Ethena’s ENA token, like a hungry wolf in the forest of finance, has devoured a 5.5% gain daily and a whopping 70% over three months. This surge is fueled by robust technical indicators and a narrative shift that has transformed the token into a shining beacon of hope. The introduction of USDtb, a stablecoin backed 90% by BlackRock’s BUIDL fund, has only strengthened the resolve of investors, making them bolder and more confident.

USDtb, with its capability to back USDe (Ethena’s delta-neutral stablecoin) and its alignment with the Genius Act, has positioned ENA as a rare gem in the rough, a blend of solid fundamentals and unstoppable momentum. It’s as if the market itself has decided to smile upon this token, bestowing upon it the favor of the bulls.

Whales Keep Accumulating as Smart Money Inflows Persist

The behavior of the whales over the past week is a testament to the growing interest in ENA. The token has climbed 6.6% in just seven days, and the top 100 addresses have added a modest 0.21% more tokens. But here’s the kicker-whales have increased their holdings by a staggering 30.19%, a clear sign of strong conviction even as prices soar. It’s almost as if they’re saying, “Bring it on, we’re ready!”

Meanwhile, public figures, those who once shouted from the rooftops about their holdings, have quietly trimmed their positions. But let’s be honest, their holdings are peanuts compared to the whales, so their outflows barely make a ripple. Exchange reserves have ticked up slightly, a common occurrence during profit-taking phases, but the real question is whether this trend will accelerate if the whales decide to cash out. For now, however, accumulation remains the name of the game.

Given that USDtb is now being hailed as support collateral for USDe, large holders might be positioning themselves for the expanded utility of ENA in collateralized DeFi strategies. If exchange reserves spike and the whales start to sell, then caution is indeed warranted. But for now, the whales are still feasting, and the bulls are lining up. 🐳🐂

Whales, those behemoths of the crypto sea, are addresses that hold vast amounts of a token, often capable of influencing price. Watching their behavior is like reading the tea leaves; it can help traders spot early accumulation or distribution trends.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bullish EMA Crossovers Hint at the Next Leg Up

Technically speaking, ENA has just confirmed a bullish trend continuation. The 50-day EMA (the orange line) has crossed above the 100-day EMA (the sky blue line)-a textbook signal of upward momentum. And if that wasn’t enough, the 100-day EMA is inching closer to the 200-day (the deep blue line), setting the stage for an even more powerful crossover and rally if the trend continues. It’s like the market is saying, “Hold on tight, the ride’s just getting started!”

The Exponential Moving Average (EMA) is a type of moving average that tracks the average price of an asset over a specific period, giving more weight to recent data points. This makes it a more responsive tool for identifying short-term price movements. A Golden Cross occurs when a shorter EMA (like the 50-day) crosses above a longer EMA (like the 100-day or 200-day), often seen as a strong bullish trend signal by traders. It’s like the market’s way of saying, “Pay attention, something big is happening!”

