It appears the US Securities and Exchange Commission (SEC) has decided to get a move on and approve those Solana ETFs, old chap! They’ve told the issuers to re-submit their filings by July 31, which is a dashed sight sooner than expected.

The SEC Cracks the Whip

According to a CoinDesk report, the SEC has requested that all applicants amend and resubmit their S-1 filings by the end of July. This is a bit of a turn-up for the books, as the formal deadline for a decision was October 10. One can only assume they’re trying to get the ball rolling before Q4.

It’s all a bit of a kerfuffle, but it seems the approval and launch of the REX-Osprey SOL and Staking ETF (SSK) has lit a fire under the SEC’s, ahem, posterior. That was the first Solana staking fund to go live, don’t you know?

Solana ETF Approval Odds as of July 7, 2025 | Source: Polymarket 📊

At the time of writing, Polymarket bettors are pricing in a 99% chance of SOL ETF approval before the end of 2025. That’s a pretty safe bet, if you ask me! 🤑

Apparently, the SEC requested clarification on staking and in-kind redemptions in June comment letters to applicants. One hopes this new deadline will bring a bit of clarity to the whole shebang. After all, it’s been a bit of a gray area since the BTC and ETH approvals in January 2024. 🤔

Will Solana Hit the Big Time?

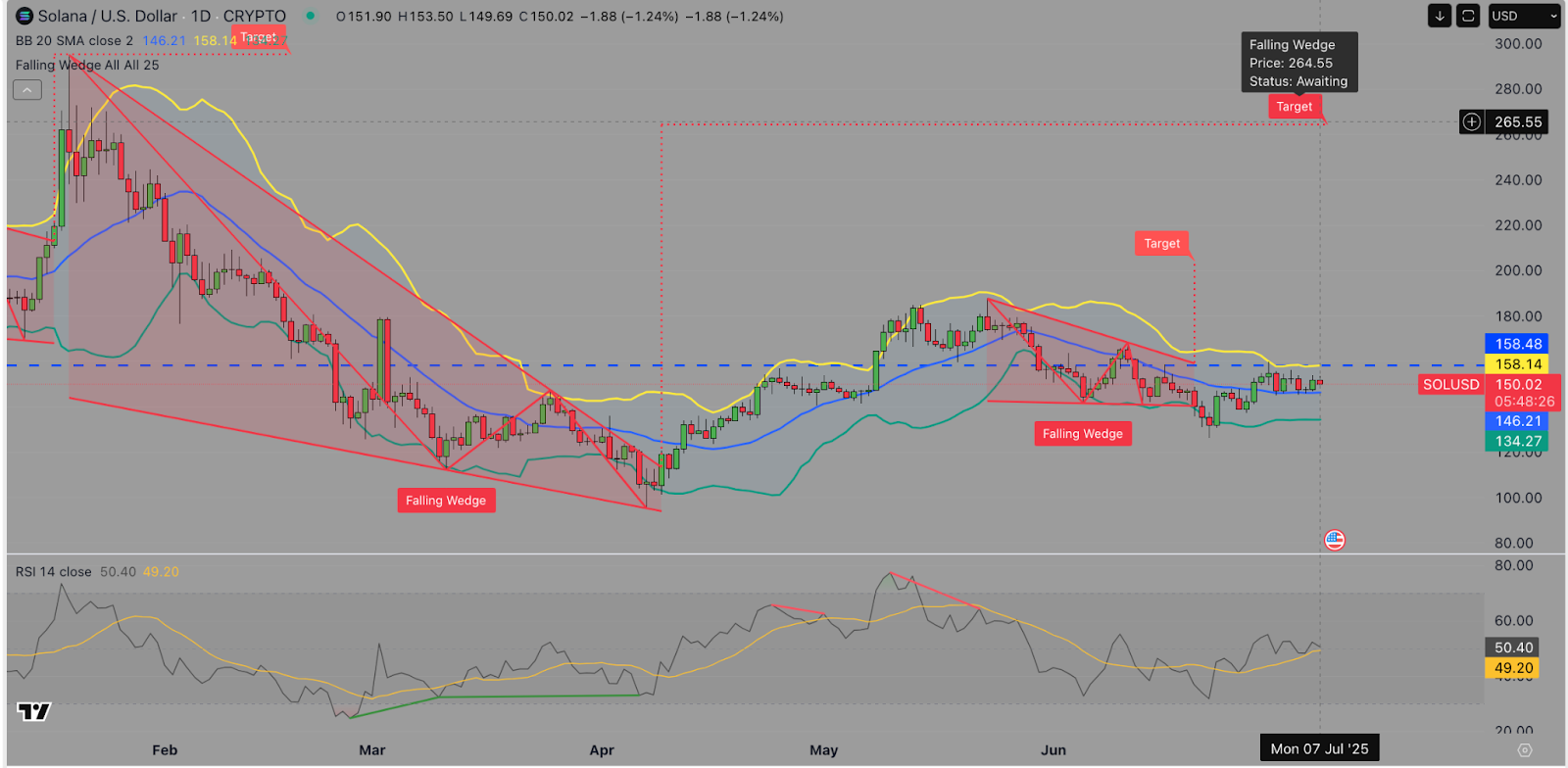

Solana was trading at $149 at press time, trending sideways with the broader market sentiment. But, old bean, the falling wedge pattern hints at a potential breakout towards $260 if formal SOL ETF approval materializes before October 10! 🚀

Historically, ETF approvals have delivered strong upside for native tokens. Bitcoin rallied over 40% after its ETF approval in January, while Ethereum gained 25% following its own approval in May. If this pattern repeats, SOL could climb toward $200, if positive sentiment surrounding SOL ETF triggers institutional demand. 🤑

Solana price | Source: TradingView 📈

On the technical front, Solana price experienced a 2% intraday dip, falling below the $150 psychological support. But, don’t worry, old chap, the Bollinger middle band shows the token still trades above its 20-day moving average, signaling active buyer interest. 📊

The key short-term resistance lies at the $158 level marked by the Bollinger upper band. A decisive daily close above this level could confirm a breakout, with $180 as the next target and $265 as a longer-term bullish target for Solana price, highlighted by the falling wedge pattern. 📈

Conversely, failure to hold above the $150 psychological level may trigger renewed selling pressure, with $135 as the next major support to watch. Oh dear, oh dear! 😬

Meme Coin Madness

As institutional investors switch focus to Solana, retail traders are ramping up activity within the meme coin sector. Snorter, the Solana-native Telegram trading bot, has crossed $1.5 million in its $SNORT token presale, with prices holding at $0.0973. Blimey! 🤑

With Solana at the center of ETF momentum, Snorter is emerging as the go-to tool for retail traders looking to capitalize on Solana-native opportunities. Visit the official Snorter website to join the presale, old bean! 📈

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

2025-07-08 00:38