap performed a collective sigh, slipping to a mere $3.84 trillion-a rounding error, really, if you’re the Galactic Central Bank. Still, Standard Chartered, ever the optimist in the face of digital absurdity, described Ethereum’s slide as “an opening,” possibly for an interplanetary portal or, less excitingly, a buying opportunity.

Geoffrey Kendrick, the bank’s digital assets chief, who apparently moonlights as a fortune-teller, peered into his tea leaves and pronounced that Ethereum could rocket to $7,500 by late 2025. This sudden optimism is being fuelled, he says, by treasury companies and ETFs, who’ve been hoarding 4.9% of ETH since June, presumably for their galactic retirement schemes. 🚀

“These inflows are only just putting on their boots!” Kendrick announced, possibly while riding a unicorn, to anyone who would listen-and also to those who would rather not.

Standard Chartered’s Enigmatic ETH Epiphany

Ethereum did briefly flirt with $4,953 on Sunday, bashing its 2021 high, before deciding weekends are for existential crises. Kendrick credited mysterious “institutional demand” for this drama-last month he even predicted treasury companies would soon own a whopping 10% of all ETH, which is surely the kind of thing Marvin the Paranoid Android would complain loudly about.

Now, Kendrick reckons that target is waddling menacingly closer, calling ETH (and its institutional collectors) “cheap as chips” at current prices, with the sort of confidence you’d expect from someone betting their spaceship on a game of cosmic snakes and ladders. 😎

Momentum: Now With Extra Inflows!

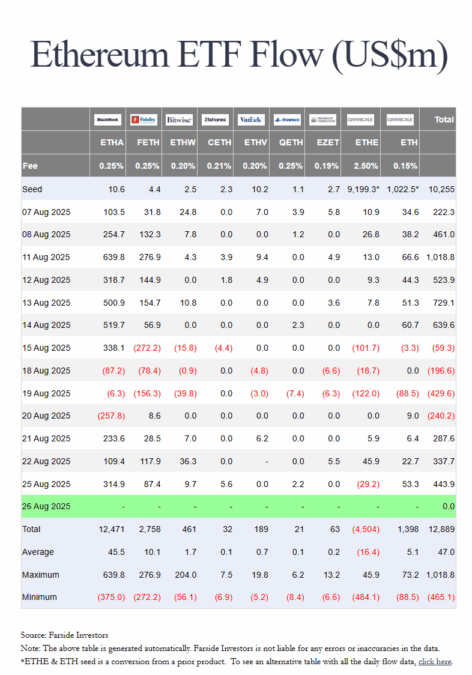

On Monday, as the markets did a passable imitation of Vogon poetry, ETH funds managed to vacuum up $444 million, led by BlackRock’s iShares-$315 million of which presumably went straight into a big black box labelled “Don’t Ask.” According to Farside Investors, Friday saw $338 million jump aboard, spurred by Jerome Powell’s dovish noises-either optimism, or an accidental broadcast from an interstellar pet shop.

Over those two blissfully confusing days, ETH funds sucked up $628 million, even as Bitcoin ETFs wandered off like bored hitchhikers. Sosovalue helped confirm this with scientific precision, for those who prefer their cosmic mysteries lightly quantified.

Ethereum pocketed a mind-boggling 32.6% gain this year-a number so much bigger than Bitcoin’s 17.3%, it’s probably worth composing a ballad about, or at least a mildly sarcastic tweet. Institutions are, for once, giddily upbeat about ETH, undoubtedly because someone told them the universe was listening. Whether this is insight or just another chapter in human financial folly is anyone’s guess-Hitchhiker’s Guide recommends betting responsibly, preferably with a pan-galactic gargle blaster in hand. 🍸

Institutions now see ETH’s stumble as more trampoline than pothole. For investors, it’s a chance to hop aboard before the next cosmic bus arrives-remember, they don’t come often, and when they do, the seating arrangements smell faintly of improbable optimism.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-08-26 23:33