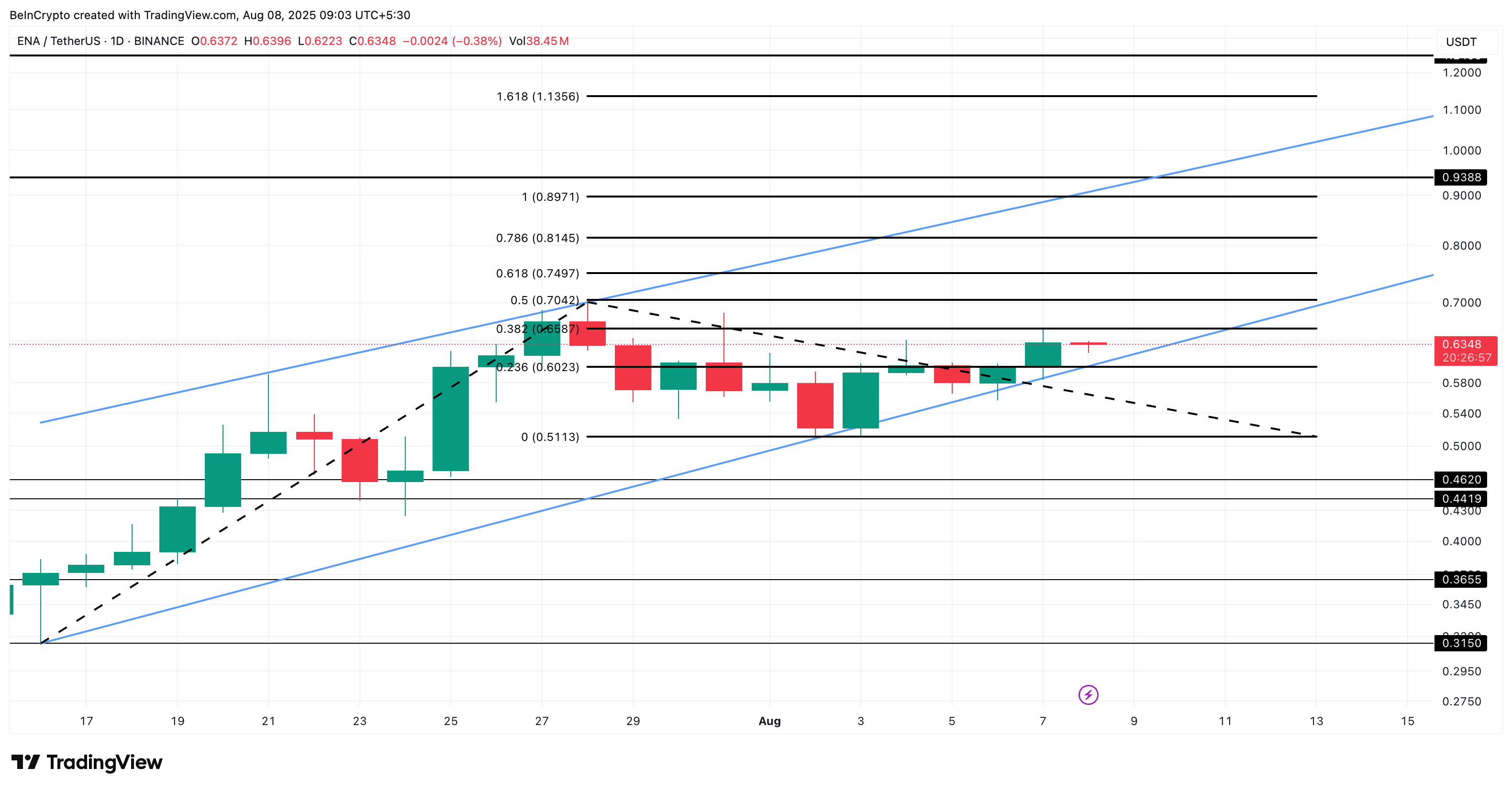

Ethena Price Trades Inside An Ascending Channel, Validated by OBV Divergence

The Ethena price is moving within an ascending channel, currently approaching a key resistance level of $0.65, which recently turned it away. Breaking through this level could open the door to a move towards $0.70 in the short term. The channel breakout above $0.93 has a target around $1.13, the 1.618 Fibonacci extension from the local swing low. It’s like the market is laying down a red carpet for ENA to walk on.

