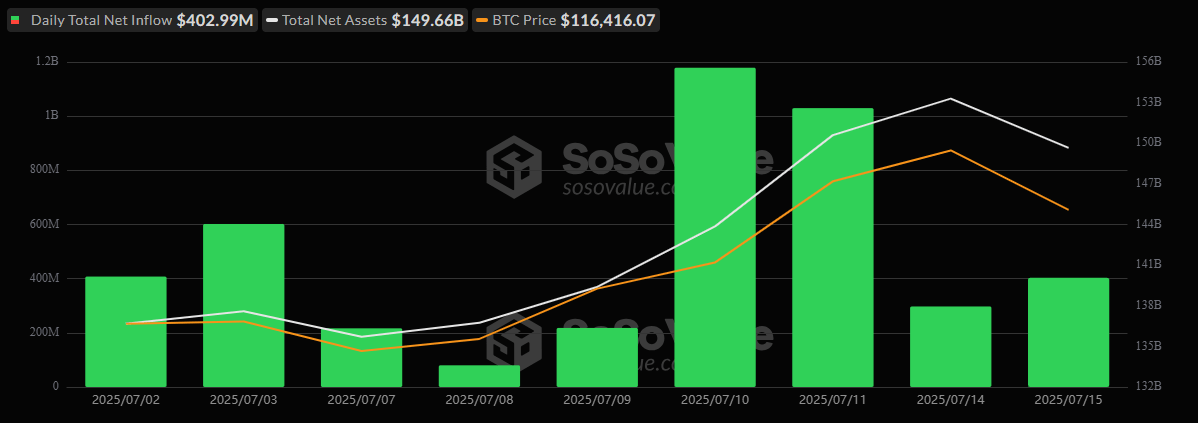

Bitcoin ETFs extended their bullish run to nine consecutive days with $403 million in net inflows, while ether ETFs not only gained $192.33 million but also set a new record trading volume of $1.62 billion.

The momentum refuses to break. Institutional interest in crypto exchange-traded funds (ETFs) stayed red-hot as bitcoin ETFs logged a 9th consecutive day of inflows, pulling in $402.99 million. The heavy lifter once again? Blackrock’s IBIT, which absorbed $416.35 million, effectively powering the entire segment on its own. 🚀

Smaller gains followed: Vaneck’s HODL and Grayscale’s Bitcoin Mini Trust pulled in $18.99 million and $18.56 million, while Bitwise’s BITB and Franklin’s EZBC brought in $12.70 million and $6.76 million, respectively. It’s like a cosmic dance of numbers, where everyone gets a turn to shine. 🌟

Not everything was green, though. Grayscale’s GBTC shed $41.22 million, with Fidelity’s FBTC and ARK 21Shares’ ARKB losing $22.93 million and $6.21 million, respectively. Still, the market remained firmly in the green, with total trading volume hitting $6.70 billion and net assets closing at $149.66 billion. It’s a bit like a rollercoaster ride, but with more zeros and less nausea. 🎢

Meanwhile, ether ETFs continued their impressive streak with an 8th straight day of inflows, totaling $192.33 million. Blackrock’s ETHA was again the dominant player, raking in $171.52 million. Fidelity’s FETH added $12.22 million, and Grayscale’s Ether Mini Trust chipped in $8.59 million. It’s like a well-choreographed ballet, but with more blockchain and less tutus. 🕺

Perhaps more striking than the capital was the activity: total trading volume hit an all-time high of $1.62 billion, and net assets rose to $14.22 billion. For both bitcoin and ether ETFs, it’s not just consistency, it’s acceleration. It’s as if the market has discovered the secret to perpetual motion, and it’s all thanks to a few well-placed algorithms and a lot of faith in the future. 🌠

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-07-16 18:57