Ethereum, that obstinate guest, still lingers beneath the two-thousand-dollar threshold as if some stern municipal official has posted a decree on the door of liquidity. The market’s mood is a brittle trinket-volatile, skittish, and prone to spreading rumors through the crypto bazaar. Attempts to reclaim the sacred threshold falter, and traders adopt the posture of a defensive chorus, eyes fixed on the horizon for any sign of movement while the derivatives specter lurks in the wings with a sardonic grin.

Though corrections are not unknown after vigorous cycles, this scene wears a different air-a creak in the machinery-as investors study liquidity and derivatives for clues about the next capricious move. The rumor mill sighs: perhaps a price swing will arrive like a late telegram, delivered with great ceremony and little mercy.

A CryptoQuant report provides further color by noting a notable contraction in Ethereum futures open interest. Data tracking the 30-day change in net open interest across major platforms reveals the derivatives market entering a cleanly staged deleveraging and risk rebalancing. The decline appears most conspicuous on Binance, Gate.io, OKX, and Bybit, signaling a broad exodus of capital from leveraged gambles, as if a cautious crowd decided to retire to the provinces and leave the carnival to the misters of chance.

Binance alone shows an approximate drop of 40 million ETH in open interest over the past month, Gate.io over 20 million, OKX about 6.8 million, and Bybit roughly 8.5 million, bringing the grand total of this retail-and-institutional penury to around 75 million ETH wiped from the ledger.

Broad Deleveraging Suggests Ethereum Market Reset

The CryptoQuant report adds that when you invite into the picture other platforms with negative open interest readings-yes, even those with volumes so modest they could be considered a polite cough-the total contraction across all exchanges exceeds 80 million ETH in the last thirty days. This confirms that the deleveraging is not the eccentric hobby of a few grand viziers, but a broad structural shift through the Ethereum derivatives empire.

Such a sweeping retreat in open interest usually means traders, especially those who treat leverage like a spice rack, are trimming exposure rather than courting new speculation. It reads as caution after a storm of volatility, or perhaps a balm applied after margin calls ran amok. In markets of this temper, one learns to respect the pivot away from momentum toward prudent risk management.

From a structural standpoint, this contraction can act as a market “clean-up.” By gradually purging weaker leveraged positions, the chance of cascading liquidations may diminish. It does not guarantee an immediate revival, but flushing out excess leverage often steadies the stage. In Ethereum’s case, the ongoing reset in derivatives positioning could help establish a firmer price base if broader liquidity and sentiment begin to regain their footing-like a stubborn chair finally finding its rightful leg after a long inspection by the furniture inspector of fate.

