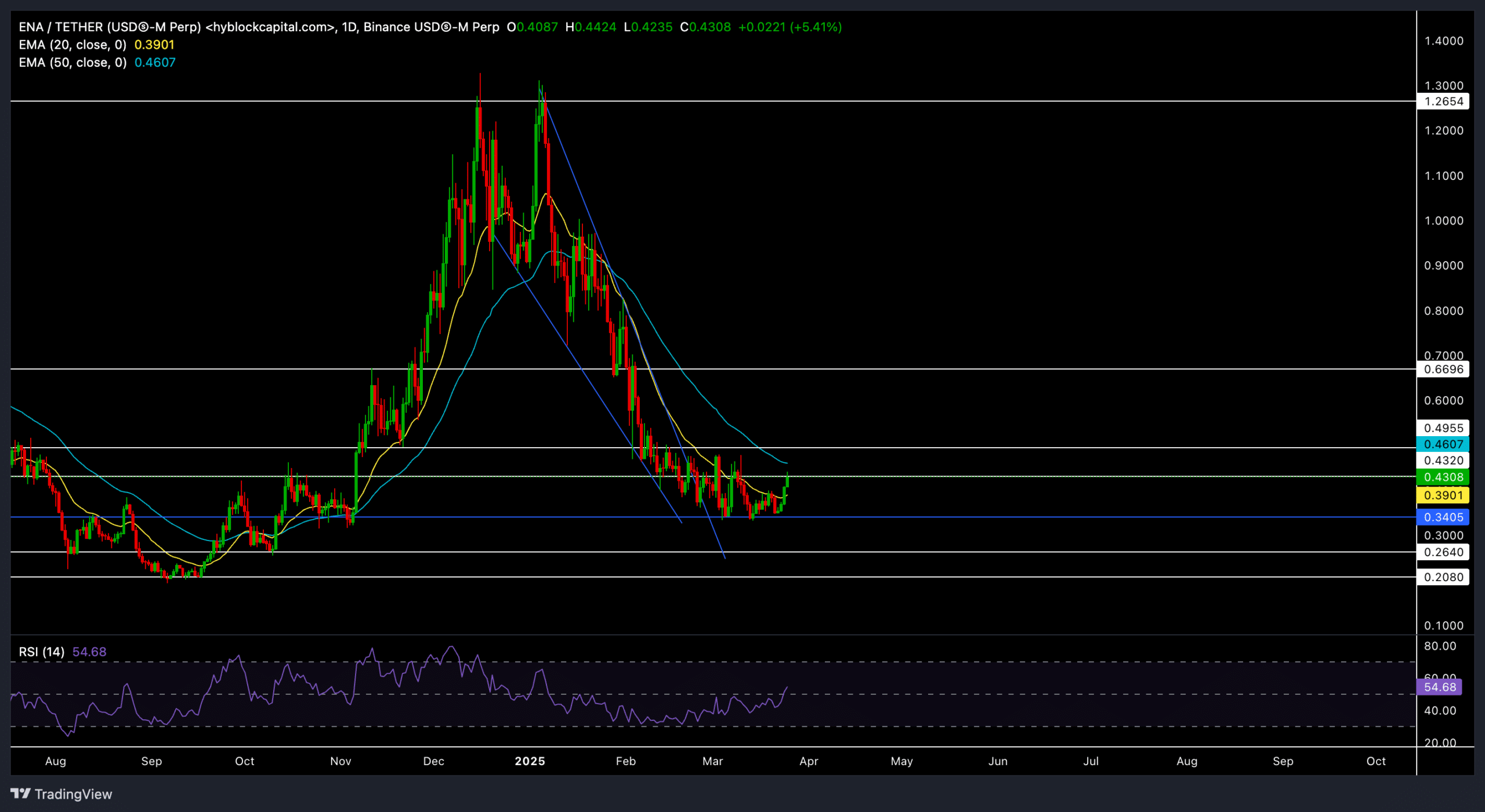

- Ah, the recovery above the 20 EMA! A mere whisper of bullish strength, but the 50 EMA at $0.46? A formidable foe, darling!

- Our dear derivatives data shows the shorts retreating like a bad date, as Open Interest and volumes have spiked! How delightful! 🎉

Ethena [ENA], bless its heart, has bounced back from the depths of despair, hovering around the $0.26-$0.28 range. What a splendid rally, pulling its price above the 20 EMA like a phoenix rising from the ashes!

Yet, our little altcoin still struggles to flip its 50 EMA. A crucial level, indeed, for ENA’s next grand performance. Will it be a standing ovation or a polite golf clap? 🤔

Is a strong reversal possible?

After a parabolic rally towards the $1.2-resistance level, ENA has taken a nosedive into a downtrend, setting lower highs like a tragic play. Meanwhile, it has formed a classic falling wedge on the daily chart—how avant-garde!

But wait! ENA’s latest bounce from the range-low support at $0.34 has set the stage for a potential structural break. Recent daily candles closing above the 20 EMA ($0.39) and the falling wedge structure hint at a flicker of bullish momentum, at least for now. Bravo! 🎭

A daily close above $0.5 would expose ENA to more upside gains towards the $0.66–$0.7 zone. However, should it fail to surpass the $0.46–$0.5 mark, the bears may come back to retest the $0.34–$0.35 support zone. Oh, the drama!

The daily relative strength index (RSI) is around 55—how positively charming! For the first time since January, a potential jump above the 60-level could increase the probability of a stronger bullish trend. How thrilling! 🎈

But, dear readers, let’s not forget that the RSI’s movements have bearishly diverged from the price action over the last few days. A hint of caution, perhaps? Buyers should ensure the RSI is above 50 before opening a long position. Safety first, darlings!

Derivatives data revealed THIS

Our dear derivatives data has highlighted a bullish divergence! According to Coinglass, ENA’s Open Interest has registered a delightful uptick of nearly 15%, alongside a 20% hike in volume. How positively riveting! 📈

Climbing OI and volume indicate rising market participation, which could drive more volatility. Meanwhile, funding rates, which have been negative for weeks, are easing towards the neutral zone. Fewer aggressive shorts? How refreshing!

Moreover, the Long/Short Ratio on Binance is near 1.5 for regular accounts and over 2 for top traders—indicating that more traders are skewed towards long positions. A delightful twist in the tale!

Should ENA see a breakout above $0.5, late shorts may end up short-squeezing each other, creating further upside volatility. Oh, the suspense!

However, let’s not forget to keep an eye on Bitcoin’s movements before opening any positions. After all, one must always be prepared for the unexpected! 🎩

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-03-26 10:20