Ah, the enigmatic world of cryptocurrency! Where bulls and bears dance a delicate tango, and the price of Dogwifhat (WIF) swings like a pendulum in a madman’s attic.

As WIF trades around USDT 0.83, we find ourselves in a market clouded by uncertainty. Traders, like hapless pawns in a grand chess game, must navigate a landscape littered with both bullish and bearish signals across various timeframes.

Leverage Pullback Signals Caution Among Speculators

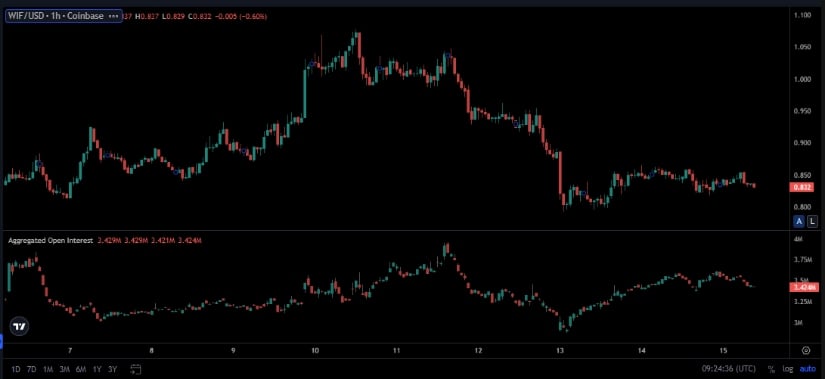

On the 1-hour chart from Coinbase, Dogwifhat Price Prediction showed a short-lived surge between June 7 and June 10, pushing the price to just above USDT 1.05. However, that momentum quickly reversed, triggering a steep decline as sellers took control.

The price dropped below the USDT 0.90 level, eventually stabilizing near USDT 0.83. Since then, WIF has been locked in a sideways trading pattern with lower highs and lower lows, pointing toward growing hesitation among both bulls and bears.

A notable shift in open interest adds further weight to this cautious environment. As WIF’s price prediction declined sharply on June 12, aggregated open interest dropped in tandem. This decline suggests that leveraged positions—many built up during the earlier rally—were systematically closed as the market turned bearish.

While open interest has slightly rebounded since, it remains well below previous highs, indicating reduced speculative appetite. This downturn in leverage participation reflects a defensive stance, as traders wait for more decisive signals before reentering the market.

The limited price movement in recent sessions mirrors this shift in sentiment. Despite volatility earlier in the month, WIF now trades within a narrow USDT 0.82 to USDT 0.85 band. With no strong directional bias, the current setup resembles a temporary holding pattern rather than a clear trend. For now, leverage remains subdued, and momentum continues to soften.

Dogwifhat Price Prediction: Bearish Tilt Evident in Short-Term Price Activity

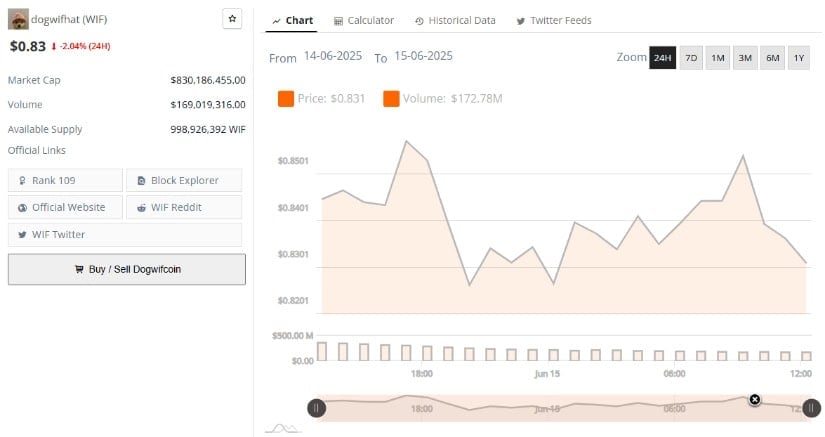

Brave New Coin’s latest 24-hour data reflects a mild but persistent bearish pressure. WIF is down 2.04%, currently priced at USDT 0.83, with the price fluctuating between USDT 0.8200 and USDT 0.8501. These choppy movements indicate that buyers have failed to break through the USDT 0.85 resistance zone, which has repeatedly rejected upward attempts. The minor price recovery attempts remain shallow, further signaling a lack of strong market conviction.

Trading volume over the same period reached USDT 172.78 million, a relatively stable figure that lacks any sharp spikes. This kind of volume profile is often linked to retail-driven trading, where institutional influence is minimal. The absence of large volume inflows supports the notion that WIF may be in a consolidation phase rather than preparing for a significant breakout or breakdown.

WIF currently holds a market capitalization of approximately USDT 830.18 million, ranking it 109th among global cryptocurrencies. Despite the current quiet spell, the asset remains firmly within mid-cap territory, which could allow for volatility to return swiftly once sentiment changes. But for now, all eyes remain on whether buyers can regain strength or whether bears will force a retest of recent lows.

Indicators Point to Weakening Momentum on the Daily Chart

From a broader perspective, the daily chart on TradingView paints a more neutral-to-bearish picture. Following the early May rally, WIF Price Prediction has been steadily retracing and now trades just above the lower Bollinger Band at USDT 0.738.

The current level of USDT 0.831 places it well below the basis line at USDT 0.926, which remains a short-term resistance point. The narrowing of the Bollinger Bands indicates tightening volatility, often a sign of impending movement, but the direction remains unclear.

The price continues to hover near the lower half of the bands, a structure that often hints at bearish dominance. If the USDT 0.738 level is tested again, and buyers fail to respond, it could open the door for deeper downside pressure. On the other hand, a close above the midline could start to shift sentiment back toward a more neutral or bullish outlook.

Meanwhile, the MACD indicator reinforces the current downward pressure. The MACD line has slipped below the signal line, and red histogram bars are becoming more visible. While the indicator is still hovering near the zero line—signaling that the move isn’t extreme—the bearish crossover suggests momentum is slowly shifting in favor of sellers. Without a bullish crossover or an increase in volume, the current trend may persist in the short term.

Dogwifhat’s current state presents a market in transition, caught between past bullish energy and emerging signs of restraint. For now, the consolidation phase continues, and with critical levels nearby, market participants remain alert for the next breakout or breakdown.

🐕💸📈 Will the Dogwifhat price prediction continue to confound traders, or will a clear trend emerge from the shadows? Stay tuned to find out!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-06-16 01:20