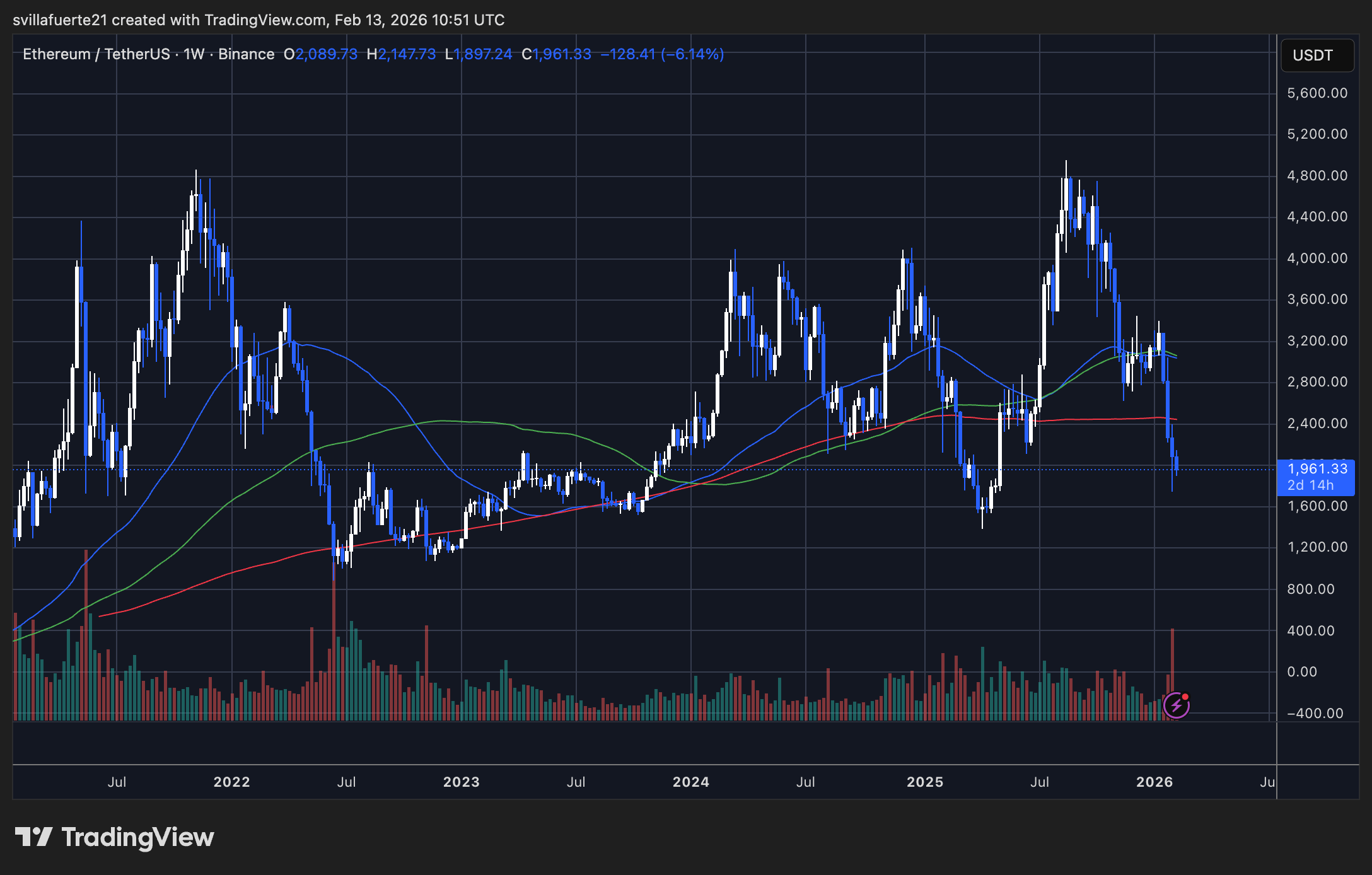

Ethereum Faces Structural Pressure Below Key Weekly Support

The weekly chart shows persistent downside pressure after the fall below the $2,000 region, a threshold that once cheered investors and once offered a pivot in calmer days. Now the price sits under several major moving averages, which act more as overhead resistance than as friendly companions, signaling a weakening of bullish ardor and a tilt toward a more defensive market temperament.

Price action bears the memory of a rejection from the $3,000-$3,500 corridor earlier in the cycle, followed by a procession of lower highs. Such a pattern typically marks a corrective or transitional opus, not a triumphant continuation of the prior march. The current decline has been accompanied by elevated volume, a sign not of grand accumulation but of distribution and deleveraging-the market bows to its own ledger and calls it a day.

From a structural point of view, the next meaningful support appears near the $1,600-$1,700 range, where prior consolidation and demand once reared their heads. Holding this zone would help preserve the broader long-term frame despite present weakness. A sustained break below it, however, could tilt the balance toward a deeper retracement, like a polite gentleman losing his temper after misplacing his umbrella.

Ethereum remains highly sensitive to macro liquidity conditions, derivatives positioning, and overall crypto market sentiment; any recovery will hinge on renewed demand and stabilization above key technical levels, as if the market were waiting for a final nod from some capricious bureaucracy before rising from the bench.

Read More

- Gold Rate Forecast

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- Christopher Nolan’s Highest-Grossing Movies, Ranked by Box Office Earnings

- KAS PREDICTION. KAS cryptocurrency

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

- eFootball 2026 is bringing the v5.3.1 update: What to expect and what’s coming

- Country star Thomas Rhett welcomes FIFTH child with wife Lauren and reveals newborn’s VERY unique name

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Mobile Legends: Bang Bang 2026 Legend Skins: Complete list and how to get them

- Decoding Life’s Patterns: How AI Learns Protein Sequences

2026-02-14 01:55