After experiencing a rather low dip at 0.019 BTC against bitcoin, ethereum has soared by a remarkable 52.63%, now reaching a stunning 0.029 BTC.

Ethereum Options Show Bold Bets on $4,000 and Beyond

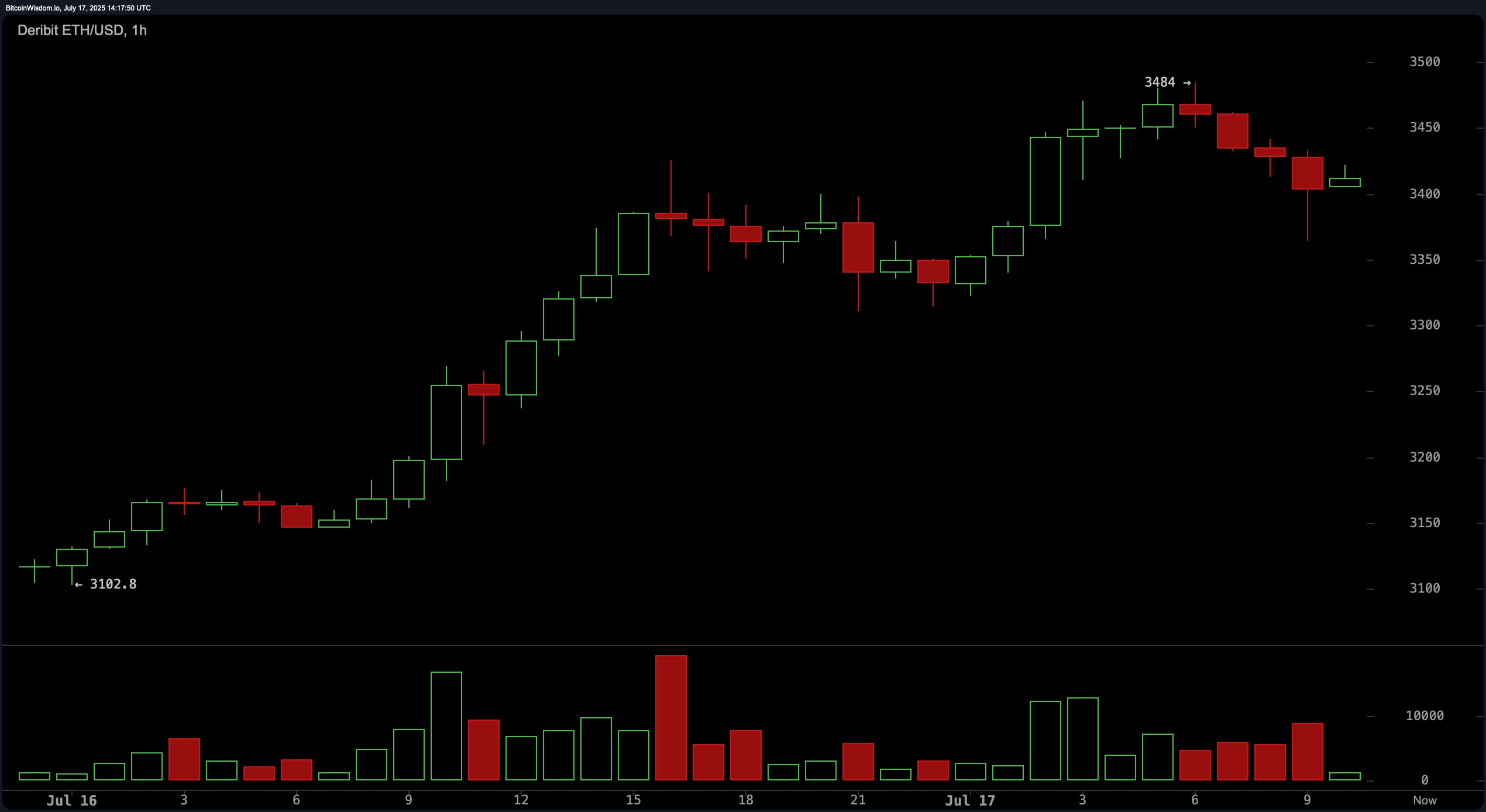

Ethereum (ETH) has made considerable strides this week, with market data showing an impressive 22.5% increase since July 10. Just recently, ETH hit a peak of $3,484 per coin, and as of 10 a.m. Eastern on July 17, it trades at around $3,408. While bitcoin has shattered multiple all-time highs this year, ETH has yet to surpass its previous record, set on Nov. 10, 2021, when ether was valued at $4,878 per coin.

At its current price, ETH would need a 25% increase to match its 2021 high. A glance at the derivatives markets shows that ETH has led the charge in liquidations. In the past 24 hours, out of $583.42 million wiped from the crypto economy, $251 million came from liquidating ETH shorts.