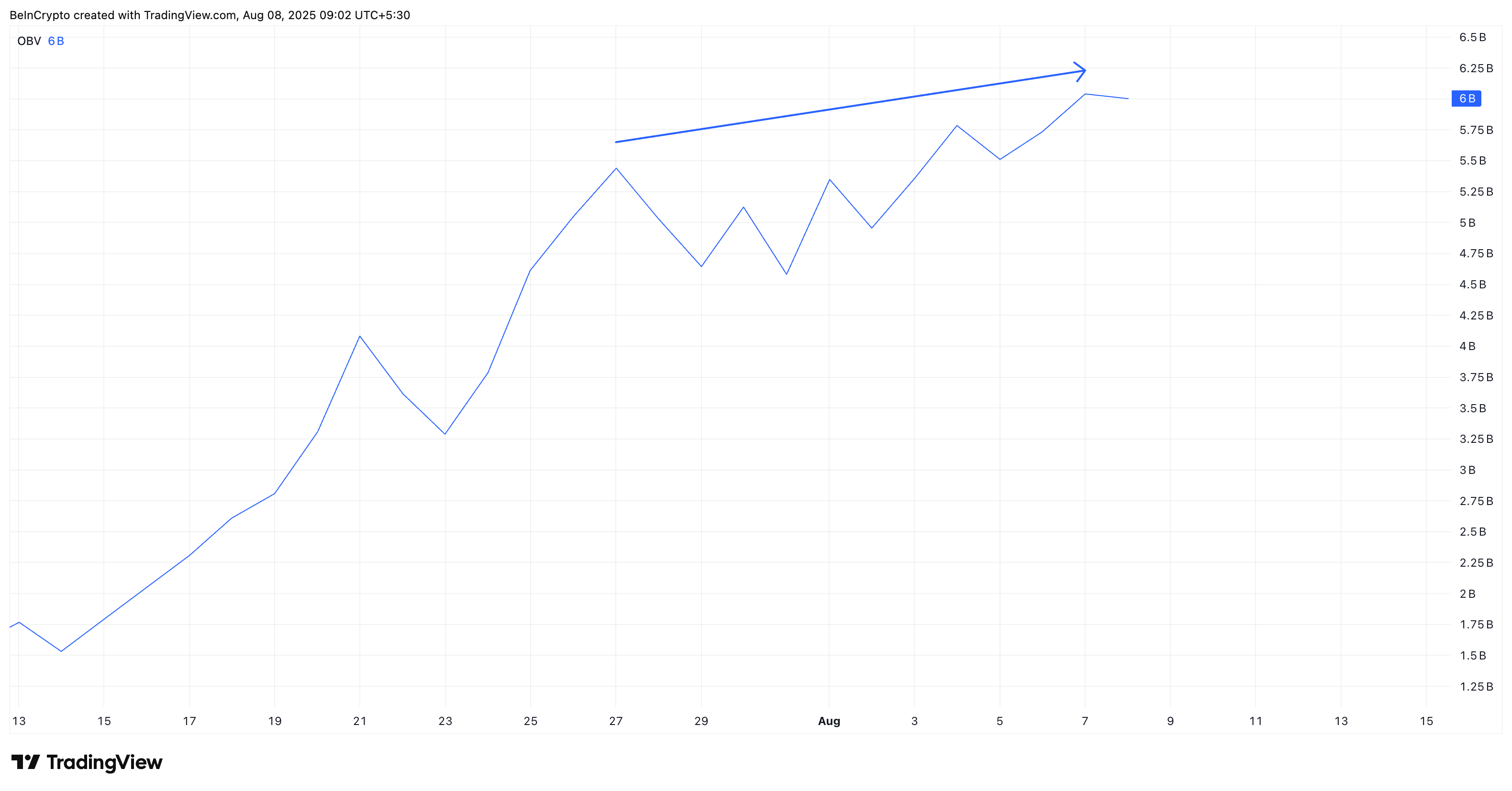

Importantly, ENA has bounced off the lower trendline, suggesting that the structure remains intact. But it’s not just about the pattern. The On-Balance Volume (OBV) indicator adds another layer of depth to the analysis. On July 28, ENA made a higher high in price, and on August 7, it printed a lower high. Yet, OBV made a higher high during this period, a bullish divergence that suggests buying pressure is building beneath the surface. It’s like the market is whispering, “Trust me, there’s more to come.”

OBV (On-Balance Volume) tracks the cumulative volume flow to confirm price trends. When OBV rises while the price lags, it often indicates that smart money is quietly accumulating. Rising OBV shows that the Ethena price surge isn’t just a sentiment-driven move; it’s backed by real buying power. As USDtb adoption grows and BlackRock’s role in collateral markets expands, this divergence could mark the beginning of a significant breakout. However, for confirmation, ENA must decisively break through the key overhead resistances. It’s like the final hurdle before the grand prize.

However, if the Ethena (ENA) price breaks lower, $0.60 remains a critical support level. If this level is breached, the near-term bullish hypothesis will be defeated, breaking the bullish structure. It’s like the market is playing a game of chess, and every move counts. 🏦🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-08 10:02