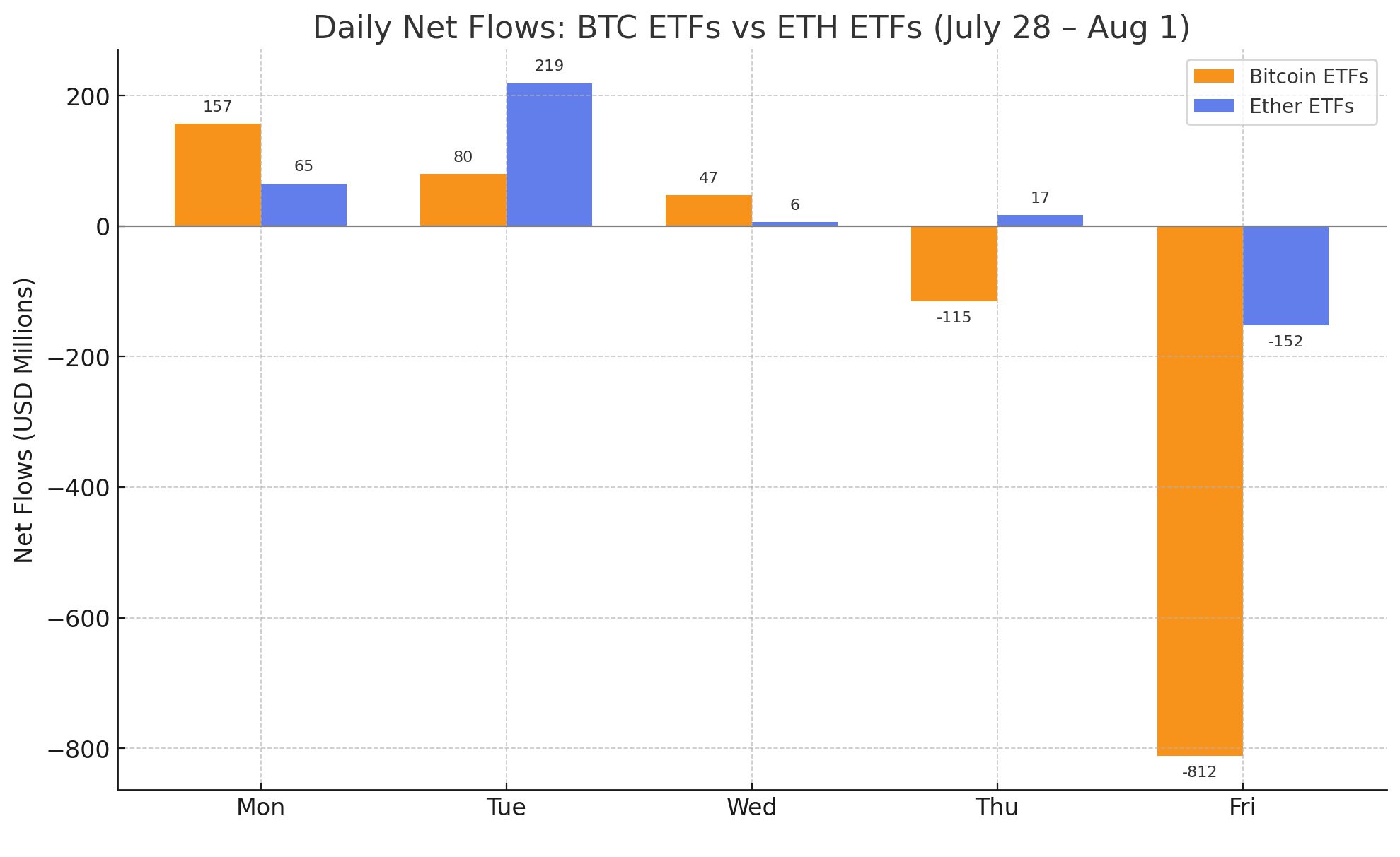

A week of turmoil saw bitcoin ETFs lose a staggering $643 million, marking their worst performance since April, while ether ETFs managed to add $154 million, albeit with a significant stumble on Friday that broke a 20-day winning streak.

BTC Takes a Nose Dive as ETH Coughs Up Gains After Marathon Run

In the grand theater of the crypto ETF market, what started as a promising act of steady inflows for both bitcoin and ether turned into a tragicomedy of errors, culminating in one of the most dramatic outflow days of 2025. The audience, composed of institutional investors, found themselves gasping in disbelief at the sudden turn of events.

Bitcoin ETFs, after a somewhat uneventful beginning, found themselves in the eye of a financial storm on Friday, hemorrhaging $812 million in outflows, the second-largest daily loss ever recorded. By the end of the week, BTC ETFs had lost a total of $644 million, shattering a seven-week inflow streak and leaving many scratching their heads in bewilderment. 🤷♂️

Amidst the chaos, Blackrock’s IBIT managed to hold its ground, adding a respectable $355.34 million over the week, while Vaneck’s HODL contributed a modest $9.13 million. However, these gains were overshadowed by the massive exodus from Fidelity’s FBTC (-$354.17 million) and Ark 21shares’ ARKB (-$443.50 million), which seemed to have caught the market’s collective imagination. 🌪️

Other notable exits included Grayscale’s GBTC (-$124.94 million), Bitwise’s BITB (-$66.58 million), and Grayscale Bitcoin Mini Trust (-$16.93 million), each contributing to the week’s dramatic narrative.

Ether ETFs, on the other hand, presented a more nuanced tale. After riding a 20-day inflow streak, they managed to accumulate $241 million by Thursday. However, Friday’s $152 million outflow left them with a final weekly gain of just $154.32 million, a bittersweet ending to what could have been a triumphant chapter. 🎉💔

Blackrock’s ETHA led the charge with a robust $394.15 million in inflows, but this was counterbalanced by significant losses from Fidelity’s FETH (-$72.05 million), Grayscale’s ETHE (-$53.80 million), Grayscale’s Ethereum Mini Trust (-$47.68 million), and Bitwise’s ETHW (-$40.30 million), each playing their part in the week’s drama.

Despite the tumultuous week, trading volumes reached unprecedented heights, with BTC ETFs recording an astounding $6.14 billion on Friday alone, and ETH ETFs surging to $2.26 billion. Even with these outflows, net assets remain impressively robust, standing at $146.48 billion for BTC and $20.11 billion for ETH. This suggests that, despite the volatility, institutional interest remains unwavering. 🏦✨

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Brawl Stars Steampunk Brawl Pass brings Steampunk Stu and Steampunk Gale skins, along with chromas

- How “Hey Grok” turned X’s AI into a sexualized free-for-all

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-04 21:58