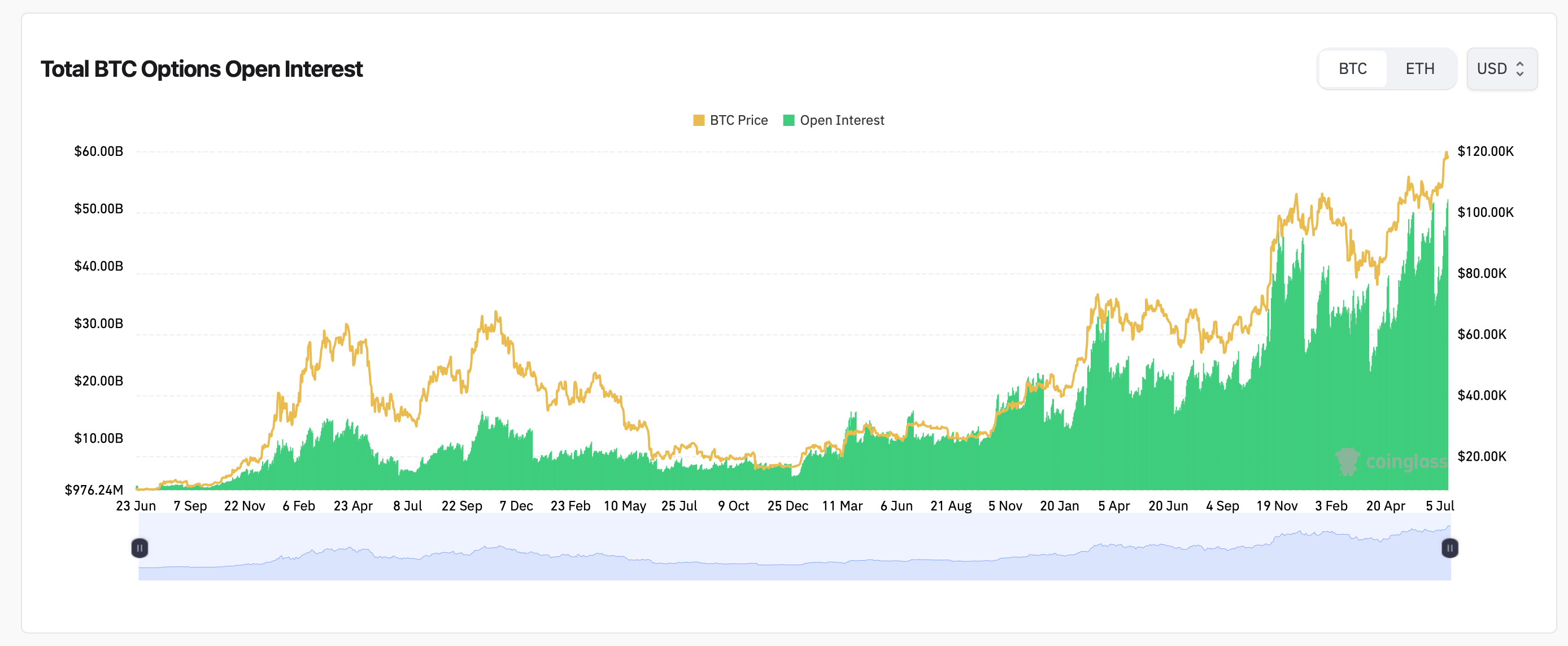

Ethereum futures open interest has spiked dramatically, surpassing $50.42 billion, with 14.75 million ETH locked in derivative contracts across all tracked exchanges. Over the past year, open interest has consistently climbed in tandem with ethereum’s price recovery. Binance leads the pack with $8.75 billion in open interest (2.56 million ETH), accounting for 17.36% of the total, followed by CME with $6.04 billion (1.77 million ETH), representing 11.98%.

Ethereum options open interest has seen significant growth, now surpassing 3.52 million ETH, with a healthy 65.2% of those in call options and 34.8% in puts. This indicates a market strongly skewed towards optimism, as traders prepare for ethereum’s price to rise further. Deribit leads the charge in ETH options activity, with the largest open interest placed on the Sept. 26, 2025, $4,000 call (93,891 ETH), followed by the $3,600 call (70,081 ETH), and the Dec. 26, 2025, $6,000 call (59,832 ETH).

The concentration of substantial open interest at out-of-the-money strike prices such as $4,000, $4,200, and $6,000 strongly suggests a bullish outlook heading into the fall and winter expirations. Both open interest and recent trading volumes indicate that traders are positioning themselves for an impressive breakout in ethereum, with the options market factoring in the potential for significant gains in the latter half of 2025.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-17 18:44